Last week’s analysis of the ASIC Financial Adviser Register (FAR), shows a decrease of 48 adviser roles, moving from a total of 20,453 to 20,405, according to HFS Consulting.

However the analysis by HFS Consulting’s Colin Williams also notes that the number of actual advisers dropped by 42 from 20,095 to 20,053

Williams writes that the key movement stats for the week to May 20, 2021 saw 67 roles appointed while the number of roles resigned was 115, giving the net loss of (-48).

…Five new provisional advisers appointed, indicating that 62 advisers ‘switched’ licensees…

“Five new provisional advisers [were] appointed, indicating that 62 advisers ‘switched’ licensees. The variance between adviser roles and actual advisers was driven in part by AMP finally closing two small licensees …who shared the same advisers.”

Williams says that 33 licensees made net adviser role gains of 56 and that three new licensees commenced for a total of nine advisers.

At the licensee owner level 29 owners gained a total of 40 adviser roles.

He adds that losses for the week were dominated by large licensees.

Fifty licensees made net losses of (-104) roles.

“As a result of the ongoing changes within large groups, losses this week are best viewed at the licensee owner level. MLC Group down (-17), AMP Group (-13), IOOF (-7) and Easton down (-6).

“There is long tail of losses with three owners down by (-3) five with (-2) and 29 for (-1) each.”

He adds that it was another big week of licensee closures with nine effectively closed* for a total of (13) adviser roles. Again losses were dominated by accounting based licensees.

The number of licensees that have closed YTD is now at 76 for the loss of 161 roles. Over 50 of the licensees closed are licensees associated with accounting firms.

*Definition of closed is that adviser roles are now zero at the licensee.

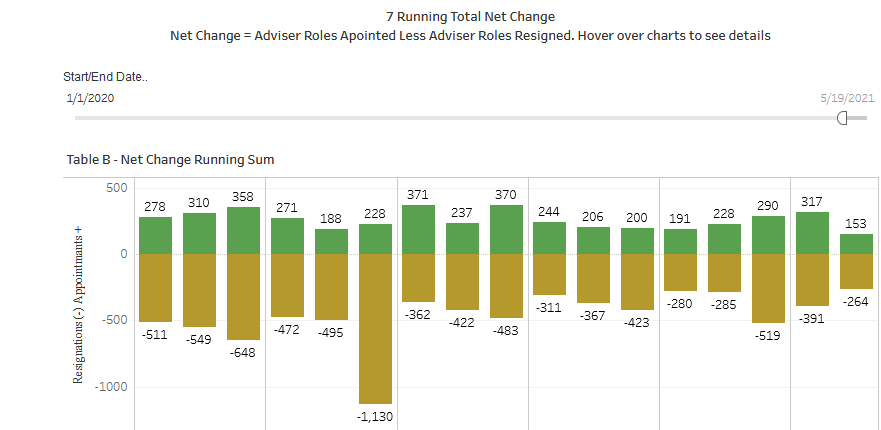

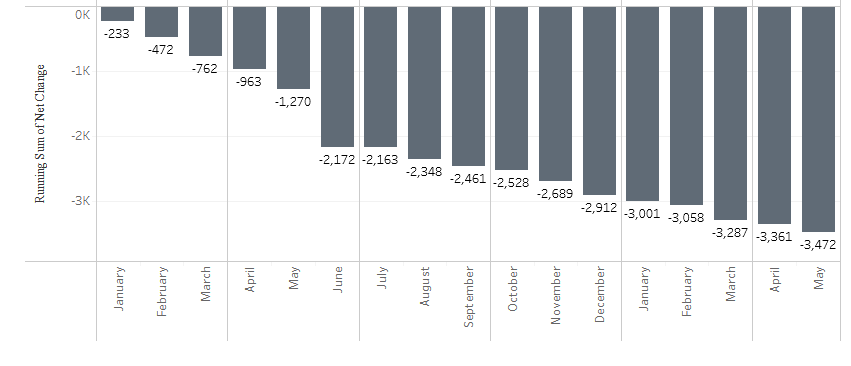

Above: Adviser roles appointed less advisor roles resigned. Courtesy of HFS Consulting.

Above: Adviser roles appointed less advisor roles resigned. Courtesy of HFS Consulting.

HFS Consulting revealed the following at the recent Lifespan Financial Conference, as reported in IFA magazine;

1. 23 new advisers registered in 2021 so far; 11 new advisers were registered in 2020; and 7 in 2019. This is compared to 2,400 new advisers who registered in 2018, just prior to the FASEA standards coming into place.

2. The FASEA website currently shows 400 advisers registered and undergoing their Professional Year; and I quote, “only 400 compared to the thousands that (sic) are leaving.”

3. Adviser numbers reached 20,500 at the end of 2020, down from 28,000 at the industry’s peak, and likely to decline by another 3,000 to 4,000 in 2021. Possible total numbers could fall to single figures by the time of the final FASEA deadline in 2026.

No matter how you slice this – the above is not encouraging.

Comments are closed.