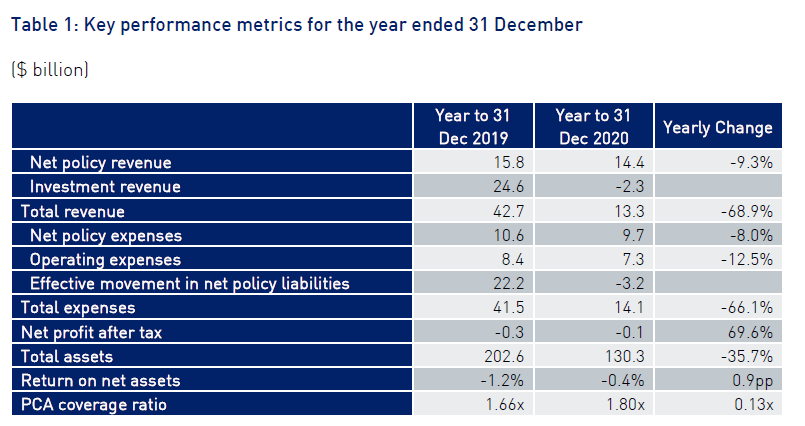

Net policy revenue for the life insurance industry for the year to 31 December 2020 was down 9.3 percent from a year earlier to $14.4 billion, according to APRA’s latest Quarterly Life Insurance Performance Statistics publication.

The report also found that investment revenue for the December 2020 year had a loss of $2.3 billion down from $24.6 billion a year earlier, meaning total revenue for the year stood at $13.3 billion down 68.9 percent from $42.7 billion in the December 2019 year.

A statement from the authority says that the life insurance industry’s performance “continues to be challenged” (also see Performance of Risk Products Deteriorates).

It says the net loss after tax for the industry was $0.1 billion for the year to December 2020, an improvement from the $0.3 billion loss in the previous year.

“Although this was an improvement, the main driver was a significant release of reserves to offset the investment losses and claims payments made throughout the year,” APRA says.

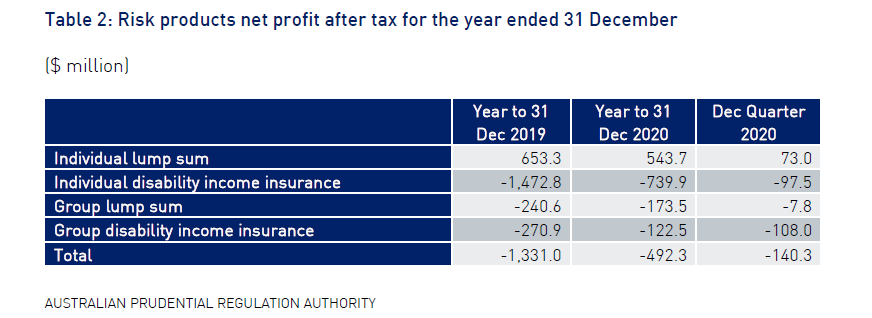

APRA says that for the 12 months to December 2020, risk products reported a combined net loss after tax of $492.3 million, which was lower than the prior year’s loss [of -1,331.0 billion].

APRA says that for the 12 months to December 2020, risk products reported a combined net loss after tax of $492.3 million, which was lower than the prior year’s loss [of -1,331.0 billion].

“In particular, Individual Disability Income Insurance (also known as Income Protection Insurance) reported a substantial loss, primarily driven by loss recognition as adverse claims experience persists.

“Individual Lump Sum insurance, while still profitable, showed a deterioration in profit over the year.”

In a highlights report the authority says that within risk products, Individual Lump Sum is the only category reporting a profit in the 12 months to December 2020.

“Individual Disability Income Insurance (IDII) recorded a loss of $0.7 billion during the year, which is a $0.7 billion improvement in comparison to the previous year’s result,” it says.

“Results for Group LS and Group DII have also improved this year; however, both products continued to record losses of $173.5 million and $122.5 million respectively.

“Results for Group LS and Group DII have also improved this year; however, both products continued to record losses of $173.5 million and $122.5 million respectively.

“The improvements across IDII, Group LS, and Group DII were primarily driven by release of reserves for each product throughout the year,” APRA says.

The Quarterly Life Insurance Performance Statistics publication provides industry aggregate summaries of financial performance, financial position, capital adequacy and key ratios.