A detailed breakdown by CommInsure of all the claims it paid in 2019 reveals that the proportion of income protection claims by female policyholders increased from a year earlier.

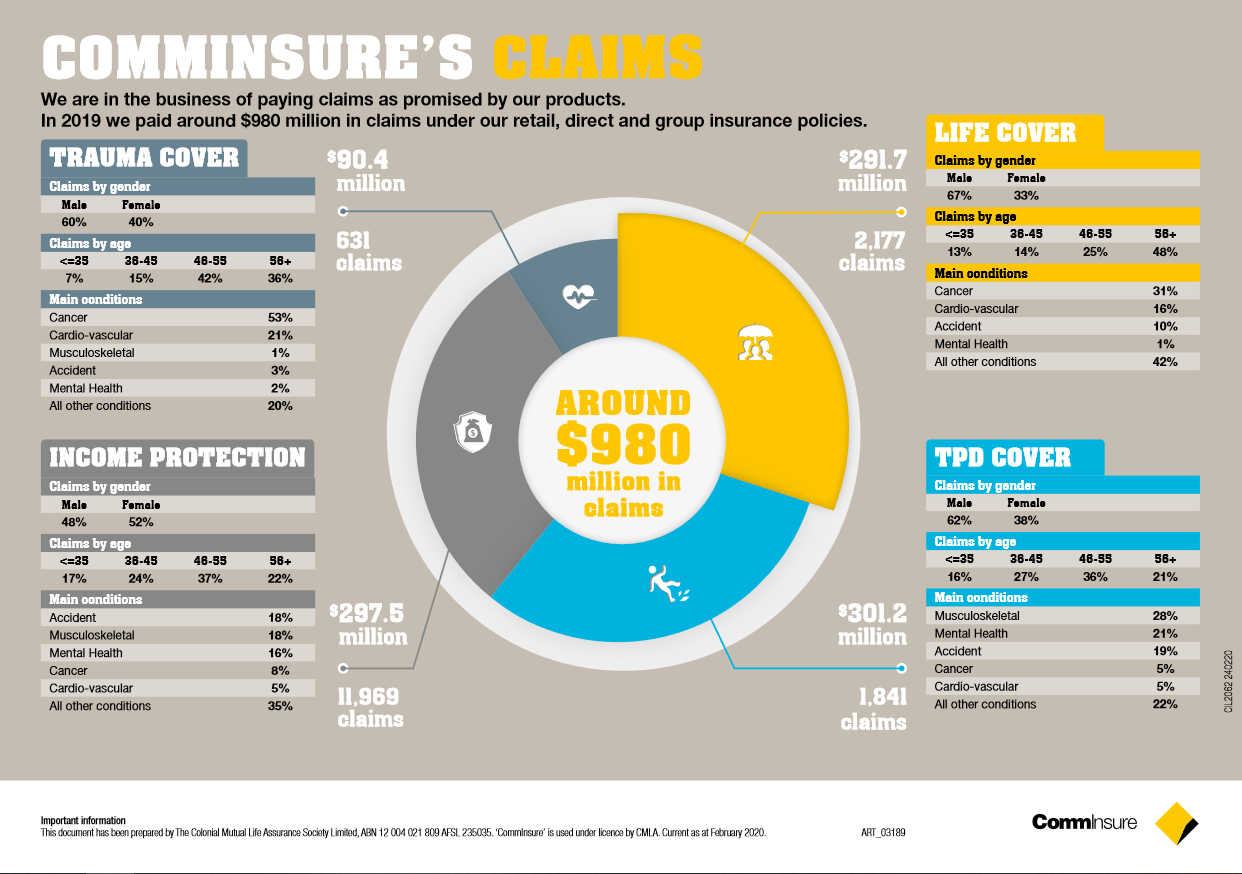

The insurer’s analysis of its total claims payments shows it paid around $980 million in 2019 (up $20 million from the 2018 year) under its retail, direct and group insurance policies.

This was made up of:

- TDP Cover – $301.2 million (1,841 claims)

- Income Protection – $297.5 million (11,969 claims)

- Life Cover – $291.7 million (2,177 claims)

- Trauma – $90.4 million (631 claims)

CommInsure’s detailed breakdown of each cover by gender, age and main conditions, shows of all IP claims 52 percent in 2019 were by females – up from 42 percent in 2018 – while 48 percent were made by males, down from 58 percent a year earlier.

Another trend appears to point to a rise in claims for mental health-related conditions. For income protection policies, these rose to 16 percent of all claims up from eight percent in 2018.

The main conditions IP was claimed under in 2019 were again accident (18 percent against 16 percent in 2018) and musculoskeletal conditions which also sat at 18 percent against eight percent in 2018.

In turn mental health claims made under a TDP policy rose to 21 percent of all claims in 2019 as against 18 percent in 2018.

The insurer has released an infographic outlining the breakdown of claims paid in 2019 under each type of cover (click here).

Claims by gender is completely misleading unless the client base is made up of 50/50 each gender, and we know it isn’t. Advised insurance tends towards 67/33 male/female split. Group is different depending on the underlying super funds.

Comments are closed.