Confirming other industry data, life risk sales have taken a fall in the 12 months to September 2019, reaching the lowest level of sales in any September quarter over the past five years, according to DEXX&R’s latest Life Analysis Report.

The report found total risk new business fell 22.1 percent over the year, down from $2.6 billion recorded in September 2018 to $2 billion September 2019.

Total risk in-force has fallen 5.6 percent over the year to September 2019 from the $16.3 billion recorded in September 2018 to $15.4 billion.

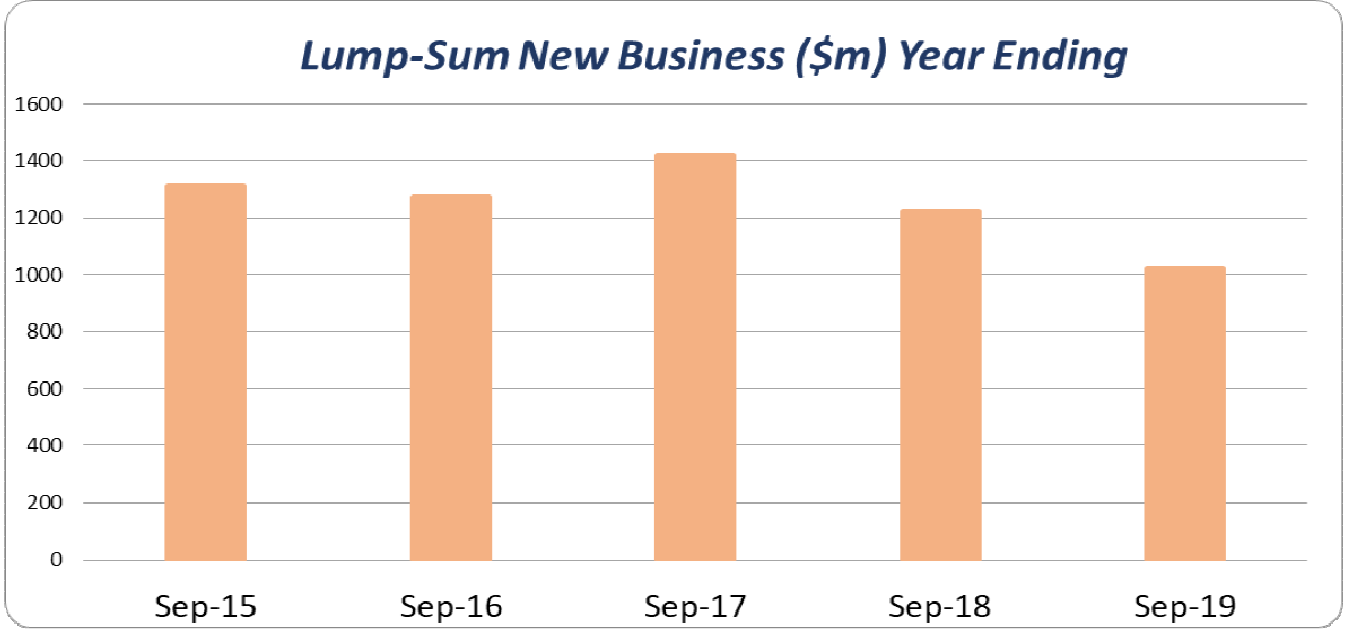

Individual lump sum new business hit its lowest value recorded in the past five years. The industry wrote $1.02 billion of lump sum new business in the 12 months ending September 2019, down 16.4 percent on the $1.22 billion recorded in the year to September 2018

Three of the top ten life companies did record an increase in lump sum new business over the year, according to the report:

- MLC recorded a $24.6 million increase in new business to $190.7 million

- Zurich recorded an $18.2 million increase to $117.3 million

- Westpac recorded a $0.24 million increase to $99.6 million at September 2019

“The continued decrease in business is the result of lower sales through advice channels and the suspension or cessation of sales of direct lump sum products by several major life companies,” the report stated.

The report also noted that ongoing restructuring of large institutionally owned dealer groups has exacerbated dislocation in the advice channel.

The LiF & FASEA reforms are really working aren’t they?

There is a vacuum in direction, though the current outgoing tide was and is totally predictable.

Repeatedly, the Life Insurers, Regulators and the Government were told that if you continue to blame innocent advisers for the sins of the Big Institutions, then there will be a back lash.

The current back lash is just the tip of the ice-berg if nothing is done to right the wrongs.

The Life Companies have lost their way when it comes to stating to Government, the obvious problems facing the Industry and the simple solution, the reason being, they take advice from professional ivory tower theorists.

It has been stated hundreds of times how to solve the issues. Is any one listening now?

Sadly no one cares Jeremy. The politicians are not listening!

If you take out the Group business the three mantises companies acquired during the year there would be no increase anywhere full stop

It’s like watching a train wreck you know what’s going to happen sooner rather than later but you just cannot look away

This is the defining year without change the industry will collapse as advisers give up and buy a sub way franchise

To avoid awkwardness Squeaky I won’t identify myself. I supposedly have dedicated BDMs. To be blunt, they’re still nothing more than Brochure Delivery Managers [not that I use hard copy apps any more].

I get better results ringing the relevant area of the life offices. And, after 40 years in the industry, I don’t charge one cent in training fees for their staff, who also haven’t got a clue. But at least they’re the ones sitting in front of the computer screen.

What I most love is having a specialist team available just for me – who then send my request to the area that actually actions it. Guess how many times they get it wrong?

Comments are closed.