Buying and selling agency Radar Results is pointing to an upswing in the value of risk advice practices over the past year.

CEO John Birt says that since its last Price Guide in June 2022 the firm has seen transactions of financial planning businesses, financial planning client registers, accounting practices, loan mortgage trail books, and SMSF administration fees increase.

“These 6% and 11% increases have had nothing to do with higher interest rates or inflation in Australia,” he says.

Birt says the last 80 sale transactions the firm has been involved with over 12 months “…show evidence of higher prices being paid.”

While he is unsure where prices are heading with an economic downturn worldwide possibly having “unstable outcomes” he adds that “…financial planning client businesses…tend to shield themselves from adverse trends and show a positive return on the investment made by our buyers.”

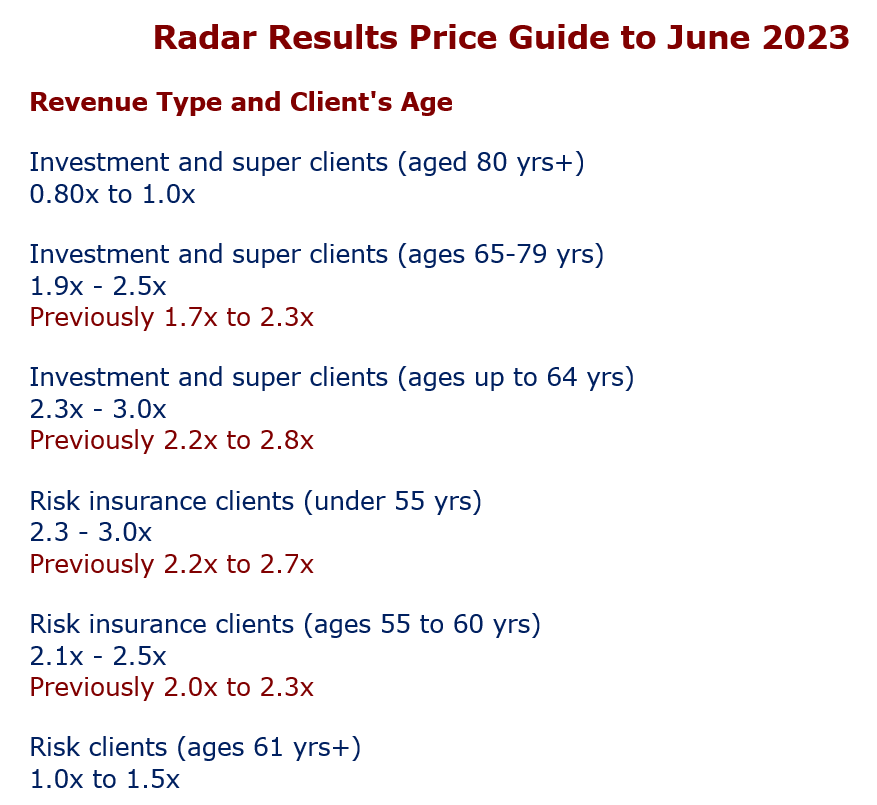

The firm provides a summary of where it sees prices sitting “…as a consensus of the seven Radar Results consultants nationwide who have been heavily involved with these sales.”

It shows that for both risk insurance clients under 55 years old and those aged 55-60 the multiples have risen from last year:

He adds too that the multiples above can vary depending on the terms the vendor offers to the purchaser when selling; the location of the vendor’s clients; the client’s ages; Funds Under Management or Administration, and the investment products recommended.

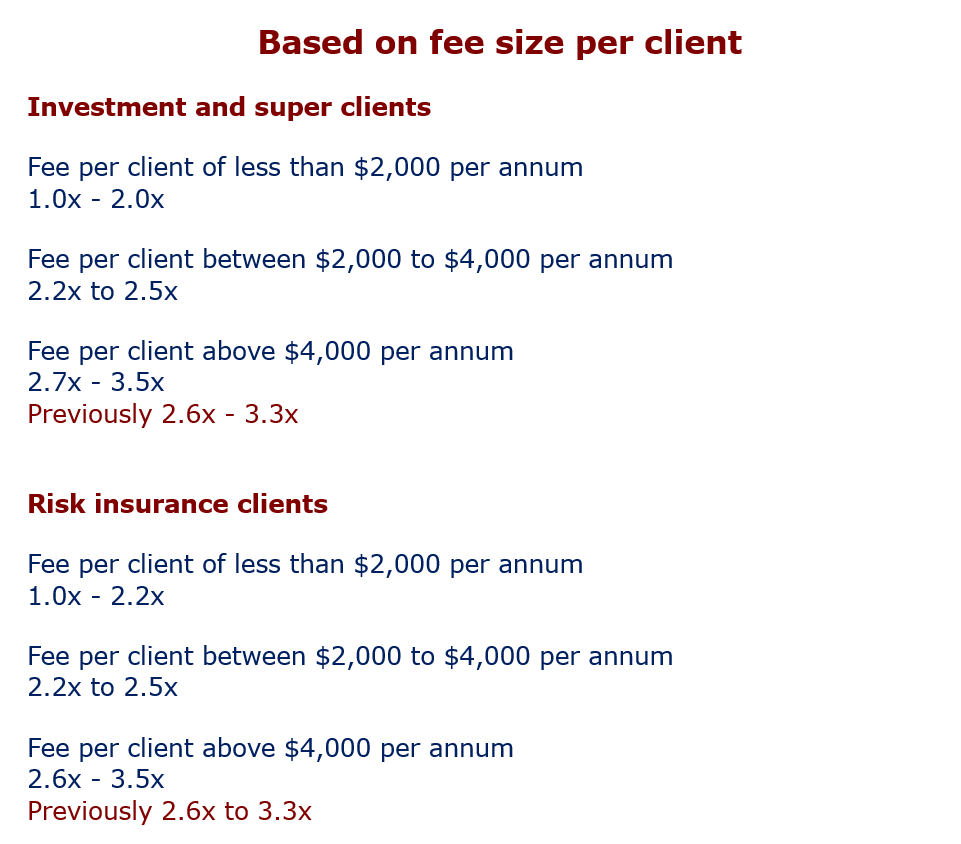

Birt adds that the dollar account balances of each client are essential with the fee-for-service charge — clients with higher dollar account balances, paying higher fees, naturally command the higher multiples.

“Multiples paid for risk books or insurance-revenue-based practices will depend on the client’s occupation, age, premium size, policy type, and geographic location of the clients.”

Birt notes again that the multiples above can vary depending on the terms the vendor offers to the purchaser when selling, the location of the vendor’s clients, the client’s ages, and the investment products recommended.

“The account balances of each client are essential with the fee-for-service charge. The most requested clients are those paying fees between $3,000 to $6,000 per annum with reasonably high dollar account balances,” he says.

“These clients, therefore, command the higher multiple. Multiples paid for risk books or insurance-revenue-based practices will depend on the client’s occupation, age, premium size, policy type, and geographic location of the clients.”

Birt explains that the tables show the multiples based on two different methods of valuing a client base, noting that most client bases are now valued using a combination of both methods.