- Disagree (54%)

- Agree (34%)

- Not sure (12%)

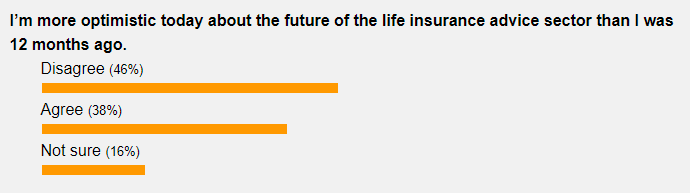

Little has changed in the last year when it comes to the adviser perspective on the future of the life insurance advice sector.

As we go to press, just over half of those voting in our latest poll (52%) disagree they’re more optimistic about the future of life insurance advice than they were a year ago. 35% do agree they’re more optimistic, however, while 13% are unsure.

When we launched this poll last week, we asked whether enough water had passed under the bridge since we asked the same question 12 months ago for you to have developed a slightly more positive (or perhaps more negative) outlook around the future of life insurance advice. The outcome so far reveals, sadly, that your collective answer to this question tends towards the negative. Here again is a reminder of how you voted a year ago:

We could take a stab at what this poll outcome means. For example, does it mean that, while risk commissions have been confirmed as having been retained, this actually means little-to-nothing if they’re to be retained with the current 60/20 commission caps and 24-month responsibility period? The intuitive argument here is that there’s little point in retaining risk commissions if the current remuneration caps act as a significant barrier to the ability to maintain and grow a commercially viable life insurance-focussed advice proposition.

We could take a stab at what this poll outcome means. For example, does it mean that, while risk commissions have been confirmed as having been retained, this actually means little-to-nothing if they’re to be retained with the current 60/20 commission caps and 24-month responsibility period? The intuitive argument here is that there’s little point in retaining risk commissions if the current remuneration caps act as a significant barrier to the ability to maintain and grow a commercially viable life insurance-focussed advice proposition.

But rather than Riskinfo speculating, we’re more interested in what you think. While we never claim scientific rigour around our poll outcomes, we’re nonetheless very interested to understand what it means to you that an even higher proportion of the Riskinfo audience has a negative outlook on the future of life insurance advice today than you collectively did a year ago.

What will need to change before more advisers see their glass half full…

…This may in turn lead us to another question, such as: What will need to change before more advisers see their glass half full when it comes to the future of risk advice? What will it take? Is it all about easing the LIF commission caps and the 24-month responsibility period – or is it more nuanced and more complex than that?

We welcome your thoughts as always as our poll remains open for another week…

YES, the poll article is completely correct in my view when it speculates:

“For example, does it mean that, while risk commissions have been confirmed as having been retained, this actually means little-to-nothing if they’re to be retained with the current 60/20 commission caps and 24-month responsibility period? The intuitive argument here is that there’s little point in retaining risk commissions if the current remuneration caps act as a significant barrier to the ability to maintain and grow a commercially viable life insurance-focused advice proposition”.

THIS WAS A SIGNIFICANT PART OF THE REASON I LEFT AND SOLD MY CLIENT BASE 3 YEARS AGO, after 36 years helping clients. I had ‘planned’ to stay at least 10 more years. However the industry was falling apart due to spineless creatures at the regulation level and at the life companies.

I also know for a fact it is the reason a good number of my 20 and 30 year++ experienced colleagues did the same and more have done in the past year. If commissions do not return to 100% upfront (yes, 100%) AND stay at 20% renewals AND a fix is not found for these extraordinarily high interminable premium increases then the life industry is completely done-for. Oh, and these new IP policies with useless stripped-down contractual definitions have to be ‘fixed’ or the whole show is over just on this alone. No self respecting adviser would/should involve any client they care about in one of those compliance and claim nightmares!

It is probably too late now anyway, given the exodus of experience and nobody left to properly field-train new entrants. University qualifications are lovely, shiny and smooth ’round the edges but without proper field training and people-skills uni quals alone are useless in creating a long term career in the highly people-complex and multi-skilled life advice arena. A slow protracted painful financial death for the life industry and all of those associated with it is more than likely ahead.

We tried to tell the life companies and regulators over 10 years ago but the self-absorbed dolts refused to listen. Now the piper needs to be paid. Sadly the consumers will be the biggest losers (advisers a close 2nd) due to the ignorance/arrogance of those very regulators and life company execs.

Comments are closed.