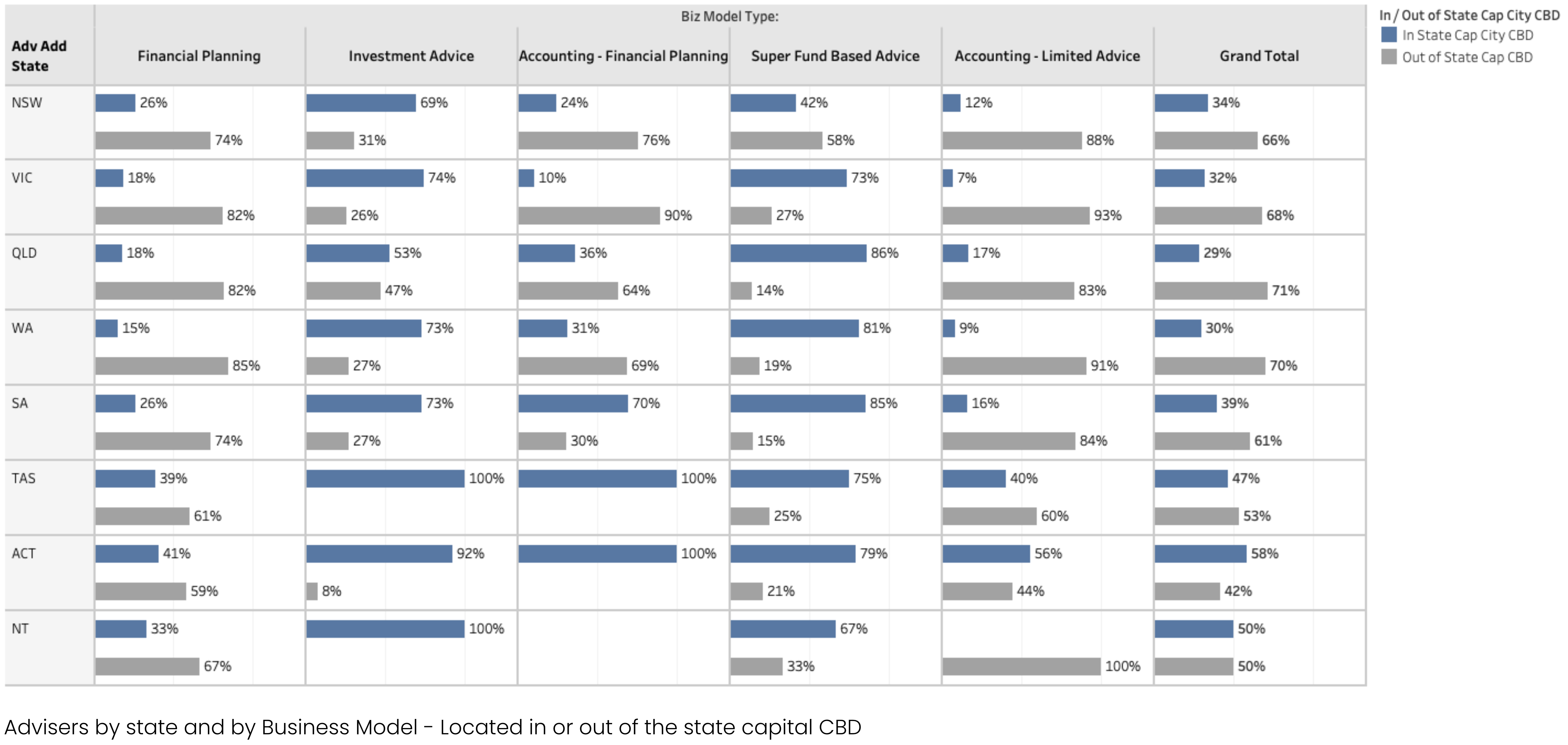

The spread of advisers who are based in, or out, of each state capital CBD, varies greatly from one business model to another, according to Wealth Data.

The research firm’s Colin Williams says in his weekly Financial Adviser Insights report that ACT advisers “…not surprisingly had the highest percentage of CBD advisers at 58%.”

He adds that NSW, Victoria, Queensland and WA were reasonably similar hovering between 29% for Queensland and 34% for NSW.

His analysis also shows that South Australia had 39% of advisers in the CBD, with 47% in Tasmania and 50% in the Northern Territory.

Williams says at the business model level, the Investment Advice model in each state “…has more than 50% of its advisers based in the CBD.”

…The Financial Planning model is not so concentrated…

The Financial Planning model is not so concentrated “…with all states having less than 50% of its advisers in the CBD, with three states – Victoria, Queensland and WA – all less than 20%.”

He also notes that the Superannuation Funds model, made up of advisers who are mostly linked to industry and other large super funds are heavily concentrated in the CBDs, with all states bar NSW being over 70%.

Williams says this is due to a concentration of advisers, many being telephone-based advisers, co-located in the CBD offices of the super funds.

He adds that currently advisers directly linked to super funds only make up 732 of the total 15,707 advisers and, since Jan 1, 2022 have dropped by 10.4%, versus a fall of 8.42% of all advisers.

Where’s the risk advice stats, specialist risk advisers. No, typically they are omitted. Go figure!

Comments are closed.