People are prioritising life insurance and other personal insurances more than ever, even being prepared to reduce their grocery bills to keep their life insurance, according to a new report.

Direct Australian life insurer, NobleOak, has launched the latest edition of its annual NobleOak Life Insurance Pulse Report that finds despite the downturn, Australians are favouring financial protection.

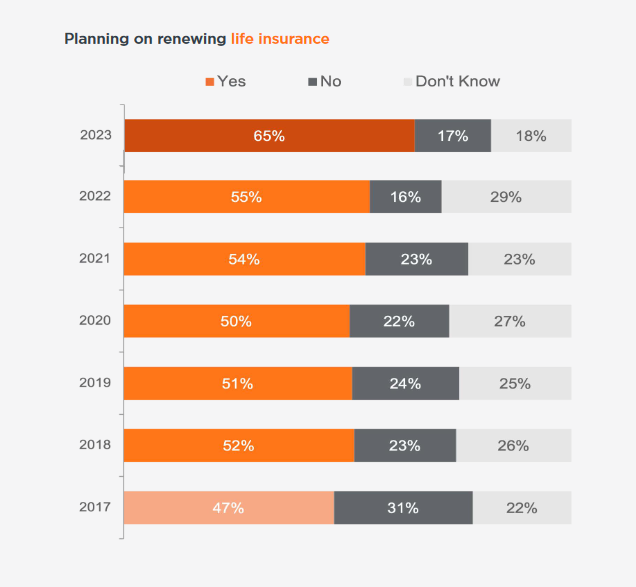

One of the findings the report highlights is that more people currently holding life insurance are planning to renew this year than the insurer has seen in every year since it began conducting the survey in 2017.

The report notes that of those that currently hold life insurance products “…a significant portion (65%) are planning to renew their life insurance this year. This trend has increased year on year, with only 47% certain they would renew back in 2017, indicating a substantial shift in consumer mindset around the value of these products.”

The report says this indicates that the current external climate is influencing Australians to become both more financially responsible and risk adverse.

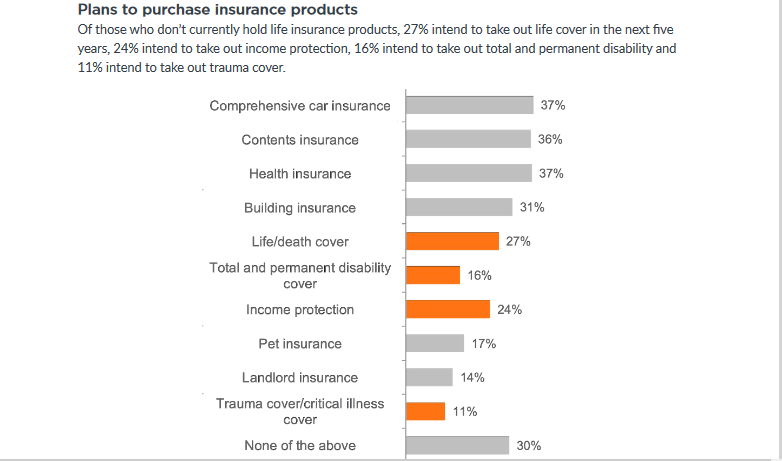

Meanwhile of those who don’t currently hold life insurance products “…27% intend to take out life cover in the next five years, 24% intend to take out income protection, 16% intend to take out total and permanent disability and 11% intend to take out trauma cover,” the survey found.

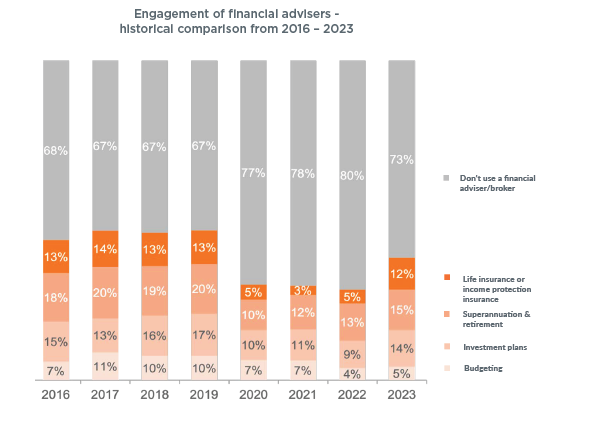

The report also notes that use of an expert such as an adviser or broker for financial advice has increased, compared to previous years, but demand has not returned to pre-pandemic levels.

It notes that “…12% of our sample now use an adviser or broker for their life insurance or income protection needs, rising slightly closer to 2016 – 2019 results after a big dip in Covid years. The trend is similar for both superannuation/retirement products and investment plans.”

Nobleoak says the aim of the annual report is to “…pulse the sentiment of the country with the aim of uncovering Australians’ attitudes and approaches towards life insurance and their current financial situations.”

Director & Chief Executive Officer, Anthony Brown says the report reflects NobleOak’s ongoing commitment to educating consumers on life insurance whilst contributing insights for the betterment of customers and the broader Australian community.

“…We recognise that a deep understanding of the financial landscape is essential for meeting and exceeding the evolving needs of Australians. This helps inform and shape NobleOak’s ongoing support for our customers.”

The research also found:

- Close to half (41%) feel concerned about their current financial situation

- One in four (25%) of Australians surveyed do not feel confident that if something happened to them, their family would be looked after financially. This figure is highest amongst those without life insurance – 37% compared to 27%

- While over a third (35%) don’t feel in full control of their personal finances, the research suggests Australians would like to become more empowered, with over two thirds (70%) of those surveyed saying they wish they could do more

Brown adds that the research underpinning the report “…shows us that Australians have a proactive mindset when it comes to their financial situation, but there is still a pressing need for improved financial literacy.”

Click here to read the full report.