The Actuaries Institute is warning of the possible impact of long Covid on the workplace, insurance claims and premiums and public health.

In a Research Note for the Actuaries Institute, How COVID-19 has affected Mortality and Morbidity in 2020 & 2021, authors Jennifer Lang, Richard Lyon and Karen Cutter examined the global and Australian experience.

In examining long Covid the authors anticipate “…higher insurance claims and potentially higher premiums for all disability-related insurance – including income protection, workers’ compensation and Group Total and Permanent Disability.”

They say that long Covid will require:

- Better health care for long term illness, such as investment in more health care workers, long Covid clinics, and other supports in the health care system

- Income support for those unable to work, or who have reduced ability to work, due to long Covid

- Support in the workplace to enable affected workers to continue working while suffering long Covid symptoms

However spokesperson Jennifer Lang adds it’s too early to say what the long-term impact will be, “…but we need to be ready. There are more people who are long-term disabled than there were before Covid.”

… Australia recorded fewer doctor-certified deaths than expected throughout 2020 and 2021…

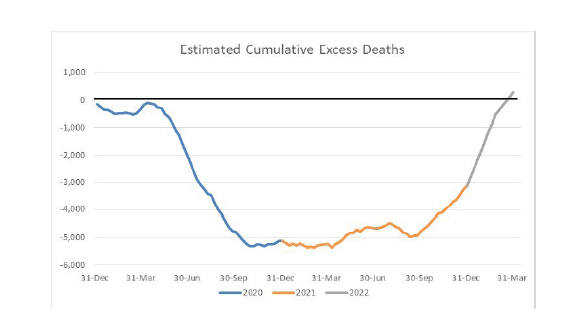

In general, the report found that Australia recorded fewer doctor-certified deaths than expected throughout 2020 and 2021, despite the impact of Covid, with measures such as border closures, face masks and social distancing helping to limit the number of lives lost.

Their data shows 17% average excess mortality across 37 countries during the pandemic in 2020-21. Excess deaths ranged from -4% (New Zealand) to +84% (Peru), with 5.7 million excess deaths over two years.

The statement says that in Australia, excess deaths were lower than predicted (-1%) over 2020-21, “…aided by a sharply lower incidence of respiratory illnesses such as influenza and pneumonia, through winter. The number of lives lost to respiratory diseases in 2021 was 17% (2,700) lower than predicted.”

- Deaths from pneumonia were 31% (950) less than predicted

- Deaths from influenza were 100% (840) less than predicted

For other non-Covid deaths, there were:

- More deaths than expected from heart disease (up 930 or 7%), cerebrovascular disease (up 420 or 5%), diabetes (up 330 or 7%), and other causes (up 2,500 or 6%)

- Less deaths than expected from dementia (down 490 or 3%) which is likely related to lower levels of respiratory disease in the community

The Institute says its “excess mortality” model measures actual deaths against predicted deaths, in total and across each cause of death and age band. The prediction allows for changes in the size and age of the population and for trends in mortality improvement.

…analysis by age band revealed surprising results…

It says the 2021 analysis by age band revealed surprising results including significantly lower deaths in the 45-64 age band, significantly higher in the 75-84 age band, and close to expected in the 85+ band. The reason for the differences is unclear.

“Perhaps the differences between the two oldest age bands are due to higher levels of protection in aged care homes, home care and hospitals than in the general community, possibly leading to much fewer-than-expected deaths from respiratory disease,” the report says.

The authors also noted the sharp rise in Covid deaths for the first quarter of 2022, with just over 4,000 COVID-19 deaths, following the relaxation of public health measures. This is almost two-thirds of the 6,341 Covid deaths over the course of the pandemic up to the end of March 2022, and it has resulted in the elimination of the negative excess mortality experienced in 2020 and 2021.

Actuaries Institute President Annette King says the Covid mortality working group, and actuaries broadly, have provided unique insights into the pandemic.

“Actuaries use their skills to advise on a wide range of current issues and public policy,” she says. “During the pandemic, they looked at the patterns of data to help policymakers and the public understand the impact of this unprecedented public health crisis.”