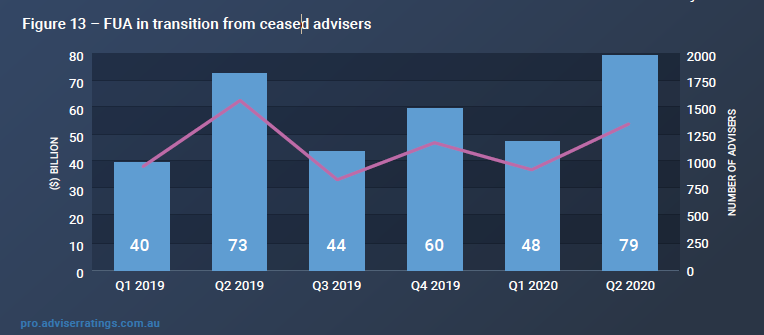

Some $79 billion of estimated advised wealth was in transition due to advisers exiting the industry and potentially orphaning their clients, says Adviser Ratings in its latest Adviser Musical Chairs Report.

A section in its recent report looked closely at client orphaning noting that behind the ongoing saga of adviser departures is the plight of their clients.

It says that today advisers are streamlining their client books for financial survival while others leaving the industry are invariably contributing to a growing pool of client “orphans”.

(Also see Adviser Contraction Rate Accelerates.)

The report highlights the potential advised wealth of $79 billion that is in transition from the advisers that have left the industry over the last 18 months and looks at this orphaning trend amongst advisers remaining in the industry.

As to the drivers to this streamlining, Adviser Ratings says it’s too simple to say that financial pressures are causing this orphaning trend. “There is no question that rising costs to stay in business are translating to higher fees for clients. While maintaining profitability is absolutely the central motivation for many advisers, the underlying reasons depend on the nature of the advice business itself and are often a combination those listed below.” They include:

- Value justification. Due to client circumstances, advisers are not adding value so can’t justify continuing to charge the same fees

- Flat fees. Switching from commissions to flat fees creates a sticker shock that clients can’t accommodate

- Capacity. Increased regulatory burdens (from ASIC and/or licensee) takes time away from facing customers and limits capacity to handle client volumes

- Risk. Some clients represent unacceptable risks due to their needs and the extra regulatory/ compliance hurdles potentially imposed by the licensee

- Business focus. Slimming the business to focus on specific areas or taking time off to deal with mental health demands a smaller, more targeted client base

- Client mix. Taking a proactive approach to reaching a better mix of profitable clients by jettisoning legacy and chasing new

- Demographics. Adviser departures force replacement of experienced advisers with younger, inexperienced ones. This creates tension with clients and requires strategies to deal with [it]

As to the type of clients that are being orphaned, Adviser Ratings says they are typically lower value in terms of funds under advice (FUA), although for lower FUA clients it may still be possible to justify the fees if the client is highly active or has changing circumstances.

“Orphans also tend to be older clients that have gone through the full advice journey and neither side sees value in continuing. Equally, legacy clients that don’t fit the current (narrowed) business focus of the advice firm, or legacy clients in grandfathered commission-based products where the commission-to-fee discussion and the work to switch under BID is not economically feasible,” the report states.

…smart businesses are “benevolently transitioning” their clients away from full service…

It adds that smart businesses are “benevolently transitioning” their clients away from full service. This involves finding a range of potential solutions, from remaining a (scaled-back) client to simply remaining in touch, while ensuring that clients are not entirely abandoned if at all possible. These include:

- Treatment of clients on a transactional basis for major or complex one-off events, and remaining in touch through newsletters or other ongoing communication

- Directing clients to their super fund for “full service” under the intra-fund advice provisions

- Introductions to digital advice solutions, although this alternative may not be suitable for every orphan who has previously relied upon a face-to-face relationship. The report says this also provides the opportunity to incubate at arms-length and return the client to a full-service relationship once they grow into the adviser’s sweet spot.