Retail-advised life insurance sales have slipped around 10 percent in the March 2020 year, according to Plan For Life’s Life Insurance Risk Premium Inflows and Sales for the Year Ended March 2020 report.

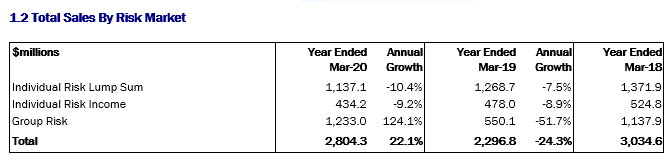

The actuary and research company says that overall annual sales in the individual risk lump sum market (term life, total and permanent disablement and trauma insurance) fell 10.4 percent while reported sales in the individual risk income market (income protection or sickness and accident and business expenses insurance) dropped 9.2 percent compared to the previous 12 months.

(Also see: Annual Risk Inflows Decline for First Time in Decades covering the December 2019 year).

PFL says in the risk lump sum market sales by MLC (5.7 percent) increased moderately while the rest were down – in particular AMP (-21.6 percent), ClearView (-19.6 percent), BT/Westpac (-17.3 percent) and TAL (-10.8 percent). AIA (-9.6 percent) and sub-market leader Zurich (-6.8 percent) also declined.

Reported sales in the individual risk income market saw MLC (46.4 percent) and BT/Westpac (16.7 percent) both report significant increases however those of AIA (-35.4 percent), AMP (-22.5 percent), Zurich (-21.6 percent), TAL (-9.6 percent) and ClearView (-8.9 percent) all fell.

Plan For Life says that in general annual risk sales actually jumped 22.1 percent due to overall reported group risk sales more than doubling, up 124.1 percent.

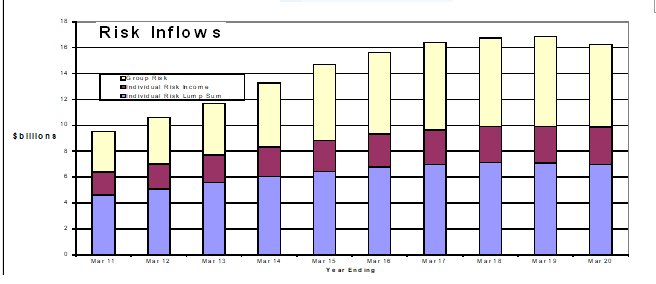

As for overall risk premium inflows, the company says year-on-year inflows were 3.6 percent lower at $16.3 billion. Among the medium to larger sized companies only market leader TAL (20.5 percent) reported any real growth in its risk business with group risk responsible for the vast majority of the increase.

MetLife’s (0.1 percent) risk inflows were virtually unchanged but those of the rest were lower in particular AIA (-27.1 percent) and to a lesser degree AMP (-6.4 percent).

The researcher notes that the individual risk income insurance market is affected by both price and the profitability of the small business sector and that the individual risk lump sum insurance market has for many years been impacted by activity in the housing market which remains a significant source of new business.

Down 6000 advisers ( so far) outrageous price increases ( 20 & 30% ) in one go ! COVID 19 highest unemployment figures since the depression What did you think was going to happen ?

Spot on Ken. I listened to the interview early this week between the FPA CEO and the FASEA CEO via the FPA’s virtual congress. The comments from advisers posted throughout the interview all had a similar tone – basically criticism of FASEA. The fact is that FASEA JUST DON’T GET IT! And this was confirmed by the FASEA CEO’s comments throughout the interview. I just don’t know what it’s going to take before the insurance companies realise that the retail life industry in particular, simply cannot go on like this. They MUST collectively go to the govt and somehow make them understand that LIF must be amended, commissions reinstated, abolish this 2 year clawback; and rid us of this ridiculous imposition of existing advisers having to undergo a degree. If they don’t, then the retail life industry will continue in decline!

Comments are closed.