Both individual risk lump sum and individual risk income markets experienced solid growth in the year to December 2021, according to Plan for Life’s Market Overview.

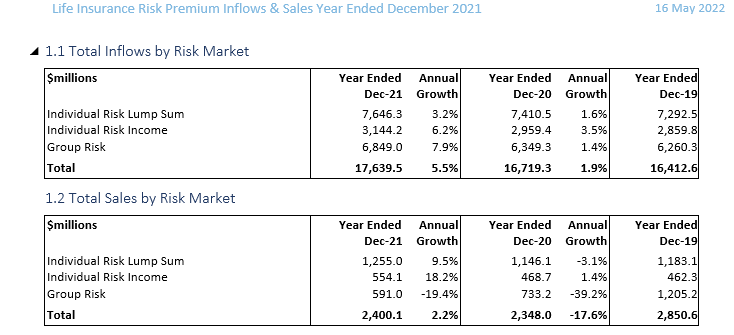

In the individual risk lump sum market, the actuaries and researchers firm says reported sales were up 9.5% compared to 2020 to $1.255 billion while in the individual risk income market total new premium sales jumped by 18.2% in 2021 to $554.1 million.

Meanwhile, research firm DEXX&R reported earlier in the week that individual risk lump sum new business sales rose 5% in the year to December 2021 noting that the final quarter of the year saw sales in this category decline by 8.5% (see: Lump Sum New Business – Good and Bad News.)

Plan for Life’s research shows that overall life insurance risk inflows in 2021 were up by 5.5% on those reported in 2020, increasing from $16.7 billion to $17.6 billion.

In the individual risk lump sum market premium inflows increased 3.2 percent in 2021, while in the individual risk income market Plan for Life found that year-on-year Inflows rose 6.2%.

Stats can be made to show anything, we all know this. Any increase in “sales” in the risk space would no doubt be due singularly to the inordinate premium price hikes the re-insurers are pushing through on older policies. Premium hikes of 50% or more are common on these policies throughout the Market. Even ‘not so old’ policies are experiencing hikes. Seems only fresh-on-the-books premiums to attract new clients are the only premiums still ‘reasonable’ – whatever reasonable is these days. No, cannot believe for a second that any NEW business is responsible for the so-called current “solid” nature of the industry. A farce as we all know.

Comments are closed.