ASIC has released a consultation paper seeking feedback on proposed updates to its Regulatory Guide on the Financial Services and Credit Panel.

A statement from ASIC explains its Consultation Paper 359 Update to RG 263 Financial Services and Credit Panel is seeking feedback on proposed updates to the Regulatory Guide (issued in November 2017) and that these updates reflect changes to the Financial Services and Credit Panel (FSCP) under the Better Advice Act.

It says the Act granted the FSCP its own legislative functions and powers to address a range of misconduct by, and circumstances relating to, financial advisers (see: Adviser Peer Review Panel Named).

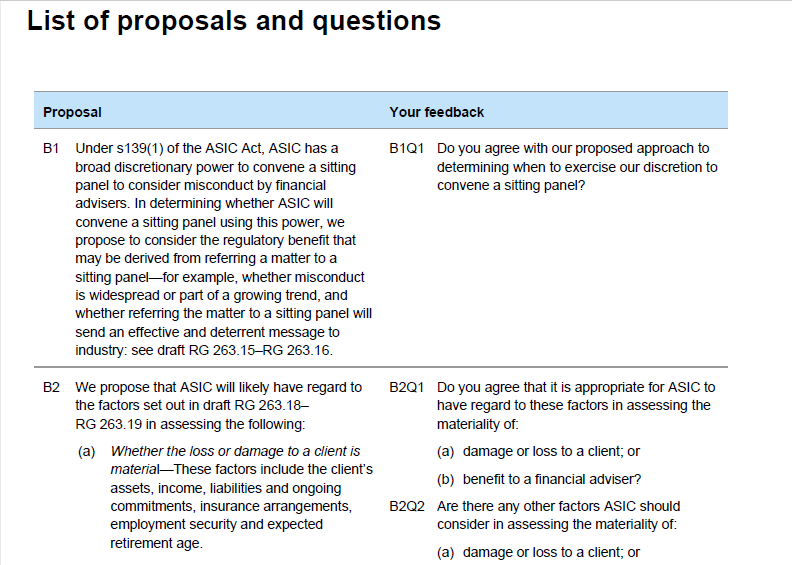

The consultation paper is now seeking feedback on ASIC’s proposed approach to:

- Determining when to convene a sitting panel of the FSCP

- Generally hold hearings of sitting panels using technology

- Publicising decisions of sitting panels.

Key points highlighted in the consultation paper in the section on Types of Matters to be Referred to a Sitting Panel note that the Better Advice Act and related regulations set out the circumstances where ASIC must convene a sitting panel.

ASIC may also convene a sitting panel in other circumstances and this section of the paper outlines and seeks feedback on the criteria it proposes to apply to:

- Decide when to convene a sitting panel at its discretion

- Determine whether loss or damage to a client or benefit to a financial adviser is material

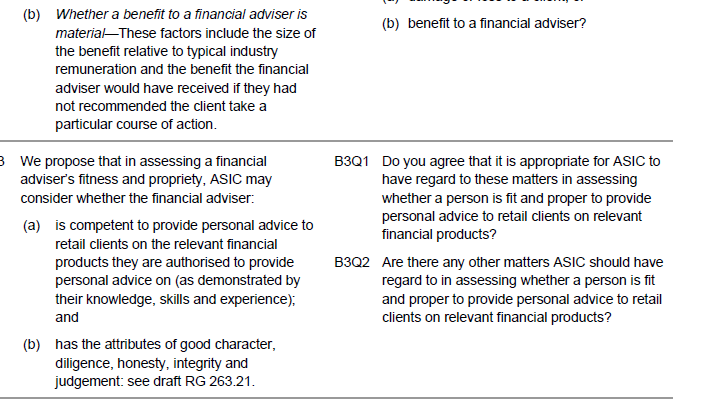

- Assess a financial adviser’s fitness and propriety

Amongst the proposals around ‘when ASIC may convene a sitting panel’ the consultation paper states that Under s139(1) of the ASIC Act, ASIC has a broad discretionary power to convene a sitting panel to consider misconduct by financial advisers.

…we propose to consider the regulatory benefit that may be derived from referring a matter to a sitting panel…

“In determining whether ASIC will convene a sitting panel using this power, we propose to consider the regulatory benefit that may be derived from referring a matter to a sitting panel — for example, whether misconduct is widespread or part of a growing trend, and whether referring the matter to a sitting panel will send an effective and deterrent message to industry.”

ASIC is encouraging comments from industry and other interested stakeholders on its proposed approach to setting principles and processes relating to the FSCP by 28 March 2022.

As background, the ASIC media statement notes that the powers of the FSCP under the Better Advice Act include the power to direct financial advisers to undertake specified training, counselling or supervision and to report certain matters to ASIC.

“An FSCP sitting panel may also: suspend or cancel a financial adviser’s registration; issue infringement notices in specified circumstances; recommend that ASIC commence civil penalty proceedings; and enter into enforceable undertakings with financial advisers.” (See: Changes to Financial Adviser Disciplinary Systems).