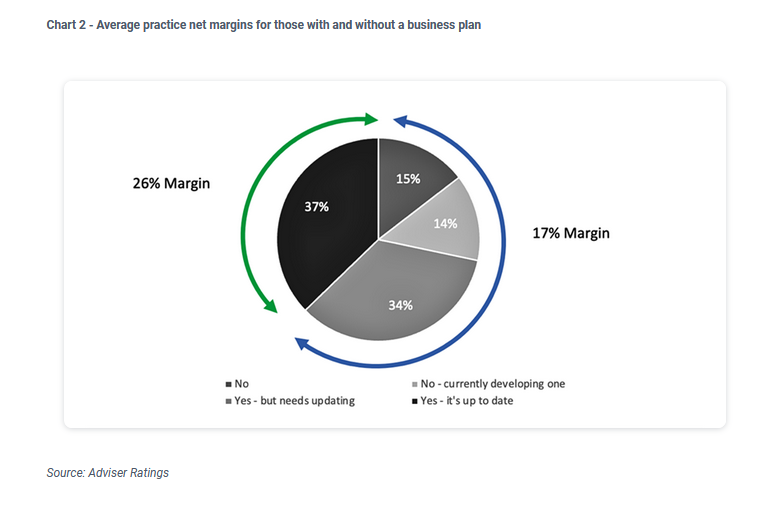

Advice practices with an active business plan are operating on average margins nearly 10% higher than those without one, according to Adviser Ratings, which also highlights that only 37% of practices have a business plan.

The research firm says that factoring in an average salary of $120,000 for the principal, those with an active business plan are operating on average margins of 26% as against a 17% margin for those without.

It adds that the margins are consistent “…for those even who have had a business plan in the past, but have not updated it. Unsurprising, as the plan needs constant and consistent refinement.”

The firm says even as it interrogates these numbers further “…these margins are just as pronounced for the solo practitioners, if not more so, for those that do have an up-to-date business plan.”

In noting that with the move to self-licensing, the foundational piece of a business plan is often overlooked, it says the “…value of this cornerstone vision document is none more evident than the profitability for those who do have one.”

In noting that with the move to self-licensing, the foundational piece of a business plan is often overlooked, it says the “…value of this cornerstone vision document is none more evident than the profitability for those who do have one.”

…the one-person practice was least likely to have a business plan in place…

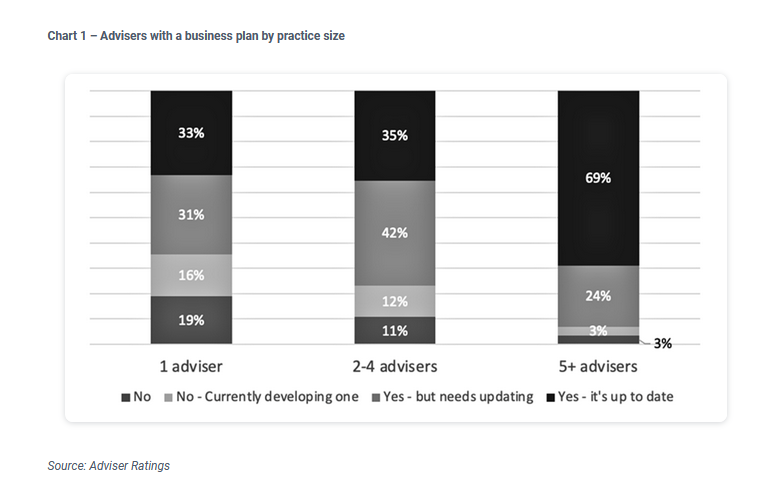

Of the approximately 500 practices surveyed, the one-person practice was least likely to have a business plan in place.

“While many tout the benefits of a comprehensive business plan, the argument when interviewing practices for not having one was primarily due to the perceived simplicity and flexibility of their operation.”

Adviser Ratings says these solo advisers often rely on their intimate knowledge of their client base, lean operational structure, and adaptable decision-making processes.

“They argue that the time and resources required to draft and maintain a formal business plan might outweigh the benefits for a small-scale operation, and that their agility allows them to pivot in real-time without the constraints of a rigid document.”

But, it says, as firms grow, employ junior advisers or support staff, the need for a living business plan becomes more evident.

But, it says, as firms grow, employ junior advisers or support staff, the need for a living business plan becomes more evident.

…Close to 70% of practice heads have an up-to-date plan…

“Close to 70% of practice heads have an up-to-date plan, with a further 24% having one in place previously.”

The firm says the benefits of a business plan are numerous “…providing clarity and a roadmap for the future, rules around navigating regulatory complexity, helping identify target audiences and building robust marketing strategies (even if referral based), helping secure funding or becoming an attractive acquisition or merger target, but the key one is increased margin.”

As to whether the size of the licensee counts, Adviser Ratings says that “…surprisingly, practice heads are running their business plans without much input from the licensee – born out in the quantitative data.”

It notes that the licensee model for many “…is more about access to dealer services than business strategy support. Notwithstanding a few outliers, especially those licensees who factor in business plans as one of their core criteria when onboarding a practice.”

Adviser Ratings concludes that “…with up to 10% margin at stake for these practices and a move to co-equity models, having a business plan for a financial advice practice and the licensee of that practice isn’t just a bureaucratic necessity, it’s a strategic tool that drives growth and margin, ensures compliance, and builds resilience in an ever-evolving market landscape.”