- Disagree (54%)

- Agree (34%)

- Not sure (12%)

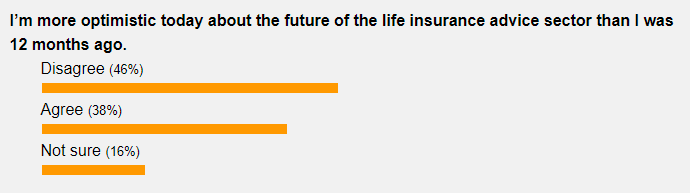

If you think you recognise this poll question, you’re correct.

We asked you this same question following the announcement – almost exactly one year ago – that Michelle Levy would be recommending the retention of life insurance commissions as part of her Quality of Advice Review findings (see: Retain Risk Commissions…).

This recommendation eventually formed part of Levy’s final report, handed to the Government in December last year, which in turn was ratified by Minister Stephen Jones in June this year (see: QoA Review Decisions…).

With the announcement a year ago that the QoA Review leader would be recommending life insurance commissions be retained – albeit at their current levels – this is how you voted:

12 months on, has anything changed in your mind? What’s changed from a year ago is the Government’s ratification of the recommendation to retain risk commissions, together with its initial acceptance of 14 of the 22 QoA Review recommendations. What hasn’t changed, however, is the debate as to whether commissions capped at 60/20 with a two-year responsibility period is sufficient to deliver a commercial viability for risk advice practices with many – most, in fact – saying it isn’t.

12 months on, has anything changed in your mind? What’s changed from a year ago is the Government’s ratification of the recommendation to retain risk commissions, together with its initial acceptance of 14 of the 22 QoA Review recommendations. What hasn’t changed, however, is the debate as to whether commissions capped at 60/20 with a two-year responsibility period is sufficient to deliver a commercial viability for risk advice practices with many – most, in fact – saying it isn’t.

Overall, though, has there been enough change or water flowing under the bridge for you to have developed a slightly more positive (or perhaps more negative) outlook around the future of life insurance advice in Australia?

We’ll be very interested to compare whether your collective view has changed from a year ago as we continue to monitor and report the relative ‘health’ of life insurance advice and its place within the future narrative of financial advice in Australia.

Tell us what you think and we’ll report back next week…

Commissions capped at 60/20 with a two-year responsibility period is an abject insult to professional advisers and their clients. It is a measure installed by those who have no clue and/or have been captured by the bleeding hearts of the vocal special interest entities. The buzzword ‘sustainability’ is a politician and corporate dribble-speak favourite these days however it doesn’t get a look-in on this subject. Life companies are not long term viable anymore with the style of idiocy now permeating policy design.

60/20 is clearly not sustainable for advisers and will be a large part of the reason why the risk specialist advice profession will not exist after 2026. It is also contrary to all the politicians and industry luminaries who are calling for new entrants to the profession. It won’t happen. Anyone smart enough to survive in this new clown world of risk advice is smart enough to see, before they enter it, that it offers zero monetary return. 60/20 is not even meeting costs, 80/20 is ‘just’ head above water and 100/20 will be the point where reward for effort finally returns. Don’t even start me on client fees for specialist pure risk advice.

I’m retired now so I do not have a dog in this race the way I once did. I do still hold life policies on my family so do care about the outcome on that sustainability front. My children will need IP one day soon. What should I say to them? Self insure? It is looking like the better option at this crazy point. I also care about the conundrum facing my clients I left behind and their horrifically escalating legacy policies. What can they do now – switch into these lightweight half-arsed stripped down worthless excuses for new modern policies? What are the poor few remaining advisers supposed to tell them to do? Pay the extortionist premiums of their older quality policies OR switch to a new one and roll the dice?

God forbid a claim occurs on these new vapourware policies – the client will be screwed without a decent contractual definition upon which to claim and the adviser is screwed when he/she is blamed for switching to an inferior policy. Create a perfect SoA, it will help you not. A good litigator will make mince meat of any SoA when monetarily motivated. We’ve seen it too many times, especially with IP.

Anything less than 100/20 for professionals with a maximum 1 year responsibility period will see complete failure in the risk advice space. Life companies, if you didn’t know this already you deserve to fail. If you did know it already and didn’t champion your advisers and clients when you had the chance to reverse this tragedy then you also deserve to fail. Clients will be the biggest losers, as usual. What a hot, stinking, steaming brown stain of a mess.

Comments are closed.