Modelling released by DEXX&R significantly reduces projections for new IP premiums over the next 10 years.

This conclusion was made by the researcher based on its latest 10-Year Market Projections Report, which includes modelling around future movements in risk new business premiums, in-force premiums and discontinuances.

In a statement accompanying the release of its report, DEXX&R makes a number of observations about the impact of the introduction of the new range of IP products from 1 October 2021, as part of APRA’s IP Intervention. Some of its key observations include:

Claims

The researcher notes that when compared with the now off-sale IP products, the post 1 October 2021 products are designed to reduce the incidence and duration of disability income claims by:

- Tightening definitions

- Reducing the amount of income that can be insured

- Deducting business and passive income from the monthly insured benefit when on claim

Impact

The impact of these measure, says DEXX&R, is that the average premium per policy for new business is expected to be lower than for pre 1 October 2021 IP contracts.

…the majority of new business will be policies with a two year benefit

It also reasons that in the past, benefits to age 65 have made up a significant portion of new business. But given what it characterises as the restrictive terms applicable to claims that continue beyond two years and, when compared to the significantly higher premiums now applicable to benefits payable through to age 65, it projects the majority of new business will be policies with a two year benefit.

Self-employed policy holders

In noting that disability income policies enjoy a higher market penetration with self-employed professionals and trades people when compared with employed white collar workers, DEXX&R says the inclusion of offsets for passive and unearned income will severely limit the suitability of post 1 October 2021 IP contracts for any person who is involved in a business with several other practitioners and in receipt of a profit share, dividends or other form of business income distribution:

“Where any self-employed person is in receipt of passive and/or ‘unearned business income’, either at policy inception or later at the time of claim, under current offset wordings the amount of monthly benefit payable is uncertain and may be reduced to nil.”

Pricing

As all current products are only available on an indemnity basis DEXX&R logically concludes the previous higher premiums per policy applicable to agreed value contracts with benefits payable through to age 65 will further lead to lower premiums applicable to new business over the next 10 years.

It adds that the limited value associated with adding an Increasing Claim Benefit option to a two-year benefit period will mean that the total premium per policy will trend lower than was the case before 1 October 2021, when this option was commonly added to policies delivering benefits to age 65.

Conclusion

DEXX&R concludes: “Taking all the above factors into account we have significantly reduced projected new premiums over the next ten years.”

Mitigating this reduction, however, is an expected improvement, according to the researcher, in the attrition rate and premium growth from alterations to existing in-force business.

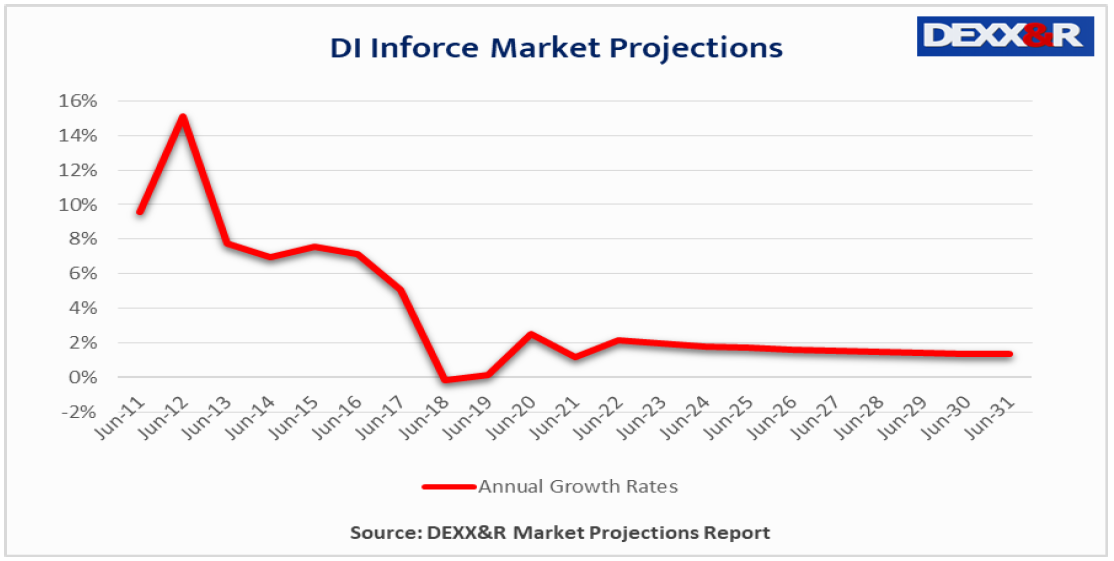

Overall, it projects the disability income In-force premium growth will fall from a rate of 5.2% over the 10 years to June 2021 down to only 1.6 % growth over the coming 10 years.

In dollar terms: “Taking into account the impact of the reduced market for current on sale products in-force Disability Income premium is projected to increase by an average annual growth rate of 1.6 per cent to $3.3 billion at June 2031.”