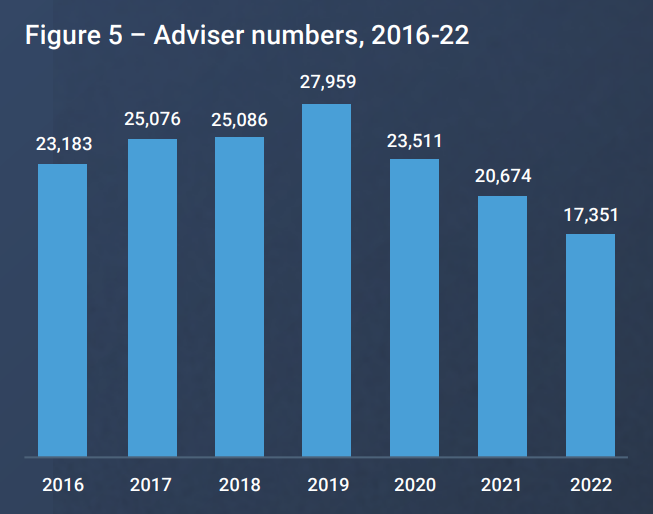

Despite the advice industry shrinking by a third of its size since 2019, latest analysis by Adviser Ratings suggests it has further to fall before it plateaus.

The research firm’s latest Adviser Musical Chairs Report for Q4 2021 says it expects numbers to fall below the 15,000 mark in the next two to three years.

The prediction is part of a special feature An industry in freefall – chronicling the last few years which states that over the past five years more than 10,000 advisers have left the workforce, “…which raises doubts about the ability of the current cohort to meet the needs of retiring Australians.”

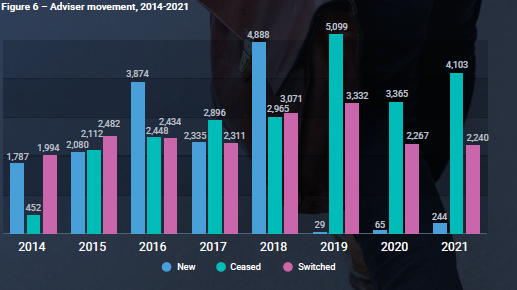

…the number of new entrants continues to be dwarfed by exiting advisers…

It says that from a peak of almost 28,000 in 2019, there are now fewer than 17,500 registered financial advisers. And Adviser Ratings says the number of new entrants continues to be dwarfed by exiting advisers.

In its special report Adviser Ratings says that when the Banking Royal Commission exposed the extent of wrongdoing within the advice industry, “…few could argue advice practices could avoid the pursuit of professionalisation.”

It says that since the start of the investigation and the establishment of FASEA, the industry looks very different. “On one hand, standards have been raised, which our analysis shows has resulted in better quality ratings for advisers. Most advisers are now degree qualified or equivalent and have passed their exam.”

On the other hand more than 10,000 have left the adviser workforce.

”Undoubtedly, this has implications for hundreds of thousands of pre-retirees and retirees who want advice, but can’t access it or afford to pay for it. In fact, recent Adviser Ratings consumer research showed most of the surveyed group saw value in advice, but only one in 20 would pay the 2021 median advice fee of $3,256.”

As to its expectation that more will leave the industry in coming years, Adviser Ratings adds that leaving education standards to one side, advisers tell them they are grappling with continual profitability and cost pressure, as well as Covid uncertainty and limited time to meet compliance obligations.

The research also shows one in six advisers who have departed the industry had passed the exam “…which indicates a commitment to professional benchmarks is not always indicative of a long-term desire to stick around.

“While regulators are looking at what they can do to induce more people into advice careers, they will need to act quickly to address what could be a dire situation for Australians who want affordable financial advice,” it says.

The last 3 years has had 338 new Advisers enter and 12,567 experienced Advisers leave the Industry.

From the 338 new entrants, I would suggest close to NIL decided to commence their career as risk specialists, which begs the question;

When are the Government, Treasury and the Regulators going to finally recognise that the Advised Life Insurance Industry has a bleak future until they understand what they have done, then ask the obvious question of, how do we fix it?

The answer has been around for years and has been ignored, though MUST be prioritised now, which is to separate risk from Investment advice and take away University degree qualifications for risk only Advisers to enable the numbers of NEW risk Advisers to grow from effectively NIL today to 20,000 which could equate to 600 personal risk clients and 60 Business clients per risk Adviser, based on less than half the population and 1.2 Million Business owners requiring Life and disability Insurance.

We are at the point where endless discussions, must turn into positive action.

Hmmm, right again Jeremy, on all counts. Separation of risk advisers from the investment advisers/FP advisers is something that continues to flummox me – why on earth that didn’t happen decades ago I’ll never know! It makes zero sense to combine and treat the two disciplines as the same – they are very different indeed both in the adviser skill set and the actual client need & solution. Why not combine plumbing and an electrician – and make them do the same degree/qualification/course? Seperate disciplines even though they both help with components to build a house.

On the attrition of advisers, regarding that small 338 coming in, I’d venture to suggest that whether risk or investment advisers there is a high attrition rate among those new entrants. The mentoring is nowhere near what it was even a decade ago. That piddling 338 number would easily be less than 100 after about 2 years of slogging it out.

The problem is that so much emphasis is placed on technical and academic prowess by these new entrants that the REAL skill of people-skills is hardly given a thought until the adviser starts to fail and, most of the time, it is far too late as they’ve lost their confidence and belief in themselves. There are no mentors now to help them pick themselves up and show them how to engender trust from the client and other crucial people skills.

In other words, for all the difference it will make, the number of new advisers entering ‘may as well’ be nothing in the great scheme of things. I certainly don’t enjoy or like to see myself writing such things but it is simply the way it occurs to me currently. Too sad for words and I can’t see any fix that any politician or industry player would tolerate that hasn’t been run up the flagpole before.

Comments are closed.