The life insurance industry’s performance continues to worsen, partly driven by the poor performance of risk business, says APRA in releasing its Quarterly Life Insurance Performance Statistics publication for the March 2020 quarter.

A statement from APRA says that the life industry’s net loss after tax was $1.8 billion for the year to March 2020, “a significant reduction from $759 million profit in the previous year”.

“This deterioration was caused by poor results in both the December and March quarters, driven by the poor performance of risk business and a substantial collapse in investment revenue owing to the Covid-19 related volatility in investment markets. This was somewhat offset by the release of reserves, which fell by 78.1 percent in the 12 months to March 2020.”

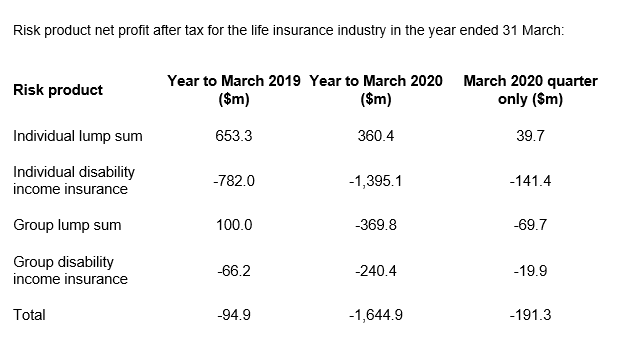

APRA stated that for the 12 months to March 2020, risk products reported a combined after-tax loss of $1.6 billion.

“All risk products deteriorated with the only exception being the Individual Lump Sum product. In particular, Individual Disability Income Insurance (also known as Income Protection Insurance) reported a substantial loss, primarily driven by loss recognition as adverse claims experience persists,” the regulator says.

The publication provides industry aggregate summaries of financial performance, financial position, capital adequacy and key ratios and is available here.

An industry in crisis and the consequence of throttling their own distribution channel with the LIF changes combined with the very serious income protection claim issues. Is it mostly mental health claims that are cratering the profitability of income protection?

APRA state that these losses result from adverse claims experience. While that may be true, everyone knows that a lack of income is also a cause. But while LIF remains in it’s current form, then these losses will continue. I really don’t know what it will take for the message to get through – risk advisers in particular cannot justify the cost of new business while trying to adhere to LIF. Furthermore, a recent article said that advisers are “overwhelmed with regulation”, which is another reason new business is down. This will only get worse as more advisers exit rather than complete FASEA’s degree. I have said this before and believe it’s worth repeating – all retail insurers, the AFA and FPA, and the major dealer groups, must go the govt collectively and make them understand what is happening to the retail life industry in this country. Reinstate commissions, rid us of the 2 year clawback and abolish this requirement of a full financial planning degree for all experienced advisers – nothing less will be accepted by advisers. The longer you leave it, the longer the recovery.

Well said Concerned I`ve been writing Risk Insurance for about 30 years and basically I haven`t written one policy since 2018. LIF is an absolute joke and I`m afraid that I won`t be looking at Risk again until the powers that be come to their senses.

Comments are closed.