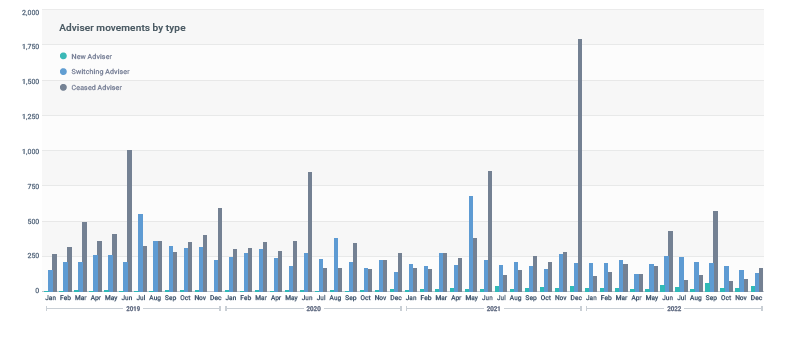

While the industry is still a way from seeing growth in adviser numbers, the steepest declines appear to be behind it, according to Adviser Ratings’ Adviser Musical Chairs Report for Q4 2022.

The research firm says that adviser movement was minimal in the final quarter of the year, particularly compared with the same period in 2021.

It says that with 327 departures “…the quarter produced less than a sixth of the exits recorded in the corresponding quarter of the previous year.”

The report noted too that for the 2022 year, more than 1,500 advisers left the market, “…which again, is well shy of what we’ve seen in the past six years. It’s also less than a third of the departures we saw in 2021 – as advisers who had repeatedly failed the exam or were waiting out the final deadline exited.”

Adviser Ratings says that as the industry enters the new year, advisers tell them they continue to wrestle with how to best meet clients’ needs against the backdrop of general rising costs and compliance demands.

…the vast majority of advisers have told us they’ll be lifting their fees in the new year…

“The vast majority of advisers have told us they’ll be lifting their fees in the new year to reach or maintain profitability. While this is a business necessity for many, it also highlights the ongoing tension between advice affordability and practice survival.”

The report adds that as advisers prepare to lift their fees, they are also anticipating the landscape may change from a regulatory and compliance standpoint.

Other key findings in the report were:

- 4.4%: Amount the financial advice profession contracted by in 2022

- 451: Number of advisers who switched licensees in Q4, 2022

- 64.3%: Proportion of advisers operating under privately-owned licensees

Come 2025/6 and total numbers will be way under 10,000 and pure risk advisers (due to onerous, expensive & pecuniary exam requirements) will be virtually extinct. Unless 100% upfronts and 20% renewals are installed (yes 100/20!) I fear there’s no future for pure riskies. This is minimum needed to recover from the past 5 years.The compliance (even with Michele’s help), rising business costs/exam costs ($ and time) along with the constant stress and threat of clueless idiot politicians meddling and changes will make anything less than 100/20 untenable. This is, of course, against the background of riskies being unable to effectively charge direct fees for risk-only advice. So, now, what are the chances of 100/20 occurring? Hmmm, yep, snowstorm in hell. No risk advice industry, as WE know it, going forward methinks.

Comments are closed.