- Disagree (76%)

- Agree (16%)

- Not sure (8%)

Our latest poll asks you to predict what will happen with individual risk new business volumes in 2021.

Data released this week by DEXX&R reveals that although individual risk new business sales were down in the calendar year 2020, there were encouraging signs in the second half of the year (see: Risk New Business Sales Recover).

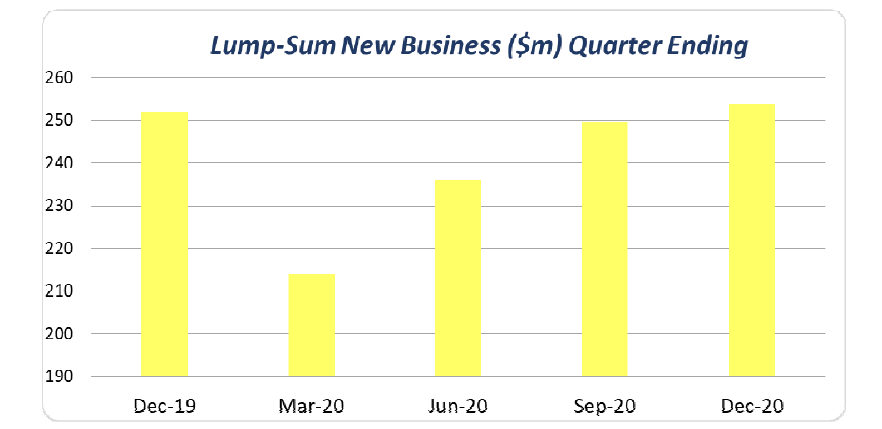

These encouraging signs relate to lump sum business, ie Death, TPD and Trauma insurance products, while individual disability income insurance new business levels, while still trending down overall, have been more consistent.

DEXX&R MD, Mark Kachor told Riskinfo that the March quarter is always slow in relative terms (given the traditionally lower levels of business activity in January), and suggests that the June quarter in 2021 may be the litmus test as to whether individual risk new business is really beginning to recover.

In recent times, the downward trend in retail life insurance business appears to have been brought about by a combination of often inter-related cause and effect factors including:

- Capped hybrid commissions and clawback requirements under the LIF reforms

- The increasing cost of life insurance due to increasing base premium rates, especially for income protection insurance

- Increasing compliance costs (the 2020 ASIC adviser levy being a recent example of the ever-increasing cost of doing business)

- Minimum education standards and the requirement to sit and pass the FASEA adviser exam

- Reducing number of risk specialists serving the Australian community

This set of cause and effect factors doesn’t make for pretty reading. But somehow, individual (retail) risk sales have headed north since April 2020:

Not forgetting this chart applies only for lump sum business, do you expect this trend will generally continue in 2021 for all retail risk new business, including IP sales? Our poll could equally have split the question between lump sum and IP trends, but for the time being, we’ll leave it as a question that relates to the overall trend in the levels of retail risk sales in 2021.

Gaze into your crystal ball and we’ll report back to you next week…