The Financial Planning Association says current commission caps under the LIF reforms do not allow sufficient and appropriate remuneration for those delivering life insurance advice.

The association’s position is documented in its submission to the Treasury’s Quality of Advice Review, in which its response to the Review’s Question 51* states in part that many FPA members have ceased providing life insurance advice to their clients at current commission rates “…as they do not remunerate the financial planner sufficiently for the work required to provide recommendations and implementation assistance to the client.”

While not as specific as the AFA’s call for the LIF commission caps be lifted from 60/20 to 80/20, the FPA’s statements nonetheless reflect and reinforce the AFA’s position that the current commission cap arrangements don’t adequately remunerate advisers (see: AFA Calls for Return to 80/20 Risk Commissions).

In reaffirming that risk commissions should remain exempted from the ban on conflicted remuneration, the FPA notes many Australians would not be able to afford to pay for financial advice on insurance by paying an upfront fee, and that risk commissions currently allowable under the LIF remuneration reforms provide the only option for these consumers to access financial advice.

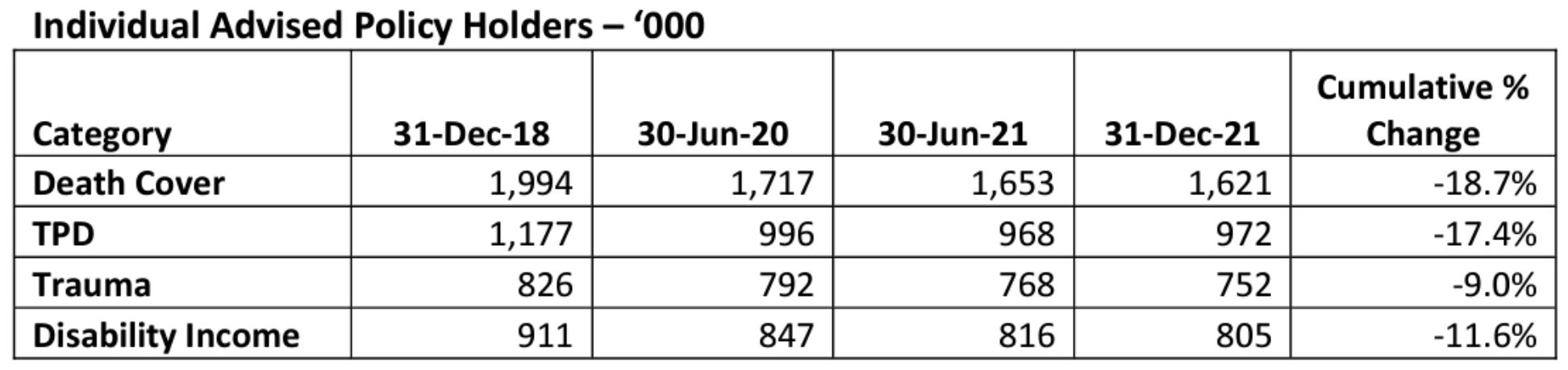

Also similar to the AFA’s submission, the FPA has provided factual data in its response to Review Question 53**, which supports the contention that the capping of life insurance commissions has led to a reduction in the level of insurance coverage or contributed to underinsurance. The two associations have cited the same APRA data to support their case, which tracks the decline in the number of individual advised life insurance policy holders since the implementation of the LIF commission caps at the beginning of 2018:

…The reduction in remuneration has made it economically unviable to provide life insurance advice to the bulk of the population

The association also cites research data from NMG Consulting which reveals retail advised new business volumes have declined from $638 million in 2016, before the LIF reforms commenced, to just $317 million in 2021. It adds this number is expected to fall further over the next few years, driven largely by the following factors:

- The significant exit of financial advisers from the profession and particularly those who are active in the life insurance advice market

- The reduction in remuneration has made it economically unviable to provide life insurance advice to the bulk of the population

- The APRA intervention in the Individual Disability Income Insurance market has led to substantial changes to Income Protection products, making it very difficult for generalist to come up to speed in terms of understanding these new products

…it has become much more difficult for Australians to access life insurance advice

The association concludes: “Overall, the number of financial planners who choose to provide life insurance advice has declined substantially and this has meant that it has become much more difficult for Australians to access life insurance advice.”

The FPA’s position on the future of risk commissions represents one of many critical elements documented in its extensive submission to the Quality of Advice Review, in which it joins with 12 other industry associations in endorsing five key themes as priorities for improving the affordability and accessibility of quality financial advice for consumers, which comprise:

- Recognising the professionalism of financial planners

- Addressing the needs of clients including easier-to-understand documentation

- Achieving regulatory certainty

- Improving sustainability of profession and practices

- Facilitating open data and innovation

Click here to access the FPA’ full submission to the Treasury’s Quality of Advice Review.

*The Treasury’s Quality of Advice Review Question 51 asks: What would be the implications for consumers if the exemptions from the ban on conflicted remuneration were removed, including on the quality of financial advice and the affordability and accessibility of advice? Please indicate which exemption you are referring to in providing your feedback.

**Quality of Advice Review Question 53: Has the capping of life insurance commissions led to a reduction in the level of insurance coverage or contributed to underinsurance? If so, please provide data to support this claim.

I’d be rolling on my office floor in hysterical laughter at this article if it wasn’t so deadly serious for our once great industry. So the FPA thinks 60/20 is inadequate, do they? They’ve rarely even acknowledged the needs of risk advisers over the decades! Did they push for separate qualifications or a more appropriate FARCE-IA exam? No! Did they listen to advisers when we told them 60/20 and 2 yrs would kill the industry? NO! Do we all remember how they endorsed 60/20 comms and 2 yr c/back when it came in?!!

Now, on their little soapbox, they say we need 80/20. How abjectly PATHETIC. FPA going cap-in-hand BEGGING for 80/20. What a sickeningly virtue signalling group of useless nothings!

This industry is on its death bed and I can tell you that NOTHING short of a sharp reduction in compliance AND 100/20 commissions will come close to fixing it. Just watch – you’ll see soon enough if they don’t do both of these things and quickly!

Comments are closed.