Six of Australia’s largest banking and financial services institutions have paid, or offered, a total of $1.05 billion in compensation, as at 30 June 2020, to customers who suffered loss or detriment because of fees for no service (FFNS) misconduct or non-compliant advice, states ASIC.

A media release from the commission says this is an additional $295.9 million in compensation payments or offers by the institutions from 1 January to 30 June 2020 (also see Institutions Pay $750m in Compensation for Financial Advice-Related Misconduct -ASIC.)

ASIC says that AMP, ANZ, CBA, Macquarie, NAB and Westpac (the institutions) undertook the review and remediation programs to compensate affected customers as a result of two major ASIC reviews. ASIC commenced the reviews in 2015 to look into:

- The extent of failure by the institutions to deliver ongoing advice services to financial advice customers who were paying fees to receive those services.

- How effectively the institutions supervised their financial advisers to identify and deal with ‘non-compliant advice’ – i.e. personal advice provided to a retail client by an adviser who did not comply with the relevant conduct obligations in the Corporations Act, such as the obligations to give appropriate advice or to act in the best interests of the clients, at the time the advice was given.

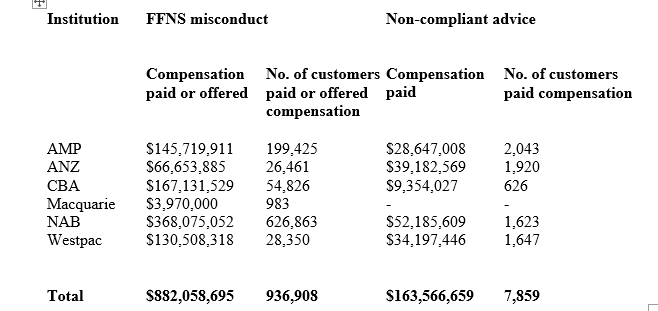

The ASIC table below provides a breakdown of the compensation payments made or offered by the institution as at 30 June 2020.

The statement from ASIC includes a footnote to the table relating to non-compliant advice noting that:

- CBA: At 31 March 2020, CBA notified ASIC that all customers who received inappropriate advice between 1 January 2009 to 30 June 2015 have been remediated in accordance RG 256 Client review and remediation conducted by advice licensees.

- Macquarie: Macquarie has not been included in this review because ASIC accepted an enforceable undertaking (EU) in January 2013 from Macquarie Equities Limited (MEL), a subsidiary of Macquarie Group. The effect of the EU was for MEL to undertake work that was largely consistent with the aims of ASIC’s review. Under the consequential remediation program, as at June 2017, MEL paid approximately $24.7 million in compensation to 263 clients.

- IOOF: In October 2018, IOOF Holdings Limited (IOOF) took ownership of ANZ’s Aligned Dealer Groups (ADGs) comprising Millennium3 Financial Services, RI Advice and Financial Services Partners. IOOF will continue customer review and remediation for non-compliant advice in relation to the ADGs using the same independently assured framework implemented by ANZ.

Oh dear ! between fines and remedial payments lack of if any new business increased claims and a “head in the sand” approach that “we know it all “ don’t give us your view your just the adviser I have a degree in how to be an idiot ??? ! It’s a wonder any of them are still in business

These banks created the mess we have today along with disengaged politicians who also allowed this to happen while constantly persecuting the advisers. All too apparent in hindsight they were chasing the wrong people.

What’s that old saying “ you reap what you sow”

Comments are closed.