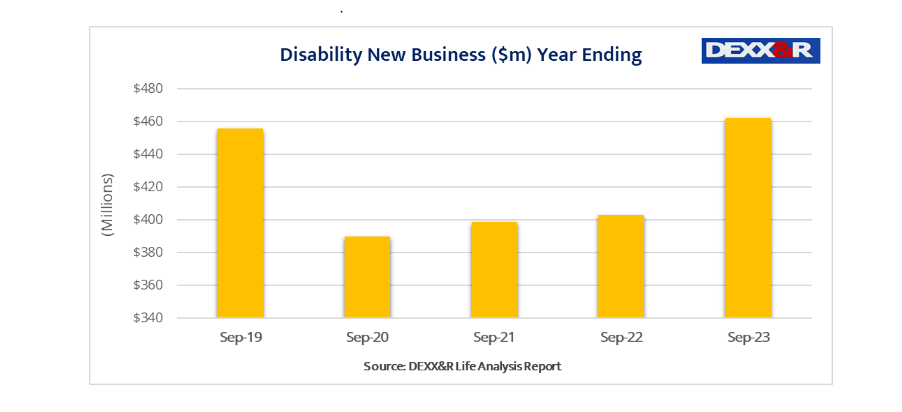

Disability income sales have rebounded rising nearly 15% in the year to September 2023, according to new data from DEXX&R.

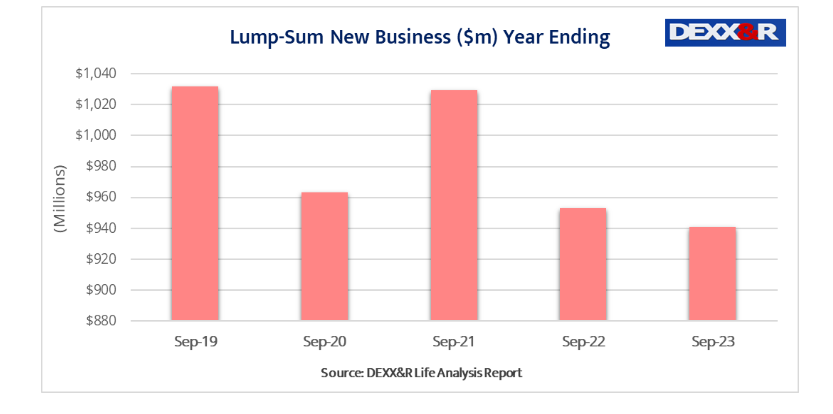

While DI sales rose, the latest data shows lump sum new business slipped slightly, which echoes a similar result in the year to June 2023 (See: IP New Business Up, Lump Sum Static).

The research firm’s latest Life Analysis Report for the 12 months to September 2023 found that disability income new business increased by 14.7% to $462 million over the year to September 2023, up from the $403 million recorded in the 12 months to September 2022.

DEXX&R’s Managing Director, Mark Kachor told Riskinfo that the 14.7% increase in disability income new business included both CPI and age-related increases along with policyholders’ voluntarily increasing their coverage.

DEXX&R’s Managing Director, Mark Kachor told Riskinfo that the 14.7% increase in disability income new business included both CPI and age-related increases along with policyholders’ voluntarily increasing their coverage.

…the 14.7% increase in disability income new business included both CPI and age-related increases…

Meanwhile, DEXX&R says that individual lump sum new business premium for the year ending September 2023 was down 1.3%.

September Quarter Data

It says that during the September quarter individual lump sum new premium remained relatively flat falling by 0.1% to $237 million, $1 million less than the $238 million recorded in June 2023 quarter.

September quarter sales of $237 million were 5.7% lower than the $252 million recorded in the September 2022 quarter.

However the disability income new business in the September 2023 quarter of $138 million was up 17.3% from the $118 million recorded in the June 2023 quarter. September 2023 quarter sales were 23.4% higher than the $112 million recorded in the September 2022 quarter.

Individual Lump Sum Discontinuances

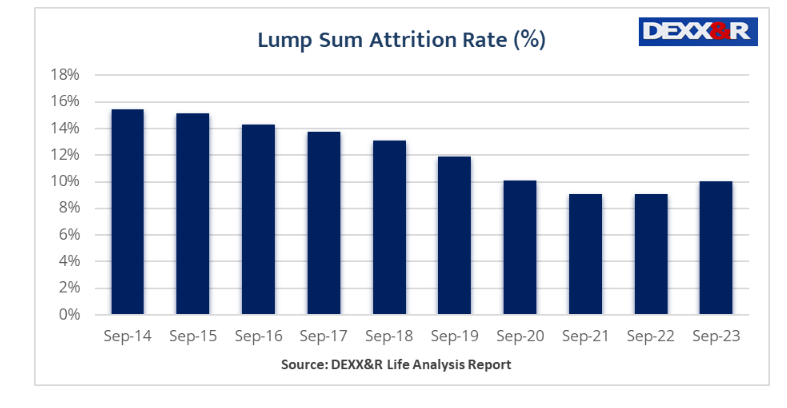

The individual lump sum attrition rate was higher at 10.0% in September 2023 when compared to the 9.1% attrition rate at September 2022.

DEXX&R’s Attrition Rate for disability income business increased for the second year, up from the 9.3% recorded in June 2022 to 10.8% in September 2023.

The firm says that DI discontinuances “…remain at historically low levels indicating that, notwithstanding the small increase during the year to September 2023, retention remains at a higher level than that applicable over most of the past 10 years.”

It notes that this trend is expected to continue “…as the terms and conditions offered by pre-APRA intervention products are significantly more favourable than those offered by current on sale products.”

DEXX&R also notes that total individual risk new premiums increased by 3.5% in the year to September 2023 to $1.4 billion.

DEXX&R also notes that total individual risk new premiums increased by 3.5% in the year to September 2023 to $1.4 billion.

Total risk in-force premium increased by 1.5% during the year ending September 2023, up from the $16.3 billion recorded at September 2022 to $16.5 billion at September 2023.

” DEXX&R’s Managing Director, Mark Kachor told Riskinfo that the 14.7% increase in disability income new business included both CPI and age-related increases along with policyholders’ voluntarily increasing their coverage.”

Politicians are the best at distorting statistics to make a point, but I don’t expect this of actuaries. The 14.7% increase is totally meaningless because of how it’s measured. This is not a measure of the increase in NEW IP business i.e. new policies being submitted, when the calculation apparently includes CPI increases and age-related increases on existing business. Who is zooming who, baby!

And if the job is to be have any legitimacy , those figures for genuine new business should also be reduced by the numbers of policies that are being purchased to replace existing pre-2021 IP contracts, which are currently the subject of massive the gouging are. That will confirm what’s really going on.

Can anyone hear the sound of that fiddle, and smell the smoke!

Advised IP Sales were up 9% on the same quarter last year (sales including new policies & voluntary increases, but not CPI / age increases).

Unfortunately, not all insurers give data relating to rebroking / replacement policies. However, from our adviser studies, rebroking has steadily declined to around 40% of total sales. We are in market again at present to get an updated lens on rebroking, as there’s a bit of divergence between lump-sum vs IP (given pre-IDII products still often being held notwithstanding higher price, given benefit designs – but expect that may change if price rises continue).

Another interesting thing we are seeing is an increasing use of aggregator sites – previously advised individuals are replacing their current policy with new one via an aggregator (ie they get why they need insurance, but are reacting to the price increases, but not using another adviser). Remains relatively small, but growing.

Comments are closed.