Just over a quarter of Australians (28 percent) are willing to sacrifice their life insurance premiums if they are financially disadvantaged as a result of Covid-19, a new survey has found.

The Swiss Re COVID-19 Consumer Survey, undertaken by Ipsos in the second week of April 2020 across Australia, Hong Kong, China and Singapore, also found that 42 percent of Australians would be willing to sacrifice their financial adviser costs if they were financially disadvantaged by the pandemic.

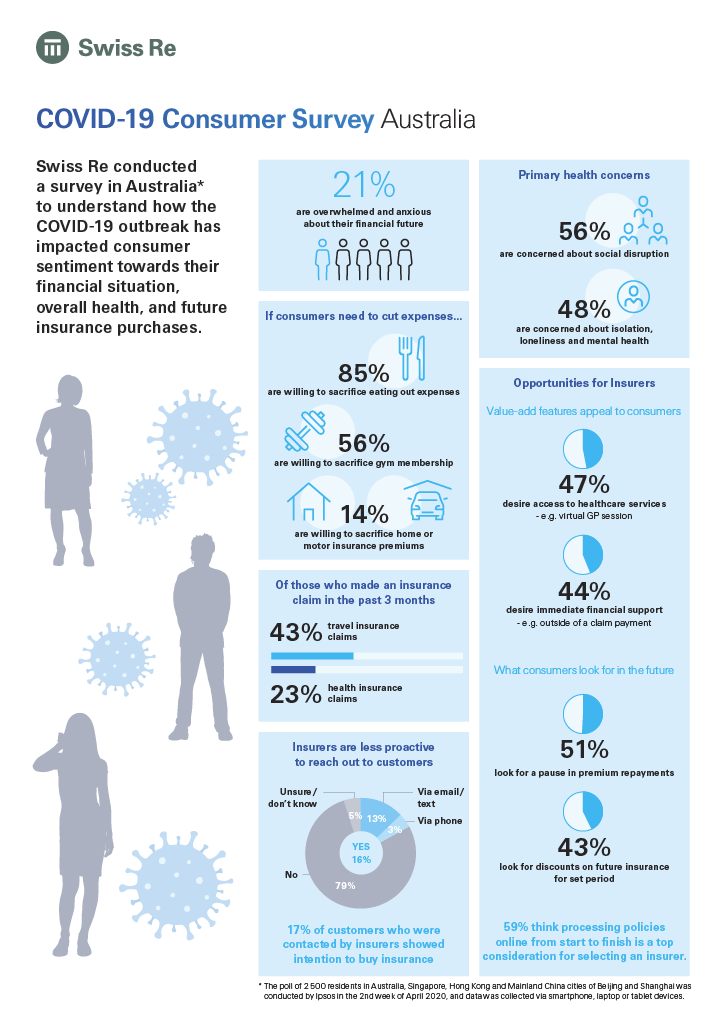

Tables provided by Swiss Re show the financial adviser costs were the third expense Australians were prepared to sacrifice after eating out (85 percent) and gym membership at 56 percent. Cable TV/internet services stood at 38 percent ahead of life insurance premiums at 28 percent. Education stood at 22 percent and last was home or motor insurance premiums at 14 percent.

The 28 percent willing to sacrifice their life insurance premium was in contrast to respondents from Hong Kong and China where the levels were at nine percent and seven percent. Eighteen percent of Singaporeans would sacrifice their life insurance premiums.

A media release from Swiss Re says respondents were also asked what sort of services would add the most impact to their policies, either current or future. Immediate financial aid was a requirement in Australia (44 percent), Singapore (57 percent) and Hong Kong (47 percent).

…..Australians preferred to have their premiums paused, or benefit from a discount on future insurance purchases…

Amongst the survey’s other findings Swiss Re says that while respondents in Singapore, Hong Kong and China also wanted faster claims payments and more flexibility these were not a priority for Australians. Instead, they preferred to have their premiums paused, or benefit from a discount on future insurance purchases.

Processing policies online from start to finish was a top consideration for selecting an insurer across all four countries.

As to claims payout, Swiss Re says 54 percent in Australia either agreed or strongly agreed to the expectation that insurance companies would pay out valid claims compared with 85 percent in China. Hong Kong and Singapore stood at 56 percent and 59 percent respectively.

Russell Higginbotham, CEO of Swiss Re Asia, says in the media release that the pandemic environment raises awareness of people’s needs for protection.

“The results of our survey give us a lot of clues about these needs and consumer preferences going forward.This is a great moment for the insurance industry to put the customer at the centre of everything we do and deliver solutions that at last show progress in closing the protection gap and making society more resilient.”