The Financial Planning Association has issued a call for the Government to create what it refers to as a ‘true professional registration’ for financial planners.

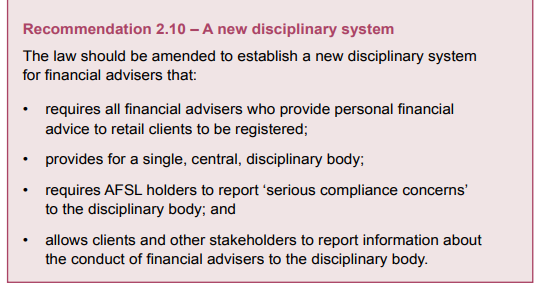

This call was made by the association following the completion of the Government’s industry consultation period for the establishment of a single disciplinary body for financial advisers, developed – at least in part – in response to Banking Royal Commission Recommendation 2:10, which called for the establishment of a new disciplinary system for financial advisers.

While the FPA states it welcomes the Government’s initiative in establishing a new disciplinary function for advisers and has ‘thrown its support’ behind many of the measures, it has highlighted the proposed adviser licensing model as an area for which it advocates further refinement.

The issue

From the FPA’s perspective, the issue revolves around the fact that the Government’s proposed model makes the registration of a financial adviser the responsibility of their licensee: “The registration is then contingent on the planner’s ongoing engagement by the AFSL and effectively duplicates the existing authorisation process.”

The solution

In offering an alternative solution that will remove this duplication, the FPA argues that a professional registration should demonstrate that an individual has met their professional requirements, is in good standing in the community and is ready to serve their clients:

“A financial planner’s registration should then follow them throughout their career and be a valued symbol of their professional status and commitment to uphold professional values.”

It’s the missing piece to the puzzle…

The association’s CEO, Dante De Gori, advocates that the creation of a personal obligation to register is an essential component of any professional framework. He says:

“It’s the missing piece to the puzzle. Similar to the legal, medical or architectural professions, the FPA strongly supports a model in which registration is the personal responsibility of each financial planner and is not connected with their employment or authorisation under an AFSL.”

De Gori adds that a ‘true professional registration’ will have flow-on benefits for consumers as it will improve the quality of the information on the Financial Adviser Register and ensure anyone can easily check the qualifications, registration status and disciplinary record of their financial planner.

Once advisers are individually responsible for their license they can’t just change licensees if they behaved as salespeople rather than advisers – they lose THEIR license.

That would be excellent as it will be a strong incentive for most advisers to work properly and professionally with clients.

Comments are closed.