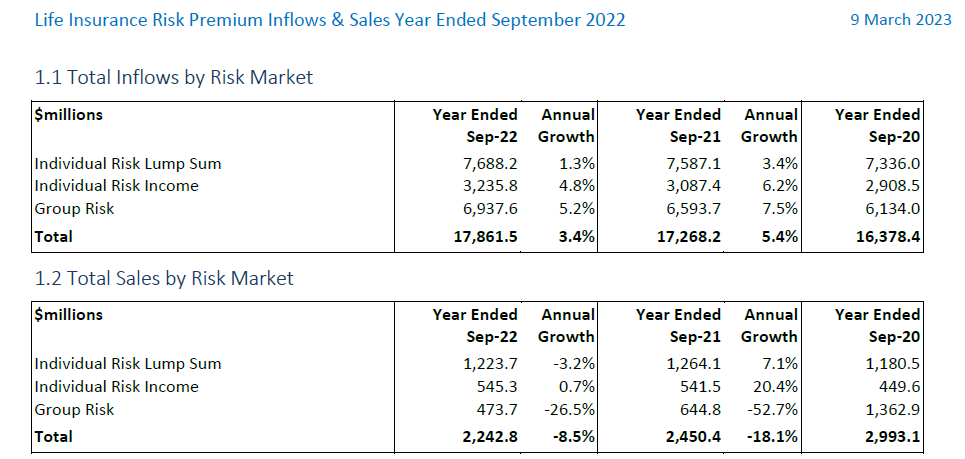

While risk premium inflows rose by 3.4% in the year to September 2022, overall annual sales in the risk market fell 8.5%, mainly due to reported group risk sales finishing down more than a quarter, according to Plan for Life’s latest data.

The Actuaries and Research firm’s latest Market Overview says that in the individual risk lump sum market, year-on-year inflows were up only slightly by 1.3%, while annual individual risk lump sum sales decreased by 3.2% to $1,223.7 million. (Also see:Strong IP Growth -Latest Data).

Plan for Life says that in the individual risk income market, overall individual risk income inflows rose 4.8% over the past year to reach $3,235.8 million.

Year-on-year new risk income sales remained little changed, up just a marginal 0.7% to reach $545.3 million, the firm says.

“Plan for Life says that in the individual risk income market, overall individual risk income inflows rose 4.8% over the past year to reach $3,235.8 million.”

4.8%! That doesn’t even cover inflation. And that’s all individual inflows, not new business. In other words it represents the gouging that our friends the life insurers are still engaging in at the moment.

Please close the door and turn out the lights when you leave!

Or here’s the thought CALI – tell the government that LIF has failed, and make it profitable for advisers to provide life risk advice in our currently completely mad level of compliance, regardless of QAR, which will soon sit on a shelf somewhere.

Comments are closed.