Much of the interest from Riskinfo readers this week has been our report on the Government finally releasing the long-awaited draft bill for the Experienced Adviser Pathway…

The government has released for consultation an exposure draft Bill and explanatory memorandum to deliver its election commitment to better recognise experienced financial advisers.

The Treasury website states the draft legislation would deem an adviser to have met the education requirements if they:

- Have 10 years (cumulative) experience providing advice between 1 January 2007 and 31 December 2021

- Have not recorded any disciplinary action on the Financial Advisers Register before 31 December 2021

Treasury says advisers would still need to pass the exam (also see: New Pathway for Experienced Advisers Proposed and Support for Pathway – With Modifications).

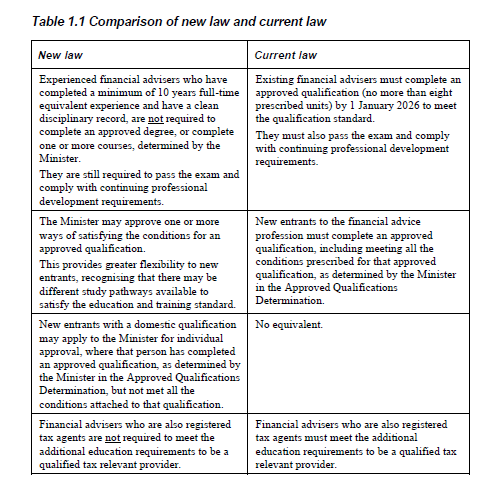

The explanatory materials on the Treasury Laws Amendment (Measures for Consultation) Bill 2023: Financial Adviser Professional Standards says that experienced financial advisers “..who have completed a minimum of 10 years full-time equivalent experience and have a clean disciplinary record are not required to complete an approved degree, or complete one or more courses, determined by the Minister.”

“They are still required to pass the exam and comply with continuing professional development requirements,” it says.

Under current law, existing financial advisers must complete an approved qualification (no more than eight prescribed units) by 1 January 2026 to meet the qualification standard. They must also pass the exam and comply with continuing professional development requirements.

Approved Qualifications for New Entrants

The explanatory materials says under the new law, the Minister may approve one or more ways of satisfying the conditions for an approved qualification.

“This provides greater flexibility to new entrants, recognising that there may be different study pathways available to satisfy the education and training standard.”

In addition new entrants with a domestic qualification “…may apply to the Minister for individual approval, where that person has completed an approved qualification, as determined by the Minister in the Approved Qualifications Determination, but not met all the conditions attached to that qualification.”

The explanatory memorandum notes too that financial advisers who are also registered tax agents are not required to meet the additional education requirements to be a qualified tax relevant provider

In looking at the context of the amendments, the explanatory materials note that the Professional Standards of Financial Advisers Act 2017 introduced “…new education and training requirements to improve consumer outcomes and increase public confidence in the financial advice industry.”

…practical implementation issues have arisen…

However, it says, practical implementation issues have arisen:

- Existing financial advisers with extensive industry experience and a clean disciplinary record are leaving the industry

- Potential new entrants are unable to meet the qualifications standard for technical reasons, despite meeting the substance of that requirement

- The Better Advice Act 2021 introduced unnecessary duplication of qualification requirements to provide tax (financial) advice services, for some financial advisers who are also qualified tax agents

The explanatory document says the Schedule contains amendments to address these implementation issues “…whilst maintaining the high standards introduced in the Better Advice Act 2021 to improve the financial advice industry.”

Consultation closes on May 3, 2023.

A question I have been continually asking and to date, there has not been a credible answer is;

What strategy is being planned and implemented, that provides sufficient incentive for someone outside the University degree pathway, to want to enter the Industry as a risk specialist?

With risk specialists having exited to the point where there are now only hundreds and holistic Advisers scoping out risk advice unless it is to save the client from leaving them due to premiums doubling and the client demanding a better premium, I am yet to see ANY solution that will solve this issue and yet, it is so simple and the answer has been provided hundreds of times over the last 7 years.

I have made submissions to ASIC and Treasury since 2016 and not one person, Business Executive, Association or Government / Regulator has been able to take my submissions apart and find fault with the direction I know we must take.

I have probably bored many people with my never ending push for a separation of risk advice from Investment advice and appropriate Education that is fit for purpose and encourages new entrants from all walks of life to enter the risk Industry either as a career, or as a stepping stone to move towards becoming a holistic Financial Planner in the future.

What we have today is a Gate keeper who blocks the path for 95% of potential new entrants by forcing them down a maze of complexity.

Most new entrants to the Financial Planning Industry, came into it from outside Industries and what they brought, was Life experience and a willingness to work and learn.

Today, none of those people can even get a look in.

I started with Legal and General in February 1987 after having a chat with an Adviser who had a practice and I had ZERO knowledge or tertiary qualifications.

I have employed many people over the last 36 years and our Business has had a 100% success rate with all our clients claims, yet today, I would not even be given a chance to join the Industry.

Multiply this by virtually every person who has been involved in Business outside of the now closed secret society that has become the Financial / Risk Advice model and what we have ended up with, are educated kids with very little experience in Life or Business, advising the rest of Australia.

A question I would like an answer to, though no-one in the Education Ivory towers seems willing to find out or discuss, is how many University graduates over the last 5 years have specialised in risk advice?

We all know over 12 thousand advisers have left the Industry, that Life Insurance advisers have been decimated, New Business has plummeted and premiums have doubled over this period, causing great financial stress and cancellations / reductions of cover for millions of Australians, with Billions of additional welfare payments now starting to add to the deficit and yet, there is still no valid answer or solution to the problem of making it attractive or viable to enter the Insurance Industry.

You are a voice for common sense Jeremy. Keep up the good work.

Comments are closed.