- Yes (50%)

- It depends (33%)

- No (17%)

- Not sure (0%)

Advice processes are under the microscope in our latest poll as we ask you to reflect on how often and under what circumstances your advice practice reviews your clients’ death and TPD cover.

The question stems from a recent article we published from The Astute Wheel’s Hans Egger, in which Egger suggests there’s a strong argument for death and TPD insurance to be reviewed more regularly – even if no significant changes have occurred in the client’s circumstances (see: Are You at Risk…?).

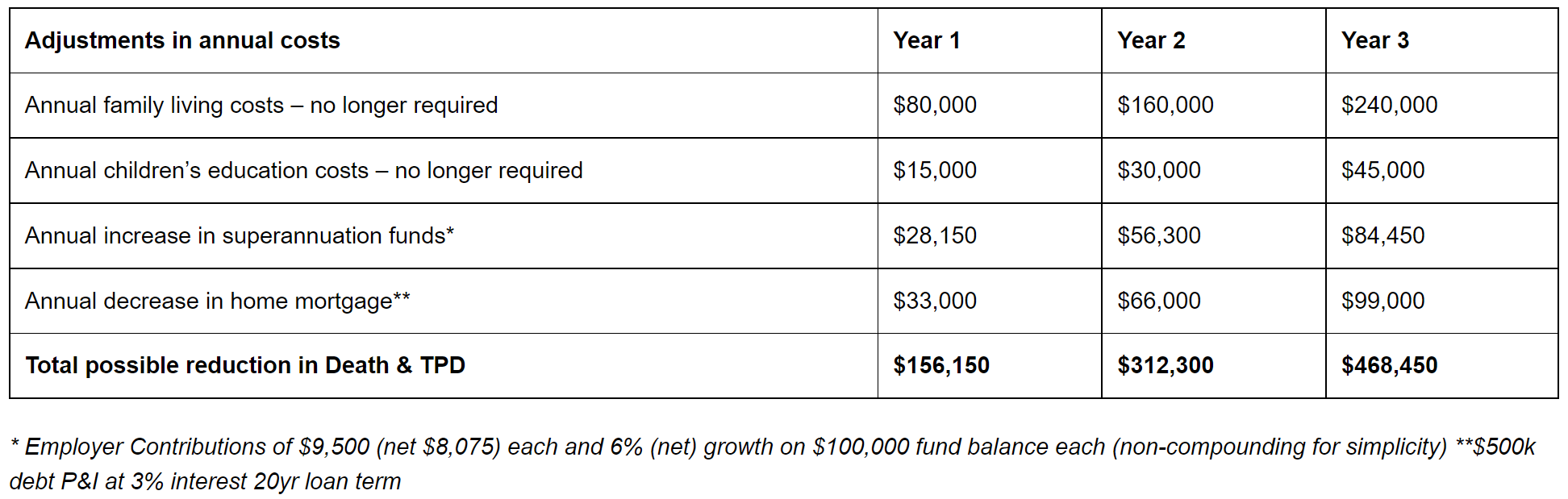

The following table articulates Egger’s argument, in which he suggests that as each year progresses, there are some expense items in the client’s insurance analysis that will reduce or drop off, even when no significant changes have occurred:

Does this approach reflect your own? Does it change your mind to any extent? How do you usually set about determining the circumstances under which you should review your clients’ death and TPD cover? Does it simply distil to a case-by-case basis? What’s your formula?

Does this approach reflect your own? Does it change your mind to any extent? How do you usually set about determining the circumstances under which you should review your clients’ death and TPD cover? Does it simply distil to a case-by-case basis? What’s your formula?

Let us know what you think and we’ll report back next week.