The 2024 course program for TAL Risk Academy has been announced, with TAL seeing it as designed to support financial advisers at every career stage.

TAL General Manager of Retail Sales and New Business, Beau Riley, says the 2024 program offers tailored courses “…ensuring that no matter where advisers are in their career, they have access to education and knowledge that can elevate their expertise.”

There are five streams in this year’s program:

- Foundations

- Professional Year

- Advice

- Business Management

- Working with TAL

Riley says the course streams have evolved this year “…to reflect the changing role of financial advice and all courses will continue to be modified to meet evolving adviser needs as the year progresses.”

He notes they are particularly focused on the development of new entrants to the profession “…and equipping advisers with skills and insights to help them successfully navigate the evolving landscape of risk management. Ultimately, this will help their clients manage risks and ensure they are protected should the unexpected happen.”

New this year is the Working with TAL stream – a program covering elements from product design and pricing to applications and claims.

Riley says the aim is to make it easier for advisers to do business with TAL and this stream “…has been designed in response to what advisers have told us they need. The new stream allows us to provide greater support directly with life insurance implementation and claims management.”

He adds that brand agnostic training is also available for advisers and licensees.

Alongside TAL’s technical team, guest speakers will include FAAA CEO Sarah Abood, AFCA Ombudsman Alexandra Sidoti, and GPA Financial Services Adviser and Managing Director Jason Poole.

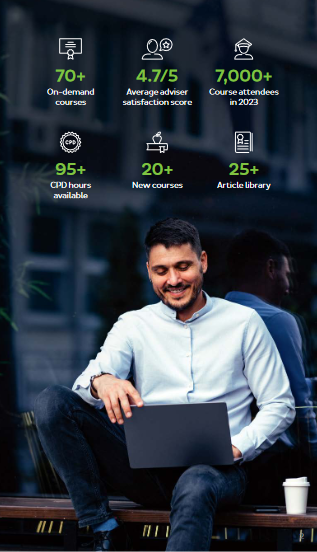

TAL notes that since its inception in 2015, the Risk Academy has:

- Recorded over 103,000 course enrolments

- Issued more than 183,000 CPD hours

- Donated $830,000 in course fees to the Australian Business Community Network charity

Click here to download a copy of the 2024 course guide.

They want to “support” advisers, do they? Ok then, put commissions back to where they were before life companies conspired with govt to reduce them to force risk specialists from the industry – so companies could go direct!

Oh, and while you’re at it, change the responsibility period back to only 1 year. Now, THAT is REAL support, not the half-baked ‘Academy’ mumblings from TAL emanating from the article. Then you can drop the facade of the so-called ‘Adviser Academy’. No use going through the academy if there’s no rewards for effort when the real job starts. What on earth happened to management in these life companies over the last 5 or more years? Like most of the world, very sadly, they seem to have lost their collective mind when it comes to common sense.

Comments are closed.