The rate of individual non-advised TPD claims has grown over the past year, according to new APRA data.

APRA has just released its latest Life Insurance Claims and Disputes Statistics publication, covering the year to 31 December 2019.

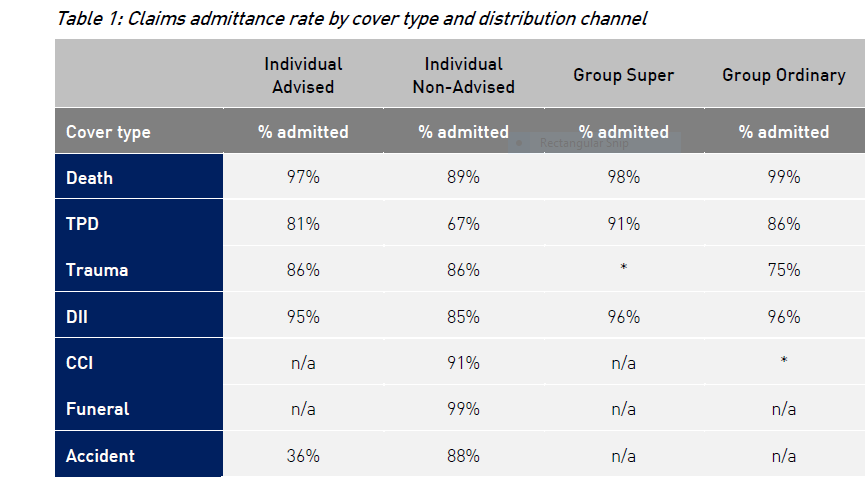

It reveals the rate for TPD claims admitted for the 12-month period under individual non-advised claims rose from 59 percent in 2018 to 67 percent in the 2019 year.

In turn, the individual advised TPD claims admitted slipped from 87 percent in 2018 to 81 percent for the latest 12 month period. (See: Latest APRA Claims Data Reinforces Adviser Value).

The data also shows that the percentage of TPD claims admitted under the Group Super channel rose from 88 percent in 2018 to 91 percent in the latest year while the Group Ordinary percentage admitted under TPD rose from 68 percent to 86 percent.

Looking at the claims paid ratio for the 12 months to December 2019 (the dollar amount of claims paid out as a percentage of the annual premiums receivable), the individual non-advised TPD ratio rose to 58 percent – up from 28 percent a year earlier – while the individual advised claims paid ratio remained at the same level as 2018 at 45 percent.

The Group Super TPD claims paid ratio also rose, from 71 percent to 85 percent, as did the TPD Group Ordinary ratio, from 25 percent in 2018, up significantly to 61 percent in 2019.

APRA says in its statement that the data is the product of “…a world-leading joint project” between APRA and ASIC, aimed at making it easier to compare life insurers’ performance in handling claims and disputes. This is the fourth publication using the full data set since it was launched in March 2019.

It says its publication presents the key industry and entity-level claims and disputes outcomes for 20 Australian life insurers writing direct business.

The statement also noted that ASIC’s MoneySmart Life insurance claims comparison tool has been updated with the latest data. It compares insurers across cover types and distribution channels on four metrics – the percentage of claims accepted, the length of time taken to pay claims, the number of disputes and the policy cancellation rates.

Reading between the APRA lines – look out advisers, by the time APRA, ASIC & FASEA are finished with you, there will only be non-advised and group left.

No expansion as to why advised is still 97-89, 81-67, 95-85 [Trauma the same]. Apparently, 8%, 14% and 10% more claims paid has no significance to APRA’s reporting. Who cares about the benefits achieved here for the consumer.

Group is commonly small sums insured and under AALs so should be close to 100%. But 75% for Trauma? Hmmm, maybe that’s because this benefit isn’t issued under the AAL rules, often an option to be added, with holes in the policy wording you could drive a truck through.

How would any average person out there have a clue as to what all this diatribe is about.

Why doesn’t APRA and ASIC just admit it – they want rid of risk advisers. Primarily, due to their stubborn belief that all things ‘commission’ are evil.

I have a ” burning” feeling in the pit of my stomach that come December when risk commissions are reviewed that will be the end of Risk Advisers full stop and a lot of others who have a book of 50/50 risk and Super will closely follow.

Isn’t it a bit Ironic how during this terrible corona virus pandemic the Government is calling on the retired and casual members of the united front { Doctors Nurses ambulance paramedics etc etc} to come back and assist. And I like everyone else thank them greatly !!

I wonder when the financial services area collapses due to inexperience and policy being put in place now that has no bearing on “client best interests” and will drive thousands of confident experienced advisers into early retirement or a new occupation will they call on the “old” fellas” to help put it back together. ? I fear the finding and development of a Corona virus vaccine will be easier.

The data was in, with a prior investigation and the truth about, what appeared to be most advisers whose sole purpose was to churn, was irrefutable evidence that changes had to occur and of course, once the LIF was enacted, then some cracks appeared about the validity of the churn data, with then an admission from ASIC and many of the instigators of the disaster we are now in, that churn in actual fact, was overstated and that a very small percentage of advisers were involved.

Data is always used as a tool to control the conversation and direction of where the protagonist wants their agenda to go.

The ability of the potential target of these attacks, to disseminate and tear apart the data, is crucial if you want to defeat inaccuracies and put to the sword the proponent of these lies and when data is used to propose an agenda that makes the truth a casualty, it should be a criminal charge with penalties to the perpetrators, equivalent to the damage done to innocent people.

When the collated data is being used to attack advisers in the future, there will not be a passive response.

Comments are closed.