The 2023 year can best be described as ‘stable’ in terms of adviser movements, with Wealth Data seeing it as an opportunity for many to breathe again after a difficult few years post 2018.

In his analysis of the 2023 year, the research firm’s Colin Williams says that while overall numbers have been stable “…the licensee space has been volatile with a continuation of new ‘micro’ AFSLs, mergers and takeovers.”

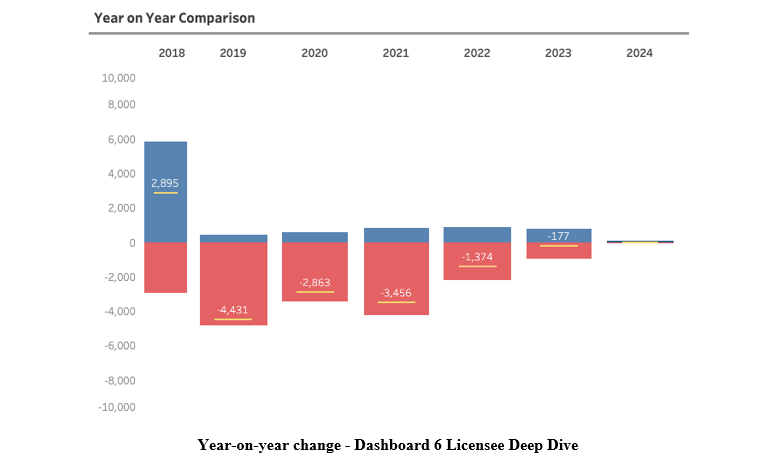

Total adviser movement at a national level saw a net loss of 177 advisers, which Williams says is a much lower number than the recent years preceding 2023.

In the Wealth Data table below net losses are highlighted by the yellow line while the blue indicates appointments and the red is resignations. The number of advisers at the end of 2023 was 15,622.

Williams has also analysed the adviser movements across business models (peer groups). His key findings are:

- Only the Accounting – Financial Planning (firms that are owned by accounting groups and provide holistic advice) has grown. The growth was driven by new licensees which, in the past, were generally practices aligned to larger licensees

- 113 new licensees commenced – all but two of the new licensees have less than 10 advisers each and 63 have ceased

- The Accounting Limited Advice (restricted to SMSFs) had the greatest percentage loss at 8.63%

- Super Funds suffered the second-largest loss of 5.17%

- The largest business model, Financial Planning (providing holistic advice), was stable but did gain the most new licensees with a net 55, as 95 commenced and 39 closed

New Entrants

Wealth Data says 381 new entrants commenced in 2023 and were still current at year’s end, representing 2.43% of all current advisers.

“The Financial Planning business model appointed 265 or 2.55% of their current advisers. Super Funds might surprise … at only 11, or 1.54% of their current advisers,” Williams says.