The Financial Services Council has released a new research report which advocates for a radical overhaul of Australia’s financial advice system.

Conducted for the FSC by research firm, Rice Warner, the report calls for a restructuring of the financial advice sector in order to make advice more affordable and accessible to consumers.

Positioned by the FSC as ‘groundbreaking’ research, the recommendations, if implemented, may serve as a game-changing development for the future of financial advice in general and potentially for life insurance advice, in particular.

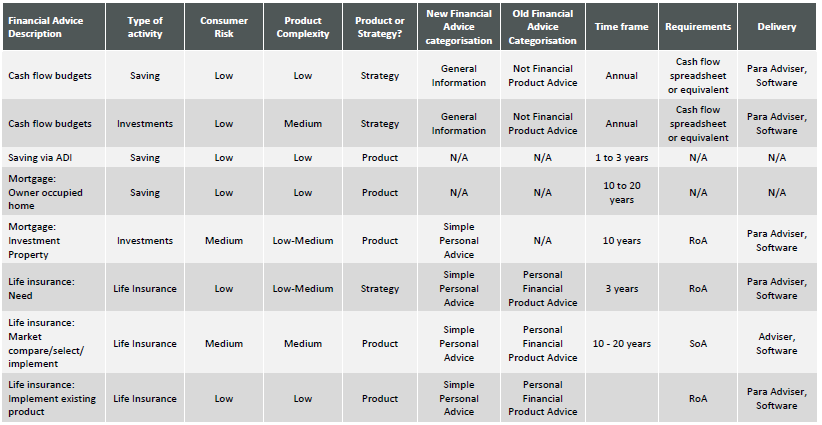

At the heart of the report recommendations is a call to legally re-define the term ‘financial advice’ into component elements of General Information and Personal Advice, where the degree of advice complexity corresponds with the perceived risk to which the client may be exposed:

- General Information – which incorporates the existing definitions of Education, Information and General Advice

- Personal Advice – to be simplified by separating it into Simple and Complex based on the extent of risk for the consumer:

- Simple Personal Advice – advice that deals with well understood financial needs and financial products. Specifically, those that are nominated under ASIC’s Design and Distribution Obligations as being for average family consumers.

- Complex Personal Advice – advice that is not simple advice but should also specifically include products and strategic topics that are known to be complex and/or risky

Taken from the Rice Warner report, entitled Future of Advice, this chart is a visual representation of the proposed new definitions of financial advice in Australia:

The report considers the need for advice and the value of advice within its summary of the current regulatory regime and then it offers a proposed new model, which is intended to deliver:

- Simplification

- Affordability

- Accessibility

- Consistency

- Quality of advice

It cites an example where three different life insurance-related advice scenarios can fall into either simple or complex advice categories:

“Another example is someone buying life insurance for the first time. This could be categorised as Simple Personal Advice if simply adding to the cover in their MySuper product, but Complex Personal Advice if they consider all life insurance needs for an individual, family or business. However, any later discussions, renewal or product changes should be easier for a consumer to understand and should carry lower risks. Therefore, the later advice could be downgraded to Simple Personal Advice.”

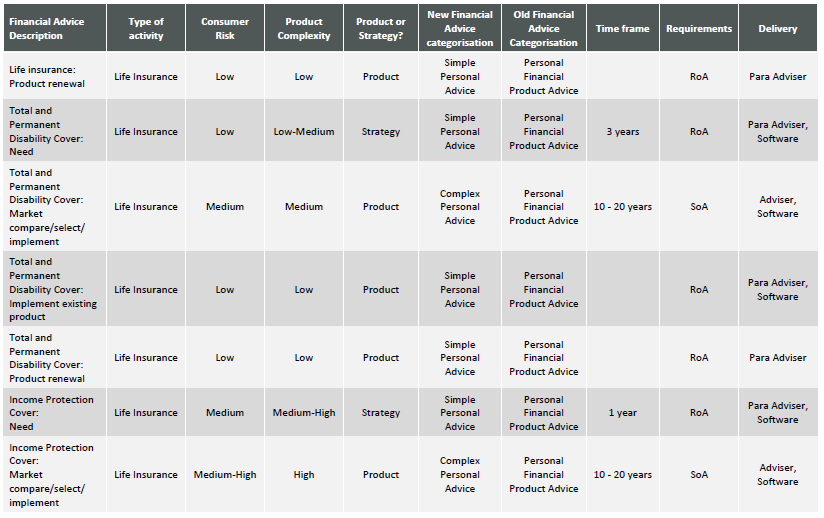

In addition to drilling down further into the types of advice under the proposed structure and giving consideration to client best interest scenarios, code of ethics and FASEA requirements, the report also includes a set of sample mappings that describe the type of financial advice, the risk to the consumer and the requirements that would be stipulated for the delivery of that particular advice solution. Life insurance advice-related tables are set out below:

In referring to the current FASEA education standards, the report notes that “…while the objective of higher standards is admirable, the implementation has been woeful.” It notes the law regards all Financial Advice (outside single-issue advice) to be complex and risky for consumers, but: “In many cases, the regime enforces an unnecessary expensive complex process which simply increases costs.”

The FSC says it will consider Rice Warner’s research as well as engaging extensively with stakeholders, including financial advisers, ahead of launching a policy document or Green Paper on Financial Advice next year, which it says is a critical step in policy development.

FSC CEO, Sally Loane, said: “The aim is to build a new model for financial advice which not only makes professional quality advice more affordable and accessible for consumers, but also removes the mass of costly compliance and regulatory burden on the sector.”

Click here to read the Future of Advice Report.

Quote from the article:

“The aim is to build a new model for financial advice which not only makes professional quality advice more affordable and accessible for consumers, but also removes the mass of costly compliance and regulatory burden on the sector.”

Let me re-phrase that:

“Industry lobby group determined to sell more product falsely claims their real interest is in making financial advice more affordable for consumers – also known as real people advisers call clients. Laughably conflicted group also fails to acknowledge the role its members played in misconduct that’s led to the mass of compliance and regulatory burden on the sector.”

Ideally this would be followed up by:

“Nonsense policy driven by inherently conflicted lobby group broadly dismissed by government, associations, consumer groups and advisers, who are focused on making advice actually accessible and better, rather than creating more loopholes so they can more easily flog their products.”

Well thought out Status quo The problem apart from just making this more convoluted in an attempt to wind back the initial stuff up is that they are only addressing part of the problem. If advisers where looked at as people trying to run a business that the whole country relies on as an intricate part of the solution they would be asking us. Why are you leaving why can you not provide adequate advice. The red tape they mention is certainly part of it but you still have to make money to survive keep staff employed and pay the bills. Great red tape down income still not right. You cannot reduce someones Income by 50% and think it wont have far reaching consequences

With the Muppet Labour MP talking about cutting Risk commissions to 0% we do this all for free. It’s the lunatics running the asylum.

Absolutely Warren.

25 years ago there were 50,000 agents working in the insurance business. By this time next year we will be lucky to see 20,000 Financial Planners remaining, possibly even as few as 15,000. Most of these are focusing on clients with large investment balances and more complex needs. In the meantime the average Australian needs access to simpler advice, and yes typically it is around protecting what they have worked hard to achieve, so the conversation is likely to center around risk protection as they have no money to invest and a fairly tight budget… Something needs to be done and SOON otherwise the flip side of over regulation will mean most Australian consumers will not be able to access advice. Making a change now is a political risk – this was clearly shown by both the minister and the shadow minister at the AFA conference, neither was willing to really give any ground on this subject. Personally I have passed the FASEA exam and will do the other required study, but as a whole the framework around financial advice has gone way beyond ‘the public good’ and is now completely counter productive to the public receiving relatively basic needs based advice.

Sound remarks as always, Tim. 100% agreement here. Ironically, all these proposed “changes” wouldn’t have become necessary if the powers-that-be had left things alone 10 years ago and stopped meddling in what worked very well. The old saying: ‘if it ain’t broke, why try to fix it?’ holds true still.

Yes Tim 100% concur with you, a blanket approach to advice/education maybe convenient for the regulators but not practical for advisers and clients. I agree with ASICs view that our advice should be Clear, Concise and Effective, but don’t understand why they continue to raise the cost of providing advice which is counter productive to the greater public good, as it is making it harder to advise those who need it most.

Q- Btw, how many clients have asked you what qualifications you have? The answer for me is zero and when I explain to clients I’m having to redo my qualification they think I’m joking, so I ask myself as a Risk Specialist why is it necessary to do a Grad Dip FP when I already have an ADFP, FChFP and ChLP, if its not the public who are demanding it? I’ll press on and do what I have to do but will continue to question the motivation and intention behind the continual burdens being placed on good advisers.

I agree Adam. We are among the thousands who have and always will act in our clients best interests, we didn’t have to sit a university course that says ‘we understand ethics from an academic perspective’ to be ethical, ethics along with many other qualities were drummed into us long before we submitted our first prop!

I hasten to add, I am not suggesting for a moment that we were or are the complete deal, we would all acknowledge some formal study has been needed and ongoing education is entirely appropriate given the importance of what we do – as you too have rightfully acknowledged, but the journey we are currently on is not where many of us want or needed to be.

Further in my opinion this current mandate was not needed to sort out what was wrong with financial planning. There were / are other issues at play, and often the adviser is not the cause, but is the collateral damage of reform.

A tiered advice structure which graduated the advice from basic to complex and required the adviser to have appropriate skills to suit the tier of advice they were delivering could have and should have been developed years ago. I believe that is along the lines of where the FSC is going with its paper, although I admit I am fuzzy on the detail in the paper and how or if it would really change the path we are on?

In the meantime Adam I am left in the same boat as you, simply having to keep going to get through it but I am very concerned about the sustainability of current risk insurance pools, the alternatives being offered ‘lower price = lower quality’ replacement and the lack of access to advice as the number of advisers dwindle is a terrible outcome from reforms which were supposed to increase accessibility to advice and sustainability of products, one has to say on current evidence they are failing on both counts.

the alternatives being offered ‘lower price = lower quality’ replacement and the lack of access to advice as the number of advisers dwindle is a terrible outcome from reforms

The fast food of life insurance is a volume game. I don’t see it working either.

Hi Tim

The FSC positions the research as ground breaking. If they cared to look back to articles written 7 to 10 years ago when BID was first proposed, they will find feedback from the people like you and me and all the other posters to Risk Info who represent the ‘Coal-Face’ that BID was going to destroy the industry. Well thankfully we were presented with ‘Safe Harbour’ which provide concise guidance and prevented destruction but did add enormous amounts of time costs and complexity to what really should be a simple process. Fast forward a few years to the introduction of FASEA, and now you have the perfect storm. None of us need expensive ‘ground breaking’ research from a bunch of Actuaries to know the system is broken. No one (and I mean no one, not even FASEA themselves) has any idea how some of the 12 Standards actually affect the real world. It’s really difficult to reconcile with FASEA’s response to industry feedback when they said…you’re reading the Standards too Literally. I mean what does anyone say to that and what does it mean? Again thanks Rice Warner for the ground breaking research but we all could have told you long before now that the system is too complex and the standards need to be abolished and rewritten with at least a little semblance of common sense. Should FSC even be commenting on the Àdvice process? I don’t see this as their roll. After-all are we not in this predicament because of FSC’s involvement from years ago? What they should be focusing on is their own back yard because from where I sit their members are the ones the public don’t trust, not advisers. I’m sick of commentators talking about the trust issues the industry has like somehow Advisers are at fault. This industry is full of self-interest groups that paddle around in their own little pond lobbying for things that matter to them to the detriment of the adviser. Unless you have 50 to 100 HNY clients to whom fees make more sense and are more economical then commissions, then we are in trouble. And if the comments of one MPJones are anything to go by, well we all better start praying that Labour don’t win the next election. MP Jones represents the self-interest group called Industry Super Funds. Of course Labour want SG to go to 12.5% and the abolition of advisers. Can you imagine the funding the unions would receive from Industry Funds if that happened…

Thanks for your comments Tim and best of luck.

BKY, appreciate your comments.

Your observations and historical references are well made. As you rightfully suggest this situation has been a long time coming, but there has been an air of inevitability all the way along and up to this point.

Many advisers have tried to call things out but have been ignored or heckled as being ‘self interested’ etc. in my view ‘the baby has literally been thrown out with the bathwater’ as over the years experienced and knowledgeable voices have been silenced and most have simply given up the fight.

Now it appears various parties who have a platform appear to see the downside of where things are heading, This may present a new opportunity…

Is it possible that a collective will develops to pursue the AFA’s call for an independent review? I really hope so… stay well, all the best to you too. Tim

How will this “revamp” life insurance? The market is crashing.

Comments are closed.