Two advice firms have launched a tailored client relationship management system designed specifically to support risk-focussed general advice practitioners operating within their networks.

The new CRM system has been rolled out by Life Plan FP Australia and Consilium Advice Australia following feedback the firms received in a survey intended to uncover insights from risk advisers who have made the transition from personal to general advice.

According to a spokesperson for the group, the new CRM offer is intended specifically for general advice to the extent that it does not include additional features general advice practitioners don’t utilise:

“The benefit of that is that it means they are not paying for something they are not using,” says the spokesperson.

Key features of the system include:

- Email templates within the CRM – advisers can upload their own templates and the CRM will populate them

- Integration with risk research tools including Omnium and Life Risk Online, where each adviser can create a quotation which the CRM will automatically attach to an email and send to the client

- Integration with commission and premium tracking – the CRM is capable of being integrated with insurance portals to track commissions

- Integration with emails – automatic tracking of all email communications with clients within the CRM

- Population of forms from clients’ contact cards

- Voice and call recording for advisers that wish to use the system for recorded client file notes

- Marketing capabilities, including bulk email send-outs

The spokesperson added that the automated elements within the package, together with the integration of quoting tools and upload features assists adviser compliance in attaching all the relevant information in their correspondence to the client, including all the required General Advice disclaimers.

Survey outcomes

The survey, which acted in part as a catalyst for the implementation of the new CRM system, sought to determine the impact on various aspects of professionals’ lives, from stress levels and workloads to overall job satisfaction, work-life balance and mental wellbeing.

While the results are based on feedback from a relatively small cohort of former personal risk advice specialists who have made the transition to risk general advice, the outcomes appear to indicate reduced stress levels and improved mental and emotional wellbeing among this group.

A selection of the findings and commentary taken from the survey is summarised in the following charts:

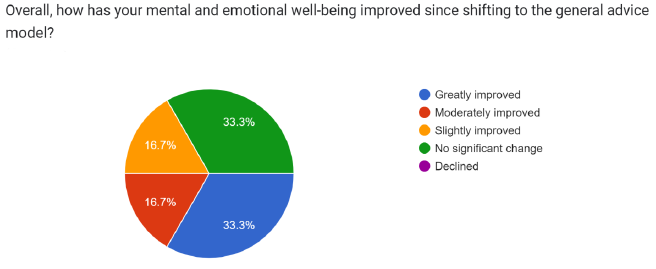

Mental and Emotional Wellbeing

The survey revealed a notable improvement in mental and emotional well-being among those who made the transition. Respondents reported that their mental and emotional states had “moderately improved” or “greatly improved.” This positive change speaks to the potential benefits of providing advice within a broader framework, which could alleviate some of the emotional challenges tied to personalised advice.

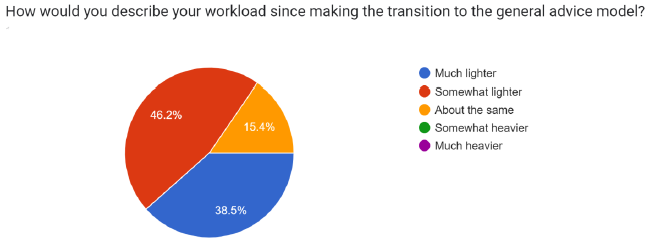

Stress Levels and Workload

One of the key aspects explored in the survey was the impact on stress levels and workload. The results indicated that a majority of respondents reported a decrease in stress levels after transitioning to the general advice model. This reduction in stress was often accompanied by a feeling of a “much lighter” workload. This suggests that the shift to a broader advice model may have relieved some of the pressures associated with the personalised nature of advice in the insurance industry and the compliance framework that goes with it.

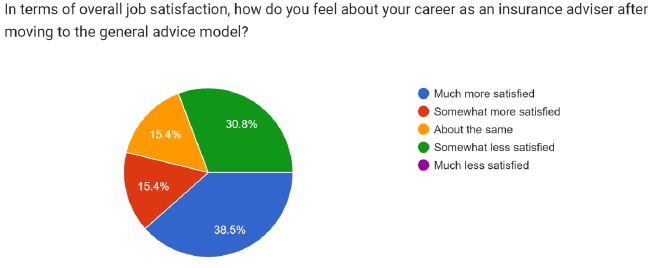

Job Satisfaction

Job satisfaction also appeared to have been positively impacted by the transition. The majority of respondents expressed that they were “more satisfied” or “much more satisfied” with their careers as insurance advisers in the general advice model. This change could indicate a greater alignment between job expectations and the actual experiences of advisers under the new paradigm.

Advisers can click here to review the complete survey findings.