Net adviser outflows continued at a subdued pace in the fourth quarter of 2020, with total advisers numbers contracting by two percent for the quarter, according to Adviser Ratings.

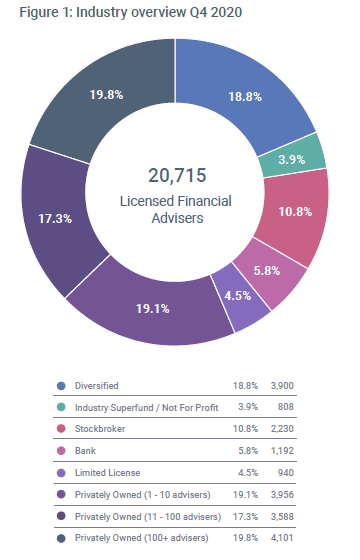

The firm’s Adviser Musical Chairs Report says that by end Q4 2020, the adviser population had reduced to 20,715, with the net decline of 431 advisers from Q3 2020 being “…the second lowest quarterly decline since the industry started net contraction in 2018”.

(Also see: Fewer Advisers Leaving Industry).

It says that 645 (3.0 percent for the quarter, 12 percent annualised) advisers left the industry in Q4 2020, almost identical to the previous quarter. But the overall reduction in adviser numbers was 431, as:

- 26 new advisers joined the industry

- 188 transitioned back after being previously ceased

During the quarter total licensee numbers increased marginally by six to 2,163 “…extending a growth trend for two quarters running now, despite an overall decline of 60 licensees (2.7 percent) over the last 12 months and 119 (5.2 percent) over 24 months”.

Another key finding was that the net reduction in the total adviser population over the last two years was 8,000, from the industry peak in December 2018.

The report says that total adviser movement for the quarter was the lowest in more than two years, with subdued results for both exits and for switches.

“Are advisers simply taking a breather after a tumultuous 2020, or will we see a return to the relentless pace of 2019/H1 2020?,” the report asks.

It says that with the continued shrinking of the total adviser pool, and plenty of examples of businesses collapsing and increased mental health pressures “.. it is easy to be gloomy about prospects for the industry.”

…two surveys identify a core of advisers that are excited and motivated about what the future brings…

However, the report says that results from two surveys run by Adviser Ratings over the last two months brings some hope.

“Together, they identify a core of advisers that are excited and motivated about what the future brings.” In the first survey of 1,000+ advisers:

- 75 percent had already completed or were waiting for their results from the FASEA exam, compared to 52 percent industry-wide

- “Even more encouragingly”, 63 percent of surveyed advisers were expecting to achieve the necessary tertiary qualifications within the next two years, three years ahead of the January 2026 regulatory deadline

Adviser Ratings says a second survey of more than 500 practice owners in the same period identified 65 percent of them that were growing their customer books, and 55 percent expected to grow adviser numbers either organically or through acquisition.

It says that anecdotally, consumer demand is also increasing, fuelled by a combination of financial stress from Covid-19; improved awareness from the government’s early access to super programme and through a greater variety of channels offering help.

“As we have said before, an imbalance between demand and supply augers well for financial advisers who choose to stay.

“It’s also why capital continues to be invested into the sector, whether directly into advice businesses or into the supporting vendor ecosystem of platforms, dealer-to-dealer services, managed account providers and financial planning software manufacturers.”

Advisers Switching Licensees

In Q4 2020, 511 advisers (9.7 percent annualised) switched licensees, “which was comfortably the lowest rate seen in the last two years”.

The report says the major adviser purges from AMP and ANZ from earlier in 2020 have potentially flared out, “although we anticipate seeing more IOOF-MLC departures in Q1 2021 as negotiations on stay-versus-go are concluded”.

Adviser Ratings’ latest survey of more than 500 practice owners indicated strong interest in switching licensees, with 16 percent planning to make this change.

“Despite this demand, there are many potential reasons for a slowdown. The larger non-bank licensees are attracting and absorbing many of these switches, however their increasingly strict vetting and onboarding processes are likely to jam the pipeline.

“The same applies to applications to ASIC for new licences, as well as the increasing difficulties of securing PI cover. And when advisers finally get serious about making the move, many are daunted by the actual effort involved or don’t know who to trust for advice.”

Licensee Movements

In the quarter, licensee volumes grew for the second quarter running as 32 new licences were registered, 28 shutdown and two returned back to the register. The trend towards shrinking licensee volumes that commenced in Q4 2018 has now stabilised, the report notes.

The composition of the 32 new licences established in Q4 has:

- 53 percent single-person self-licensed boutiques

- 88 percent with no more than five advisers

In terms of license de-registrations the majority of businesses continue to be relatively young, however this quarter was notable for the surprisingly high proportion of limited licensees, the report says.

Click here to see the full report.

The slowdown in advisers exiting will continue as most of the remaining “survivors” will sit the FASEA exam, which will enable them to have 4 years breathing space, at which point, thousands more will leave the Industry, unless there is a recognition of experience.

I have decided, as a protest to a system that is inherently wrong, to exit as an Adviser in December, as I find it abhorrent that my 34 years experience, employing staff and helping thousands of Australians over the decades, with a 100 percent success rate with claims and NIL client complaints, means nought unless I hold a piece of paper that is little more than a slap in the face for the vast majority of Advisers who have always been ethical and gone out of their way to help their clients.

However, I will continue to push for change so there will be a future for all the hard working and honest advisers who have been treated with disdain from an over zealous Regulatory regime that at least has now, had the decency to recognise that they have overstepped the mark.

The next step is to bring some common sense back to Regulations and I will not cease until Risk advice has been separated from Investment advice and the Education requirements match the field that advisers work in.

Comments are closed.