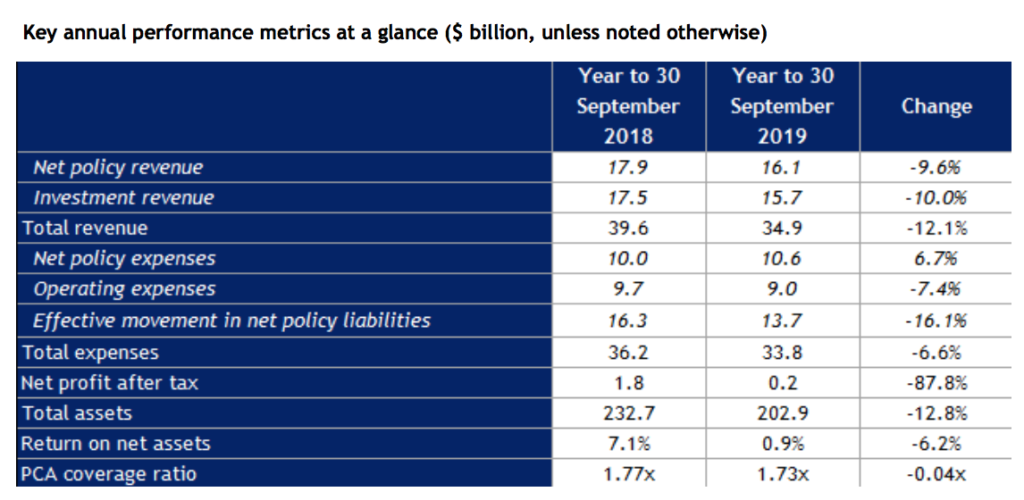

Australia’s life insurance industry’s performance continues to decline, according to the Australian Prudential Regulation Authority’s latest Quarterly Life Insurance Performance Statistics publication for the September 2019 quarter.

Industry net profit after tax (NPAT) was $0.2 billion for the year to September 2019, a significant reduction from $1.8 billion for the year to September 2018.

The report stated the persistent decline is primarily caused by poor performance of risk business with figures showing risk products recorded a combined loss of $105 million for the September 2019 quarter.

For the 12 months to September 2019, risk products reported a combined after-tax loss of $417 million, a significant reduction from the $654 million profit for the previous 12 months.

The report stated that apart from Individual Lump Sum which remained largely the same pre-tax, all other risk products deteriorated, particularly Individual Disability Income Insurance, primarily driven by a significant reduction in discount rates and a recognition of persistent adverse claims experience.

Results by product included:

- Individual Lump Sum $238 million profit

- Group Lump Sum $45 million loss

- Group Disability Income Insurance (DII) $67 million loss

- Individual DII $231 million loss

Click here to view the September 2019 Quarterly Life Insurance Performance Statistics publication.

It seemed to happen right after LIF,I wonder if there is a connection?

I know your being facetious but you are exactly correct Michael

If you drew a timeline I would guarantee you would see a slow but undeniable downturn since day one

The question is who do we blame ?? There is such a large choice of idiots that were put in charge of something they had no idea about and when it got to hard the either left that portfolio or blamed the advisers and set about putting more and more onerous and ridiculous rules and regulations on them

Not one has ever admitted maybe we got it wrong ?!!

Actually, the DI profitability problem started well before LIF. This has been a 10 year problem in the making. Some people were yelling about this a long time ago – but there were a lot of heads in the sand.

Comments are closed.