While latest data reports an overall rise in life insurance risk premium inflows, individual new business sales remain flat.

This assessment is based on Plan For Life’s Risk Premium Inflows and Sales Overview for the first quarter of the year, ending March 2022, where the researcher reports:

- Overall premium inflows into the individual risk lump sum market (Term/TPD/Trauma) increased by 2.3%

- However, individual risk lump sum new business sales declined by 2.7%

- Overall premium inflows into the risk income (IP) market grew by 6.7%

- And individual IP new business sales increased by 9.8%

On the surface, it appears that individual lump sum new business is down slightly, while IP new business sales have delivered a solid increase.

Future reporting by Riskinfo, however, will seek to provide more detailed breakdowns on these numbers, as the data reported by PFL currently combines both new policy sales and increases to existing contracts, eg age and CPI-related increases.

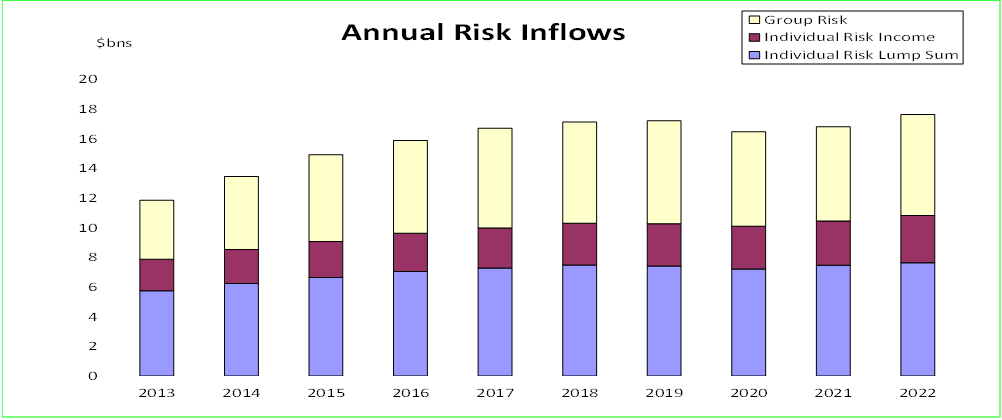

Meanwhile, overall risk market inflows in Australia increased by 5.0% in the year to March 2022, as the chart below demonstrates, with the increase from from $16.8bn to $17.6bn attributable mostly to activity within the group insurance sector: