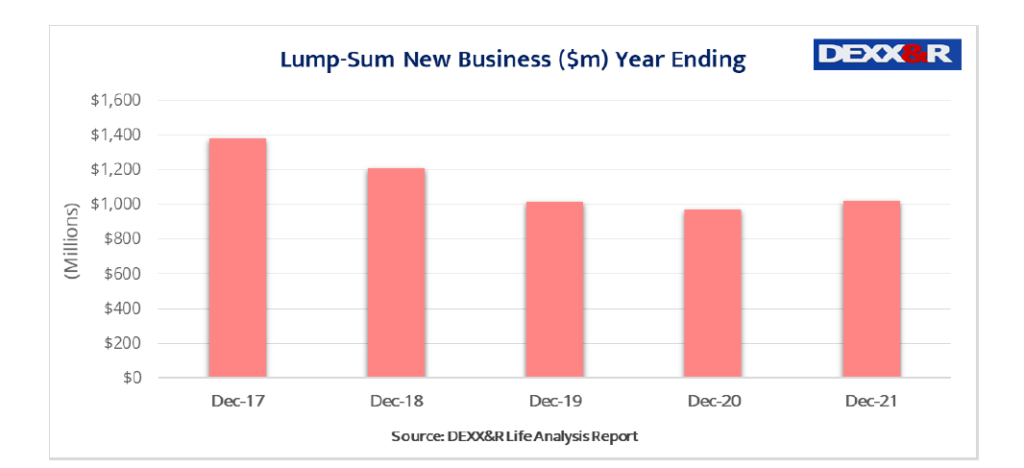

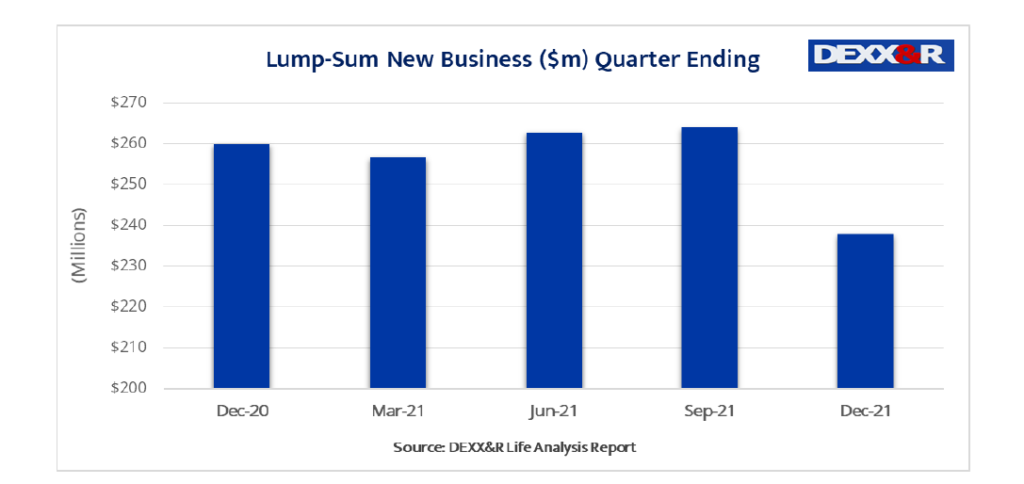

There was an overall increase in individual risk lump sum new business in 2021, but sales in the final quarter of the year declined, according to latest DEXX&R data.

While the researcher reports individual risk lump sum new business sales rose 5% in the year to December 2021, the final quarter of the year saw sales in this category decline by 8.5%, which is an indicator, according to DEXX&R, that the overall annual increase may not be sustained.

It notes the December quarter decrease in new business “…reflects the ongoing impact of the contraction in the number life companies with onsale products and a reduction in the number of financial planners following the transfer of ownership and restructuring of retail bank owned dealer groups.”

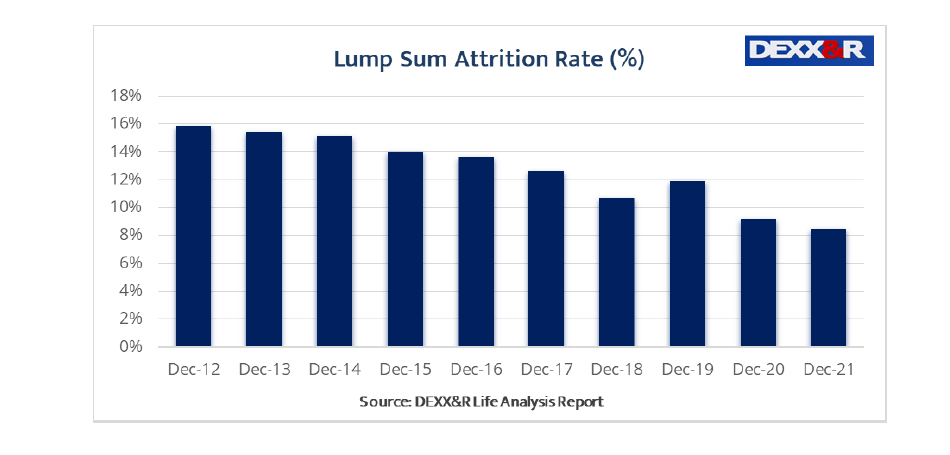

As to Individual Lump Sum Discontinuances, the Individual Lump Sum attrition rate peaked in December 2013 at 15.5%. The Attrition Rate fell to 8.5% in December 2021, down from 9.2% in December 2020.

DEXX&R says this trend indicates that more existing policy holders are retaining their existing cover. The firm’s Attrition Rate calculates discontinuances as a percentage of in-force premiums.

For the December 2021 year, Disability Income New Business increased by 4% to $408 million, up from the $392 million recorded in the 12 months to December 2020.

The firm says this increase follows a slump to a 10 year low in the year to December in 2020.

However in the December quarter, Disability Income new business was $97 million, down 12.9% from the $111 million recorded in the September 2021 quarter.

“December 2021 quarter sales were also 6.4% lower than the $104 million recorded in the December 2020 quarter.”

DEXX&R says that the decline in new business during the December 2021 quarter is “…attributed to APRA’s mandated product intervention with new products on sale from October 2021 offering more restrictive terms and conditions than the range of Disability Income products previously on sale.”

It says that quarterly sales will be closely watched over the coming three quarters to assess the ongoing impact of these changes.

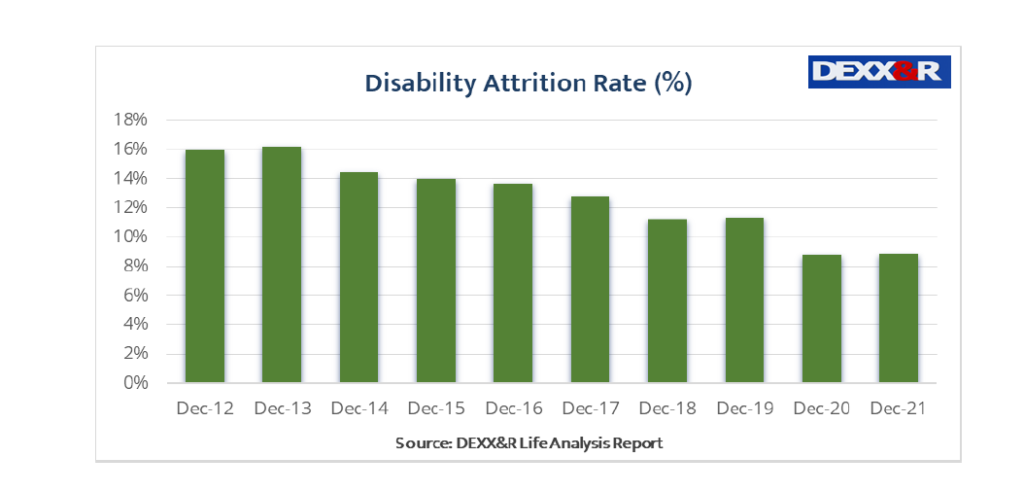

The DEXX&R Attrition Rate for Disability Income business decreased for the eighth consecutive year, down from the December 2013 high of 16.2% to 8.8% in December 2021.

The firm says this low level of discontinuances “…indicates that clients are retaining their existing Disability Income policies at a higher rate than has been the case over the past 10 years. This trend is expected to continue as the terms and conditions offered by existing products are significantly more favourable than those offered by current onsale products.”

There are some flaws in the figures.

Premiums have risen and actual clients on the books, have stagnated.

Massive premium hikes have, in the short term, helped with inflows, though the sentiment from the people paying the premiums, is that they are reaching unaffordable levels.

There is only so many times you can squeeze the mop to wring out the life giving water.

The truth is, that Australia has an ageing population of premium payers who provide most of the revenue and who will be cutting down on their Insurance cover each year going forward.

There is a critical shortage of the next generation to take up the batten to make up what will be an evaporating pool.

The next generation tap needs to be turned on to refill and expand the current capacity.

Comments are closed.