Individual lump sum risk new business was down marginally in the September quarter 2021, but individual IP new business rose 4.2 percent in the quarter, while annual attrition rates for both IP and individual lump sum continued their downward trend.

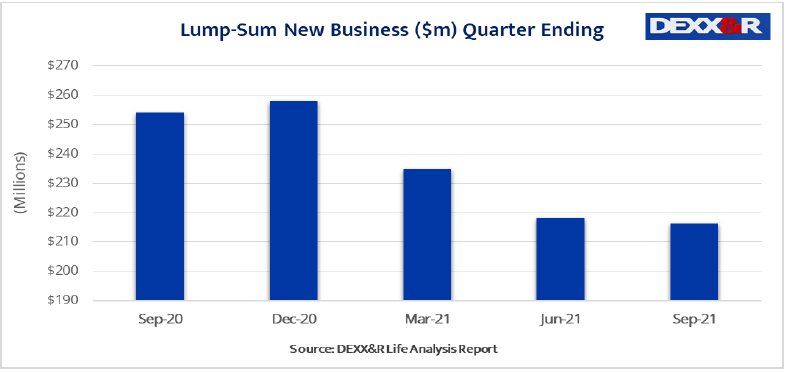

These were some of the key take-outs from DEXX&R’s Life Analysis Report* for the year ending September 2021, which revealed individual lump sum risk new business decreased by 0.8 per cent to $216 million, from the $218 million recorded in the June 2021 quarter.

The report notes lump sum new business sales for the year ending September 2021 were down 4.2 percent to $927 million. This is the fourth consecutive yearly decline in lump sum new business sales since September 2018.

The research firm says the continued decrease in new business reflects the impact of Covid-19 lockdowns and disruption in the advice distribution channel, including the restructuring and transfer of ownership of retail bank-owned dealer groups and a fall in the number of life risk advisers.

The report also notes that the individual lump sum attrition rate** fell to 8.6 percent in September 2021, down from 10.1 per cent in September 2020. It peaked in September 2013 at 15.6 per cent.

Income Protection

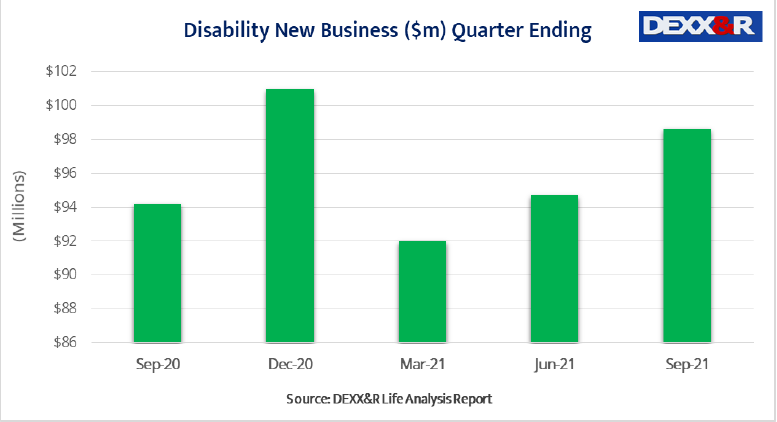

Meanwhile the data also shows that disability income new business in the September 2021 quarter was $99 million, up 4.2 percent from the $95 million recorded in the June 2021 quarter.

September 2021 quarter sales were up 4.7 percent when compared to the $94 million recorded in the September 2020 quarter.

For the 12 months to September, however, disability income new business decreased by 2.2 percent to $386 million over the year, down from the $395 million recorded in the 12 months to September 2020.

DEXX&R notes this is the lowest level of new business recorded since 2011 – a 10 year low.

“This fall is attributed to the impact of the COVID lockdown and disruption in advice channels and the APRA mandated product intervention effective from the end of March 2020,” it states.

Disability Income Discontinuances

Disability Income Discontinuances

The firm says the attrition rate for disability income business decreased for the eighth consecutive year, down from the September 2013 high of 16 percent to 8.6 percent in September 2021.

…This low level of discontinuances indicates that clients are retaining their existing disability income policies at a higher rate…

“This low level of discontinuances indicates that clients are retaining their existing disability income policies at a higher rate than has been the case over the past 10 years,” the firm says.

* The report includes data on all risk business issued by life companies from their statutory funds.

** The company says its DEXX&R Attrition Rate calculates discontinuances as a percentage of in-force premiums and that the formula “…provides a stable and consistent measure of discontinuances by premium value over time.”