Insurtech platform lifeinsurancedirect.com.au has launched a premium projection facility as part of its comparison engine.

A statement from the company says that for years life insurance customers have struggled to understand insurer discounts and specials and how they would impact their premiums over an extended period.

It says that customers will now be able to estimate their premiums over an extended period of up to 10 years.

lifeinsurancedirect.com.au CEO, Russell Cain, says the industry has seen customers confused by how ‘upfront’ discounts work and what the impact is on their premiums.

“I think most people in the industry are perplexed as to how they work, and the impact they have on the premiums for customers.”

He says that adding a premium estimate facility to its platform will go a long way to further educate customers over the long term costs of premiums.

Cain says that customers can be swayed by attractive upfront discounts offered by insurers, but over time some of these ‘specials’ can work out more costly than what was expected.

The company notes that while no one can guarantee what rates would look like in the future, “…the premium estimation facility gives customers an indication of what premiums could potentially look like for the next 10 years based on the information available today.”

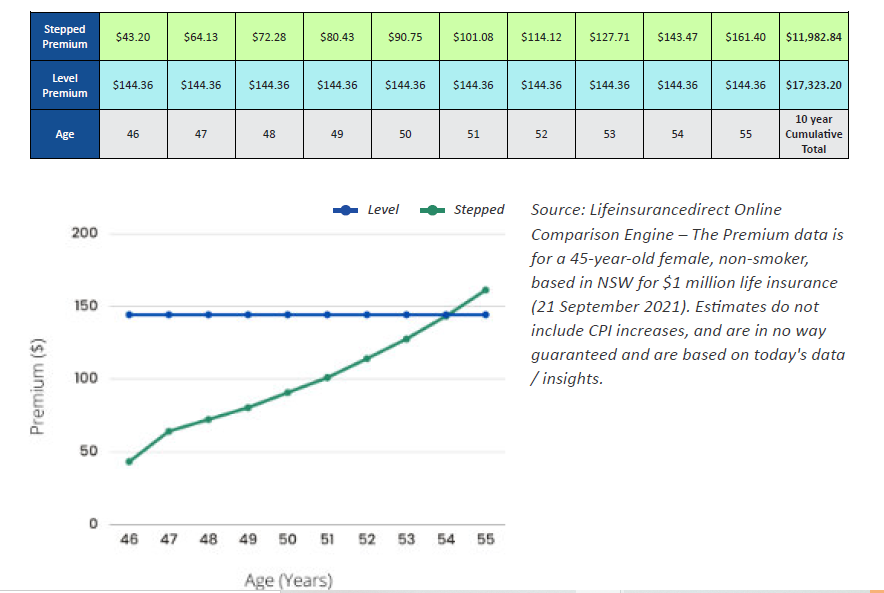

Customers will also be able to compare stepped premiums which are typically more affordable in the short term with level premiums that may be more affordable in the long term.

It says the pandemic was the cause of a significant amount of uncertainty and that customers need as much information as possible to make informed decisions with regards to their cash-flow considerations.

“The premium estimate facility will be able to guide customers looking for life insurance, income protection, TPD, and trauma insurance.”

Premium Examples and Cumulative Total

Reiterating that customers typically have a choice between stepped or level premiums when considering buying a life insurance policy, the company has provided an example (below) based on current knowledge, of what a customer’s premiums could look like over the next 10 years as well as the total estimated spend.