Nearly 80% of life insurers’ breaches of the Life Insurance Code of Practice were down to ‘human-related causes’, according to the Life Code Compliance Committee’s latest report.

Its Annual Industry Data and Compliance Report for the year to June 30 2023 says ‘human-related causes’ include human error, resourcing issues and employees not following established processes and procedures. (Also see: Life Insurers Struggling to Meet Claims Handling Obligations.)

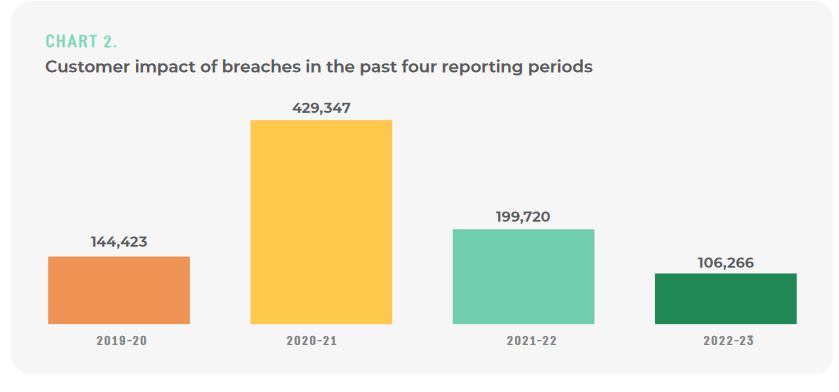

The report notes that at the industry level, there has been no change in the reported top three causes of breaches since the inception of the Code. For this latest period the causes were:

- Human-related causes – 9,754 breaches (79%)

- Deficiency in process or procedure – 2026 breaches (16%)

- System error or failure – 367 breaches (3%)

The LCCC says of the breaches reported as having ‘human-related causes’, most were attributed to human error (46%) and that this has been the most common cause for the last three reporting periods.

It says resourcing issues also featured prominently among reported causes “…accounting for 23% of the breaches from ‘human-related causes’.”

The report notes that in explaining these issues, insurers cited the ongoing effects of Covid, high levels of staff turnover, difficulty with staff retention, and a lack of experienced staff.

However the report says while the committee acknowledges the impact that the pandemic has had on resourcing “…we expect to see these issues addressed and normalised in the coming reporting period.”

It adds that insurers “…must strengthen their efforts to better train and develop staff. It is crucial that increases in staff levels are accompanied by comprehensive onboarding and training processes, as well as thorough oversight.”

The report says a comprehensive program for staff training and development “…can also improve retention rates, increasing experience across the organisation.”

The committee says these findings highlight key patterns and trends in breach reporting based on its analysis of the Annual Compliance Statements submitted by insurers for the 2022-23 reporting period.

Impact of breaches

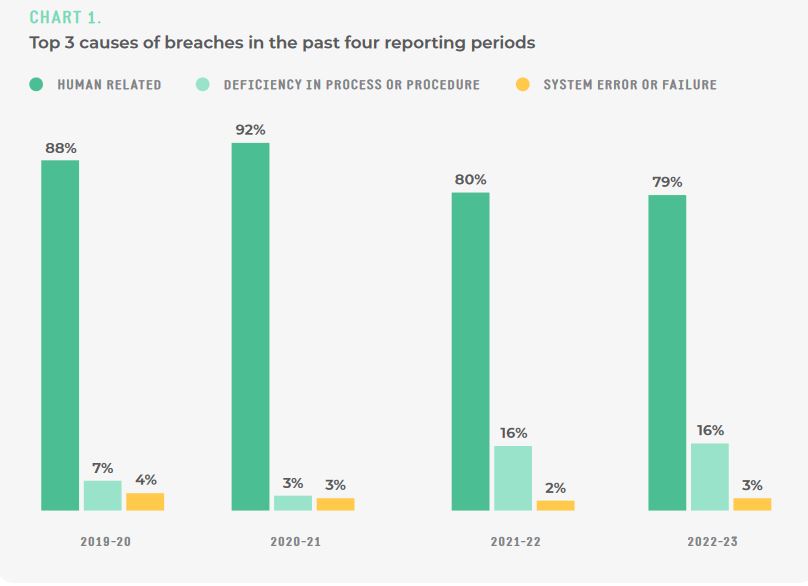

The report also highlights that breaches for this reporting period impacted 106,266 customers, a decrease of 47% on the 199,720 recorded in the 2021-22 period.

The number of customers impacted by breaches has now decreased two years in a row.

However, it says, the decrease in impacted customers comes despite an increase in overall breaches for the reporting period.

“This suggests that insurers are working to address the root causes of breaches that impact high numbers of customers.”

It says that failures with systems and automation for annual notices has been an issue “…and we have been working closely with insurers to address this. Our important work highlighting issues in this area has brought breaches to light, some of which have been reflected in reporting.”

The LCCC report says it’s vital that insurers focus on improvements to reduce all breaches.

However, breaches that “…impact high numbers of customers indicate systemic issues, which must be assessed as a priority.”