The contraction rate in advisers departing the sector accelerated during the last quarter, amplified by several significant corporate actions, according to Adviser Ratings’ Adviser Musical Chairs Report.

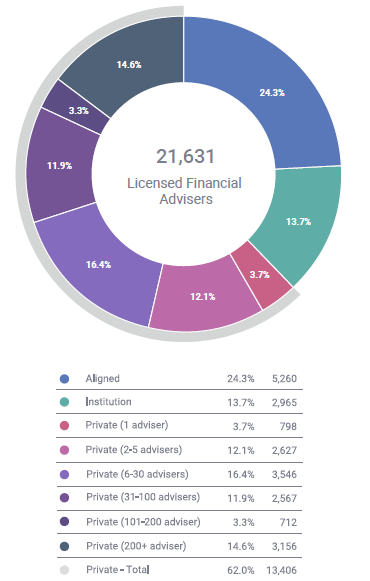

The company says that by the end of Q2 2020, the adviser population had reduced to 21,631 representing a net decline of 1,198 advisers (5.2 percent) from Q1 2020.

This was 80 percent higher than last quarter and, representing a 21 percent annualised decline, well above the overall adviser reduction of 16 percent experienced last year.

Other key findings the report highlighted included:

- 679 advisers changed licensees in the quarter, equal to 12 percent annualised switching and steady with the last 1-2 years

- 2.9 licensees were shut down for every new licensee formed in the quarter. YTD de-registrations up 63 percent (annualised) versus 2019

- 74 percent of licensees shutdown in the quarter were less than six years old

In its industry overview, Adviser Ratings says this quarter was characterised by the pandemic, noting that the financial distress this has caused consumers has led to an increase in demand for financial advice, evidenced both empirically through level of inquiries and anecdotally from advisers. Further driving demand for advice was the early access to super scheme.

The report states that the adviser exits from the industry and the continued long-run trend of the radical mass privatisation of the licensee market remains a permanent feature of the landscape, however this quarter the institutionally owned and aligned sectors held their own against the privately owned sector in terms of market share.

“The institutionally owned and aligned sector fell by a combined 361 advisers, now representing 8,225 advisers or 38 percent of the total market.

“By comparison, the privately owned sector shrunk by 901 advisers in the last quarter but remains flat at 62 percent of the overall industry.”

It says that over the last quarter there has been some minor re-positioning of the different privately owned licensee groups in terms of size and market share.

While the report expects greater movement towards the ‘safe haven’ of the larger licensees over the medium term, it notes these same organisations are also making strategic shifts in their business plans and this is leading to some material reductions in adviser numbers, not all necessarily equating to permanent departures from the industry.

…meanwhile the two-to-five adviser segment staged a fight-back…

Meanwhile the two-to-five adviser segment staged a fight-back, actually increasing overall numbers by 29 (1 percent) while all other segments fell, culminating in a 6.3 percent drop in overall privately owned sector adviser numbers.

Switching Advisers

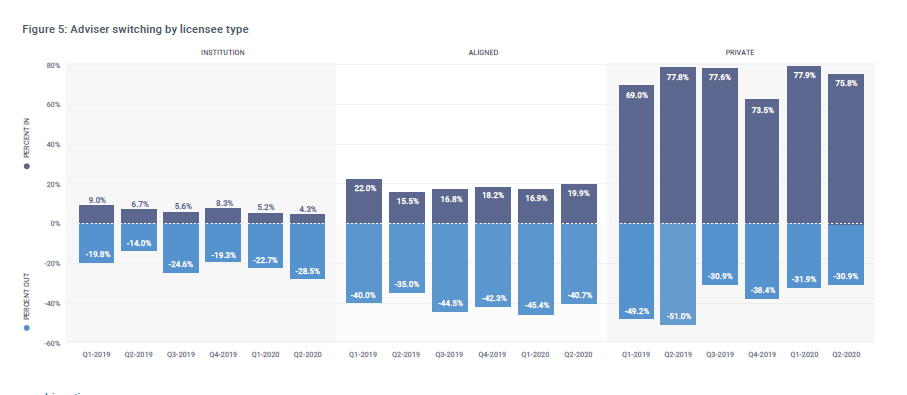

The report also noted that during the quarter, 679 advisers (12 percent annualised) switched licensees, which Adviser Ratings says is consistent with recent performance and it pointed to “… the persistent shift of advisers out of the institutionally owned and aligned licensees into the privately owned camp”.

The anticipated slow-down in switching that it anticipated last quarter due to Covid-19 has not eventuated. “This was on the assumption that there would be a brief hiatus as the pandemic caused businesses to pause and attempt to ‘wait out the storm’. On the contrary, COVID-19 appears to have catalysed a range of corporate actions that have propelled more advisers into finding new homes.”

Licensee Movements

Adviser Ratings says that the sharp reversal of licensee volumes has continued this quarter. From a ratio of new licence registrations outnumbering de-registrations by 3-4 times over the last few years, this trend switched direction in Q2 2019 to where de-registrations outnumber new registrations. Now this pattern is accelerating as more businesses struggle with the current economic conditions.

In Q2 2020 83 licensees ceased and 29 formed. This compares with 61 licensees ceased and 29 formed in Q1.

It says the ratio of licensees ceased:formed has climbed from 1.48 in Q2 2019 to 2.90 in Q2 2020, with year to date 2020 de-registrations up 63 percent on an annualised basis versus 2019, while licensee formation rates remain steady.

It notes too that as of June 2020, there are a total of 2,155 licensees with 97 percent of these licensees privately owned.

In summarising these trends Adviser Ratings points to:

- 93 percent of de-registrations were privately owned licensees (no change from the last 12 months)

- 74 percent are five years old or younger (versus 65 percent in prior 12 months)

- 47 percent of businesses have one adviser and 87 percent have no more than five advisers (versus 65 percent and 90 percent in prior 12 months)

“These latest results show a worrying trend; that the sustainability pressure on younger businesses continues however it is now spreading to the larger (two-to-five adviser) self-licensed boutiques,” it says.

However it adds that encouragingly, rather than leaving the industry entirely, 24 percent of these advisers have remained but are working for other licensees, although this number is well down on the 62 percent who remained last quarter.

This data is a continuation of what advisers have been warning would happen since the start.

Prior to the first round of research and investigation of churning by ASIC, the Retail Life Insurance Industry was in good shape and even though there were a tiny minority of advisers churning, there was a future and opportunity to grow and expand the Industry.

Now, after hundreds of millions of dollars of Tax Payers and Shareholders money that has been spent to investigate and improve the Industry, what do we have to show for it?

As we foretold and it did not need a crystal ball, we are seeing the decimation of a great Industry for NIL benefit to anyone and a financial disaster for Australia.

ASIC, all Public servants, the Government and those vested interest groups who perpetrated the fiasco we face today, should be held to the same account, advisers are held to, with the BID regulations we abide by.

The Retail Life Industry can come back from the abyss, though allowing the very people and organisations who pushed it to the brink, to continue with their insane and illogical processes, is akin to putting a fox in charge of the hen house.

The solution is clear, it is simple and will not cost Tax payers a cent.

In fact, if all the perpetrators that have financially benefited from the chaos they have caused, were removed, the Government would then save hundreds of millions of dollars.

An Adviser body of proven experts that have practical solutions, that can cut through the maze and get straight to the issues and advise the Government how to fix them, is the solution.

What we have today are too many voices, with little common sense and solutions that clearly do not work.

I would be prepared to step up and tell the Government what they need to hear, as I feel the current representation is not clearly articulating what must be done.

My email address is jeremy@businessfp.com.au for any advisers and Licenses who would like to add their name to enable me to represent all advisers and Dealer groups in a way where there can be a future.

As Bachmann Turner Overdrive once sang, ‘You Ain’t Seen Nothin’ Yet’.

With the FACEA deadline still 16 months away, an enormous number of experienced risk writers are simply biding their time.

Unless the powers that be moved quickly to make the enormous changes necessary to reverse the existing damage, it is unlikely that many will bother to study irrelevant subjects and sit a tricked up exam in order to remain in an industry where writing new business costs more than it pays.

And then…

I’m one of the statistics for this quarter.

Mid 50’s, decades of experience, and employed people.

Looked at the cost, both $$$ and personal of getting a degree, looked at the value of my business and where that value (to sell) was heading and how much longer I wanted to work.

Return on investment just wasn’t there for me,and to much down side risk from all different quarters, not enough up side.

SOLD.

I just sit and watch as people tie themselves in knots trying to give advise. They know what good advice is, they know whats right for their clients,its just regulation ties them up in knots. decreasing the ability to deliver relevant cost effective advice

Comments are closed.