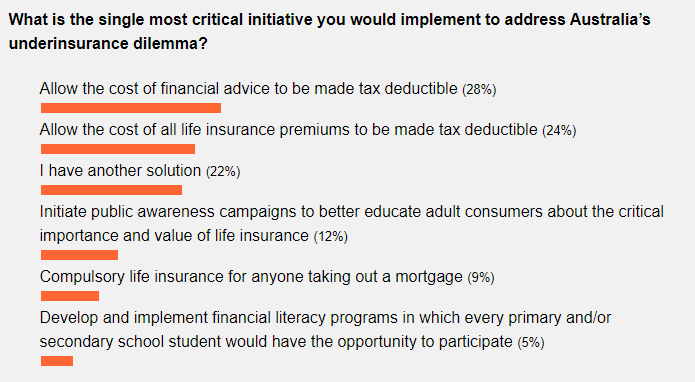

- Allow the cost of all life insurance premiums to be made tax deductible (26%)

- Allow the cost of financial advice to be made tax deductible (19%)

- I have another solution (17%)

- Develop and implement financial literacy programs in which every primary and/or secondary school student would have the opportunity to participate (15%)

- Compulsory life insurance for anyone taking out a mortgage (14%)

- Initiate public awareness campaigns to better educate adult consumers about the critical importance and value of life insurance (9%)

Offering tax breaks continues to be the preferred option for advisers – but not the only option – when it comes to identifying the best solution for the underinsurance dilemma.

As we go to press, 44% of those voting in our latest poll are evenly split on their preferred option (22% each) as to whether the cost of financial advice or the cost of all life insurance premiums should be made tax deductible.

A different solution to those offered is the next most popular option, where long-time contributor to Riskinfo, Jeremy Wright, may represent a number of his peers when he makes this observation about the potential (unintended) damage being inflicted on the risk advice sector by current regulatory reforms:

Separation of Insurance and Investment advice, an overhaul of the LIF and FASEA to encourage existing advisers to remain in the Industry and provide an incentive to recruit risk advisers is the solution.

What we currently have is the exact opposite situation, which reflects the growing Under-insurance epidemic.

To date, the outcome of this poll closely reflects the result when we posed the same question last year:

Ultimately, the resolution to Australia’s underinsurance dilemma will most likely be found in a combination of future actions, potentially including some which have been articulated in this present conversation.

In the current environment, however, there exist more pressing issues for many risk advice specialists, many of which revolve around the more immediate concern about the future viability of their business proposition – and we will keep you up to date with all these issues as they continue to progress and develop.

In the meantime, however, this poll remains open for another week if you’d like to have your say…