Most advisers who have been in a small licensee, tend to opt for another small firm, if their current licensee has closed, according to Wealth Data’s latest analysis.

The firm’s Colin Williams writes in his latest Financial Adviser Insights that recently the industry has seen one AFSL close for every two that commence – in the current financial year to date, 101 licensees commenced and 54 ceased.

He says this raises the question as to what happens to advisers who once belonged to an AFSL that closed.

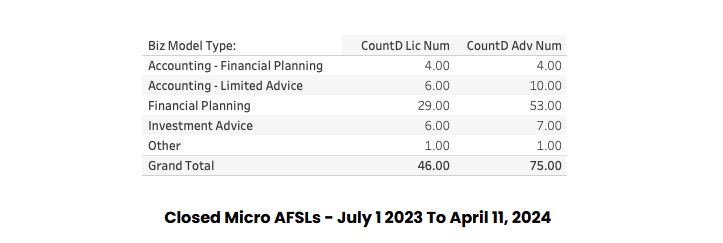

The firm’s analysis is based on 46 closed AFSLs, which had started the financial year with five or fewer advisers.

“The chart shows that 75 advisers were affected. The majority are in our Financial Planning business model with 29 AFSLs closed affecting 53 advisers.”

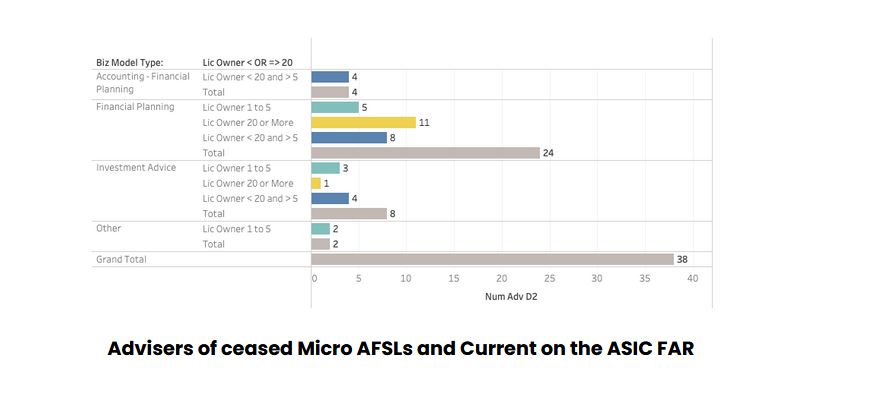

Williams says that of the 75 advisers affected by the closures “…a total of 38 are still current on the ASIC FAR. The majority of 24 are in the Financial Planning model.”

Of those still current, he says, only 12 advisers are now authorised under licensee owners who have 20 or more advisers. (11 in the Financial Planning model and 1 in the Investment Advice model).

“Ten have remained in AFSLs where the licensee owners has between one and five advisers. The balance of 16 are in AFSLs of greater than five and less than 20 [advisers],” he notes.

“The data indicates that most advisers, who have been in a small licensee, tend to stay in a small licensee,” Williams concludes.