As the larger adviser groups acquire and divest some of their licensees, Wealth Data has calculated which are now the three largest advice groups.

The firm’s Colin Williams writes in his latest Financial Adviser Insights that with Count acquiring Diverger and its licensees, Count jumps into third position (see: Count completes Diverger Acquisition).

He notes that Insignia has indicated a deal to sell its Godfrey Pembroke licensee back to advisers, but that deal has not been announced as finalised (see: Sale of Godfrey Pembroke).

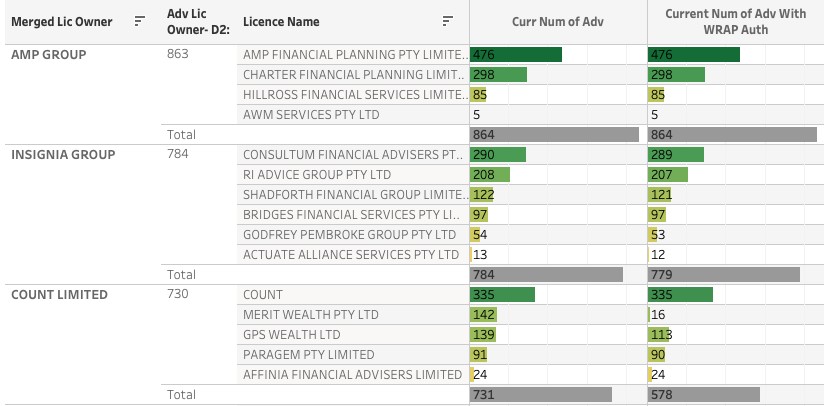

Wealth Data’s analysis lists AMP as the largest of the adviser groups with 863 advisers, followed by Insignia with 784 and then Count with 730.

The chart below shows the three largest licensee owners and their current adviser numbers.

Williams says Wealth Data has also included the advisers who are authorised to provide advice of investments held on a wrap, which ASIC describes as an IDPS.

“This is a good guide to distinguish advisers who are authorised to provide advice beyond a restriction of SMSF admin based advice.”

He says Count is showing a total of 731 advisers across the licensees. However, the group is at 730, as one adviser is authorised at two Count licensees.

“Insignia is at 784 with 54 sitting at Godfrey Pembroke. If the Godfrey Pembroke advisers leave, that would put Insignia at 730 and be equal to Count.”

He says that Insignia does have a far greater number of advisers authorised to offer investments via a wrap at 779, versus Count at 578.

“ This is mostly due to Count owning Merit Wealth which has a total of 142 advisers, but only 16 that can offer investments via a wrap. Most advisers at Merit Wealth would be specialist SMSF advisers,” he says.