- Disagree (70%)

- Agree (23%)

- Not sure (7%)

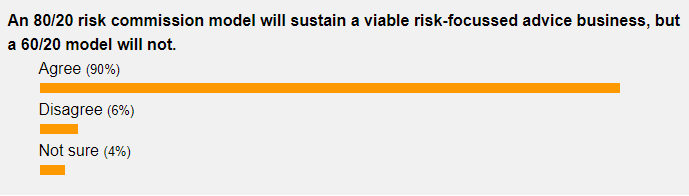

Our latest poll seeks your updated view, a little more than 12 months since we asked you the same question about what level of commission will sustain a risk-focussed advice practice.

We’re re-visiting this question following the release of ClearView’s recently-released 2022 Reform Agenda, in which the wealth manager strongly reinforces its support for the continuation of life insurance commissions, stating:

“The commission model is globally-accepted, economically rational and reflects how consumers prefer to pay for life insurance advice.”

Clearview’s agenda document adds that risk commissions enable product manufacturers to cover the full or partial cost of life insurance advice and that without this subsidy, the majority of Australians would not be able to access adequate protection (see: Leave Commissions Alone – ClearView).

…current life insurance commission rates in Australia are appropriate

In unequivocally supporting the retention of risk commissions, however, the wealth manager also notes it believes “…current life insurance commission rates in Australia are appropriate, capped at 60% upfront and 20% ongoing”, adding that any further changes are unnecessary and would have a detrimental impact on consumers, society and the life insurance industry.

Where do you stand on the question – not of retaining life insurance commissions, but whether – if retained – a 60/20 upfront and renewal model would be sustainable for risk specialist advice businesses.

A year ago, the adviser view on this question was very clear, as the final poll numbers indicate below:

Last time, we asked a slightly different question, which sought to compare the viability of an advice business operating under a 60/20 commission cap with one operating at 80/20. This latest poll, however, is focussed solely on whether the 60/20 commission model will sustain an Australian risk specialist advice business and – perish the thought – enable it to operate profitably.

Has your thinking changed at all since we covered this issue early last year? Or does the 60/20 commission cap remain seemingly a bridge too far for most advisers when it comes to future business sustainability? Tell us what you think, and we’ll report back next week…

The question of what is a reasonable commission to make it feasible for Advice practices to provide BID Insurance advice, comes down to two simple points. Cost and Risk.

Everyone, including the Government, Regulators, Insurers, Licensees and Advice Practitioners agree that the Regulations have made it too hard, the costs and risks have reached the point where surviving or exiting has become the focus and unless this changes, there will be a continual decline in Advisers wanting to be involved.

In the current climate, 60/20 is not enough and if 80/20 becomes the new benchmark, that will help alleviate the COST part of the equation, though does not help with the RISKS, whether real or perceived.

Everybody needs certainty and costs can be calculated, then planned for.

Regulatory risk is the big unknown, as it seems everyone has a different interpretation, including the Lawyers, the Regulators and the Judiciary, which leaves the rest of us at the mercy of the Maze of Complexity game that we all must live by.

There is work being done to improve this and I am pleased to say, we are heading in the right direction and it would appear the light at the end of the tunnel is getting bigger.

If Advice Practices can reduce the time and cost to service, while still providing great advice and be comfortable that the advice is compliant and not putting them at risk of potential liability for a grey interpretation that requires Lawyers and the Regulators to try and interpret, then there is a case for a reasonable commission that is profitable for Adviser practices, while also allowing the Insurers to provide reasonably priced Insurance products at a profit.

Commission is the ONLY viable way forward to help pay for all the work and advice around Insurance. The question of how much commission will always depend on Cost and Risk.

Jeremy, I hope that light at the end of the tunnel isn’t yet another train coming at us!

Well said again Jeremy on this topic of commissions.

I don’t believe many advisers would agree with Clearview’s Simon Swanson that the 60/20 commission model is now accepted by the majority of advisers. Far from it Simon. Just look at last years year’s poll where around 90% of advisers supported the 80/20 commission model, and the current poll above shows 60% still disagree that the 60/20 model is sustainable. Come on Simon go into bat for the financial advisers, support them and separate yourself from the pack of life insurers who are singing from the same choir sheet.

Comments are closed.