Latest APRA claims data continues to reinforce the value of financial advisers when the rubber hits the road.

In what it has positioned as a ‘world-leading’ value-add for consumers, the corporate regulator, in association with ASIC, has released its rolling six-monthly Life Insurance Claims and Disputes Statistics Report for the year to 30 June 2019.

Not unsurprisingly, the key metrics remain similar to those reported for the 12 months to 31 December 2018.

While individual advised claims metrics surpass those of individual non-advised metrics, one of the few key statistics that experienced a bump in the last six months was that of TPD admissions for unadvised claims.

In the 2018 calendar year, 87% of individually-advised TPD claims were admitted, compared with 59% of non-advised claims (see: ASIC Releases ‘World Leading’ Life Insurance Claims Data). The latest data to 30 June 2019, however, reveals a small decrease in advised TPD claims admittance (87% to 85%), and a statistically-significant increase in individual non-advised claims admitted (59% to 73%).

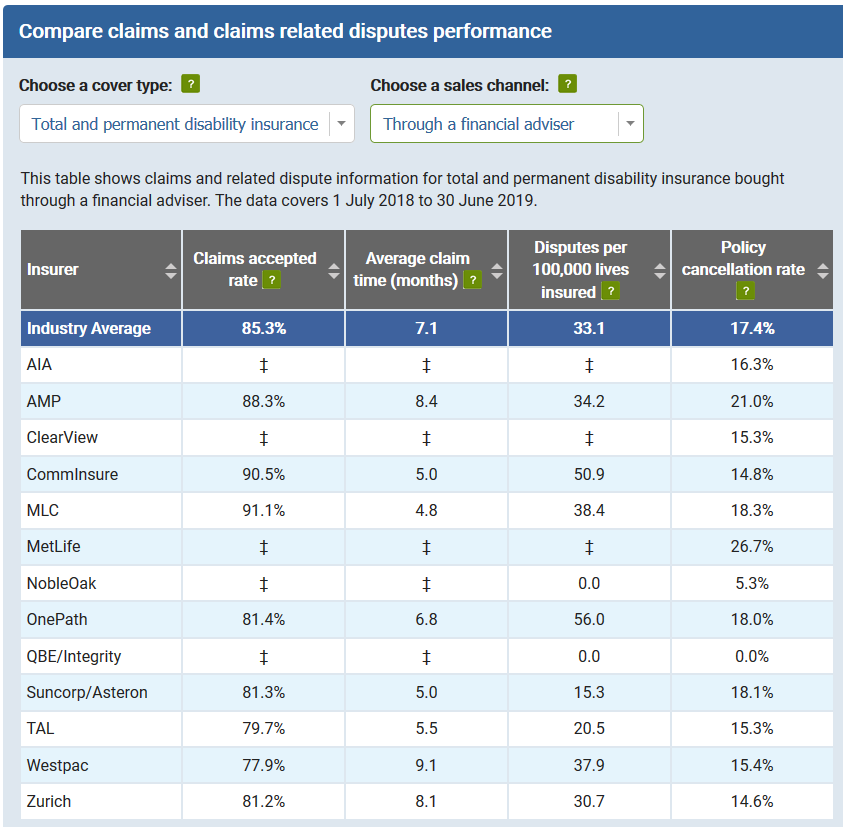

Meanwhile, ASIC’s MoneySmart Life Insurance Claims Comparison Tool has been updated with the most current metrics, including latest TPD claims data for the year to 30 June 2019…

So the percentage of TPD claims for non-advised clients are improving. Do those figures include GROUP, because they should be separated from retail

My view – ITS A SUGAR HIT, and will be gone in a year or so. The reason is obvious, insurers are feeling unsupported and lonely following the limited exposure of dodgy TPD and IP claim decisions at the RC. For the moment the “softies” in claims are winning over the hard nosed nasty bean counters, but it wont last, because the shareholder must win.

About 12 months ago, a few honest insurers commented to me, on questioning how a number of IP and TPD claims that I thought were not strong had “got up”, said that they feared ending up in one of Adele Ferguson’s “stings” or on Current Affair or in the NSW Court of Appeal.

Comments are closed.