Industry response to the Riskinfocus 23 CPD Tour events has served to proudly re-affirm the value and critical importance of life insurance and life insurance advice.

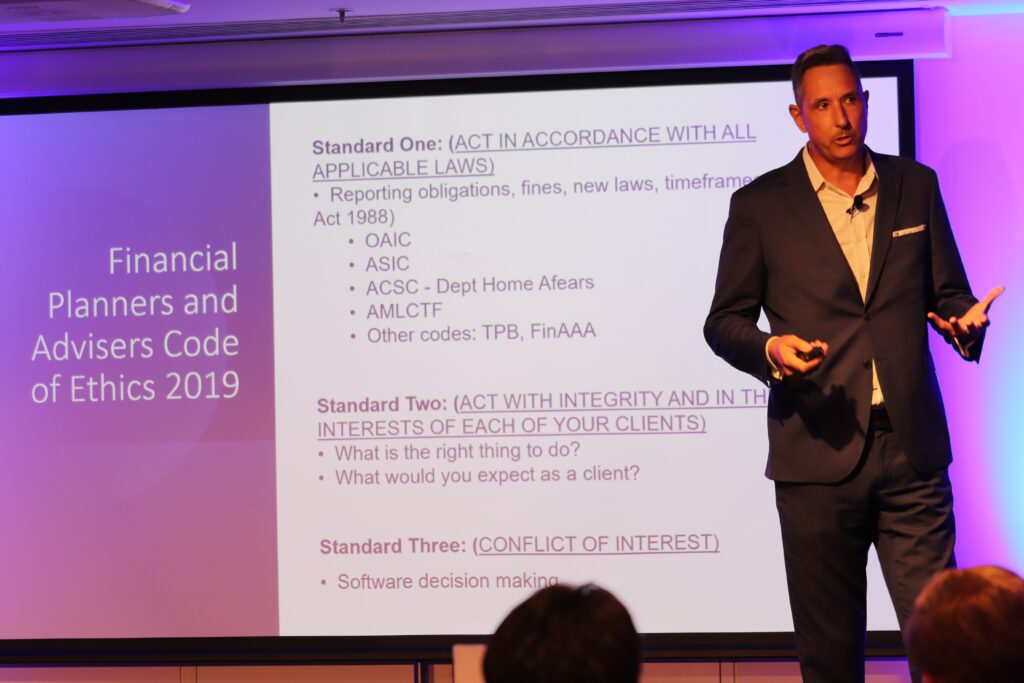

Advisers attending in large numbers at the six risk-focussed events across the country had the opportunity to hear from industry experts – many of whom were either current or former advisers – who shared their insights across a spectrum of topics which considered life insurance and life insurance advice matters as well as business building and practice management issues.

Eight CPD hours were accredited for the day-long event series, ultimately attended by over 700 registered delegates in Adelaide, Perth, Hobart, Brisbane, Sydney and Melbourne.

Advisers, dealer group colleagues and company attendees appear to have been united in welcoming a life insurance-focussed professional development day, with both the attendance figures and nature of the feedback across all venues suggesting demand exists for such an event series following an extended period during which messaging around the fundamental importance of both life insurance and life insurance advice has been swamped by regulatory reform controversies and reputational issues.

With overall adviser numbers continuing their downward trend, and consequently less Australians having access to advice, the role of life insurance as the cornerstone of all sound financial plans was readily acknowledged. Also acknowledged at the events, given the decimation of risk-focussed advice practice numbers in recent years, was the critical importance for non-specialist or generalist advisers and financial planners to find a way to either build more life insurance narrative into their advice proposition or to ensure their clients have access to those conversations from others within the practice or the licensee network or through trusted referral sources.

The in-person-only events also provided a rare and welcome opportunity for many advisers and other industry colleagues to both renew acquaintances and also to meet in-person for the first time, having only been known to each other via virtual means until now.

The financial advice industry faces a serious challenge in its efforts to re-establish adviser numbers – both overall and risk advice specialists. Part of that challenge involves the sharing of thoughts and ideas around demystifying some of the actual and perceived complexities attaching to life insurance and financial advice and collaborating across the sector to deliver more efficient and more commercially sustainable financial and life insurance advice services. The insights shared at Riskinfocus 23 served to address some of these issues, with the ultimate aim being for the sector as a whole to work together to find a solution to the many real issues presently confronting it.

In thanking all those involved in delivering a successful inaugural risk-focussed event series, The Riskinfocus Risk Advice CPD Tour will return in March 2024 and will seek to add seriously meaningful value and relevance for all advisers looking to attend.