A decline in individual lump sum new business in the year to March 2022 has been offset to an extent by an increase in disability income new business for the same period, according to latest reporting released by DEXX&R.

The expert research firm’s Life Analysis Report for the year ending March 2022, released this week, reveals individual Death, TPD and Trauma new business was down by 2.3% for the period, while individual IP new business levels grew by 2.5%, resulting in an overall decrease of 1% in total individual risk new business premiums.

Lump sum new business

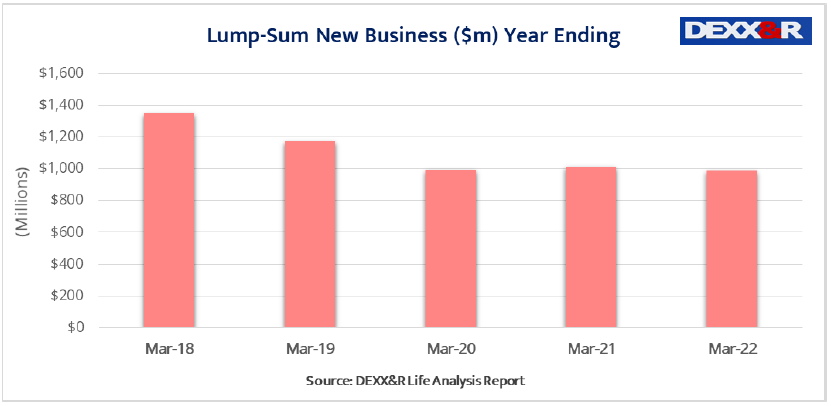

The decline in lump sum new business, according to DEXX&R, is indicative of the current trend in recent years, although the following chart suggests this decline may have plateaued:

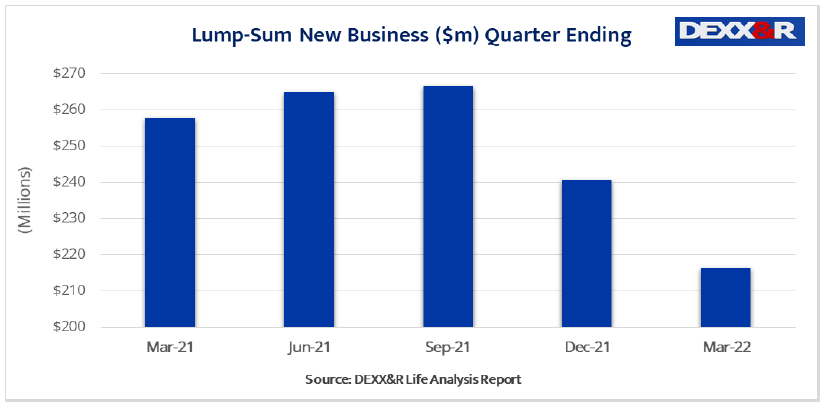

This year-on-year plateau, however presents in stark contrast when comparing lump sum new business in the 2021 March Quarter to the same period this year, which has seen a significant decline:

This year-on-year plateau, however presents in stark contrast when comparing lump sum new business in the 2021 March Quarter to the same period this year, which has seen a significant decline:

DEXX&R MD, Mark Kachor, told Riskinfo this 2022 March Quarter decline is indicative of the ongoing impact of the contraction of the number of life company brands offered in the market, such as CommInsure, Asteron Life, BT and AMP, and the accompanying reduction in life company BDM activity, all of which is exacerbated by the disruption to the dealer group sector, which is witnessing a continuing decline in specialist risk licensee firms.

DEXX&R MD, Mark Kachor, told Riskinfo this 2022 March Quarter decline is indicative of the ongoing impact of the contraction of the number of life company brands offered in the market, such as CommInsure, Asteron Life, BT and AMP, and the accompanying reduction in life company BDM activity, all of which is exacerbated by the disruption to the dealer group sector, which is witnessing a continuing decline in specialist risk licensee firms.

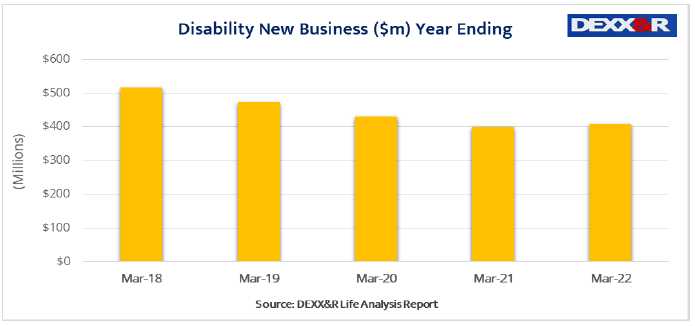

IP new business increase – at last

In contrast to lump sum products, IP or Disability Income new business increased by 2.5% in the year to March 2022. DEXX&R reports this increase finally halts what the firm stated was a slump to a ten-year low in IP new business in the year to March 2021:

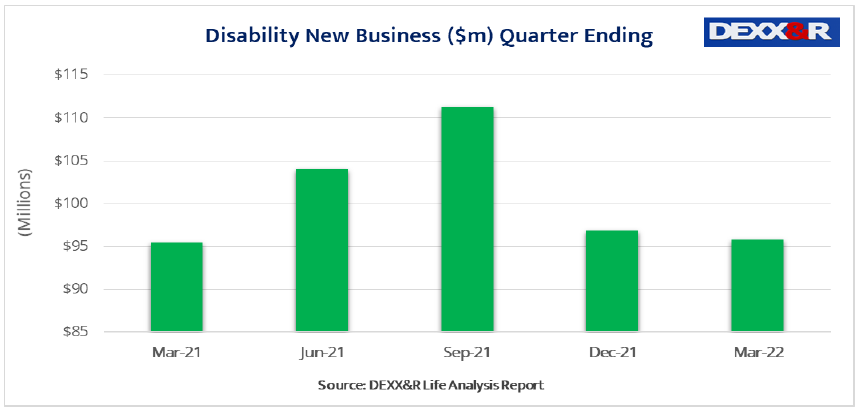

Unlike the lump sum new business data, the March 2022 quarter numbers for Disability Income almost matched March quarter 2021 activity (only down 0.4%).

Unlike the lump sum new business data, the March 2022 quarter numbers for Disability Income almost matched March quarter 2021 activity (only down 0.4%).

The same chart below, however, also highlights the decline in IP new business since the end of the quarter to September 2021, with DEXX&R referencing the elephant in the room in relation to “…APRA’s mandated product intervention with new products on sale from October 2021 offering more restrictive terms and conditions than the range of Disability Income products previously on sale.”

Finally, DEXX&R reoports that attrition rates for both lump sum and disability income products remain at or near nine or ten-year lows, indicating more policy holders are retaining their existing cover – particularly for income protection products, where this trend is expected to continue as the terms and conditions offered by existing IP products are significantly more favourable than those offered by current on sale product options.