The 2020 AFA Vision Conference saw AFA CEO, Phil Kewin outline the association’s vision for advice, which he says is about the industry getting on the front foot and shaping the future.

Kewin told the conference that AFA had been responding to new legislation inquiries for the last few years, “…but now is the time to set the vision, our blueprint for the future”. It aims to finalise the policy platform before the end of the year.

He says AFA’s blueprint for the future of advice is its response to both the immediate challenges advisers face and its longer-term vision. The Policy Platform seeks to achieve the following objectives:

- Increasing accessibility and ensuring affordability of financial advice for most Australians

- Enhancing the professionalism of financial advice

- Maintaining strong consumer protections and increasing public confidence and awareness in financial advice

- Facilitating policy settings that enable good financial advice practices to thrive

Kewin said that due to the rapidly changing environment AFA sees its Policy Response in three phases. Firstly its Royal Commission priorities, then a “smart regulation” program and thirdly its long-term vision for financial advice.

Of the Royal Commission response, he says its recommendations are:

- Annual renewal – where we focus on a practical ‘one form’ process with more flexibility for clients

- We believe clients should be able to pay for advice through any superannuation fund of their choice, provided it meets the requirements of a revised Sole Purpose Test

- The proposed Single Disciplinary Body represents a significant opportunity, if done right can significantly remove regulatory duplication

- Advocating for the retention of life insurance commissions at a viable level

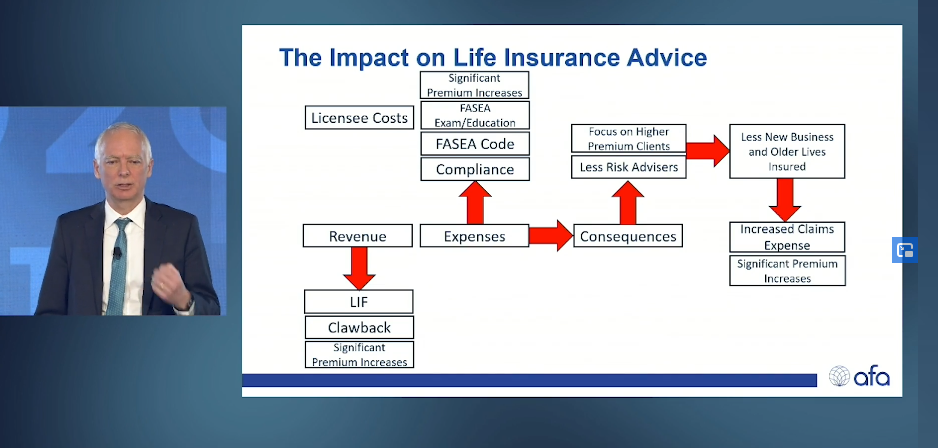

As to the the AFA’s smarter regulation priorities, Kewin says these are focused on ensuring a raft of regulation across the whole value chain of advice “…is actually practical and conducive to a growing, more vibrant and sustainable profession where it is easier for consumers to access advice and easier for advisers to run sustainable businesses”.

The priorities here include:

- Sensible pragmatic fixes to the outstanding FASEA issues

- Review of cumbersome financial advice documents like SOA and ROA

- Policy to ensure that small business life insurance advisers can continue to serve all Australians cost effectively

- Creating an environment for new professionally qualified candidates to enter financial advice more easily, by supporting small businesses to employ them

He also pointed to the AFA’s long term vision, which included:

- Tax deductibility of financial advice

- The most effective registration and licensing model

- The role of technology

- In essence addressing the overall, cost and efficiency of providing financial advice

Kewin noted that perhaps the only way to achieve this last point is through a comprehensive, fully independent review of advice.

“One that approaches it not from a negative perspective, designed to catch people out and magnify problems but one that genuinely comes at it from the consumer’s perspective, from a positive perspective, recognising that people need and want advice, but unless the system is completely overhauled, advice will increasingly be the domain of only the very wealthiest members of our society.”

The detail

The new blueprint for financial advice policy platform is being spearheaded by AFA’s General Manager of Policy and Professionalism, Phil Anderson, who covered some of the policy points in more detail in his address to the conference. He explained that the AFA’s priorities with the Annual Renewal Royal Commission Recommendation are:

- FDS: Repeal Fee Disclosure Statements

- One Document: The Agreement, Renewal Notice and Client Consent Form should be just one document

- Client Flexibility: Removing the linkage to FDSs enables greater flexibility in the timing of signing. We suggest anywhere between the 9th [of the] month and the 15th [of the] month

- Client Consent: Evidence of client consent should be provided to product providers electronically and less frequently than annual

And under its Smart Regulation policy Anderson told the conference that AFA’s key FASEA recommendations were:

- Recognise Experience/CPD: The Explanatory Memorandum spoke to the recognition of Diploma courses and CPD. It did not happen. Why not?

- Increased Flexibility in Study: Allow existing advisers greater flexibility in what they are required to study

- FASEA Exam: Provide clearer guidance and feedback to those who fail. Allow more discussion on the exam experience. Remove the limit on re-registering until three months after you last sat

- FASEA Code: FASEA needs to provide more certainty with what the code requires and Standard 3 needs to be changed. The code should not increase the cost of financial advice and reduce accessibility.

How many of these objectives do you think will come to fruition?

Our world is full of visionaries ? apparently This is starting to resemble the search for the holy grail

Comments are closed.