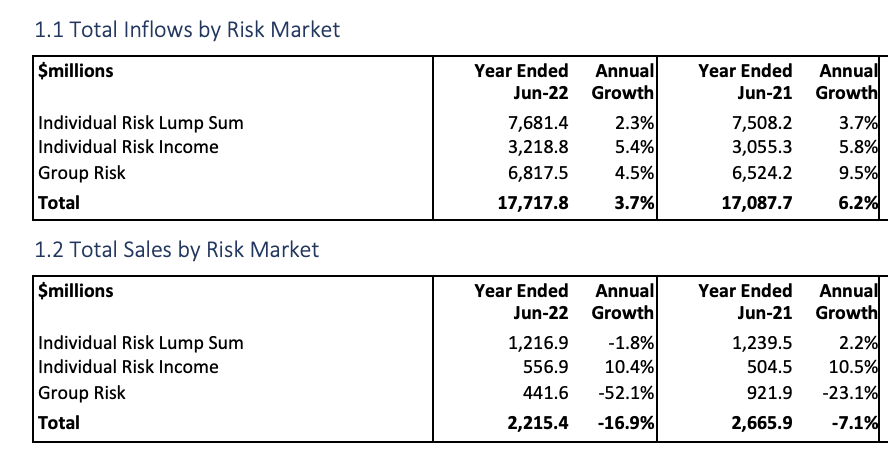

The latest data from Plan for Life reports risk insurance inflows rose over the year to June 2022, but individual risk sales are trending down.

Key findings from the report include:

- Risk sales of most insurers fell, with AIA, Metlife and NobleOak showing the biggest decrease

- Annual risk sales across both individual and group dropped 16.9%, mostly attributed to Group risk sales more than halving

- In the Individual Risk Lump Sum market, Life, TPD and Trauma insurance experienced a slight decline in sales

- In the individual Income Protection market, sales increased by 10.4%, significantly faster than the Individual lump sum market.

Inflows and Sales across Insurers

Based on data gathered by Plan for Life:

- Sales in the Individual Lump Sum market are generally impacted by activity in the housing market. This remains a significant source of new business, but with rising interest rates and the slowing property market, this may translate to decreased lump sum sales.

- Sales in the individual Risk Income Insurance market are affected by both affordability/premium rates and small business profitability.

- Group Risk suffered a significant decline in sales of 52.1%. This could be the result of super fund insurance mandate movements, which was relatively subdued in the market during the past year.